TLDR

When it comes to investing in real estate in Singapore, traditional beliefs may not always hold true in today’s rapidly transforming market. Property agents now rely on digital platforms like Facebook and PropertyGuru rather than classified ads. While owning a freehold property may be beneficial for long-term investments, newer 99-year leasehold properties could be smarter choices for mid-term gains. Being near an MRT station isn’t always the best option, as other factors like entry cost and specific product choice play crucial roles. Additionally, the belief that the next-door resale condo is a bargain may not always hold true, as seen in the comparison between J-Gateway and Caspian properties. The property market is ever-changing, challenging long-held rules and expectations. To navigate this dynamic market, staying flexible and open-minded is key. Gain more clarity on property investments by scheduling a financial assessment session.

When it comes to investing in real estate in Singapore, there are several so-called “rules” that seem to dictate certain choices. These “rules” have been around for ages, based on certain “beliefs” that have been passed down or shared through word of mouth.

Do These “Guidelines” Still Hold Weight in the Present?

In this era of rapid transformation, what worked before is no longer successful. Ten years ago, property agents could rely on classifieds ads to generate buying inquiries, but now they have to take their listings to the digital realm of platforms like Facebook and PropertyGuru in order to get the most exposure. The Classifieds section has become a shadow of its former self. Ultimately, it has become outdated and superfluous.

Are You On The Cutting Edge…Or Stuck In The Past?

As I challenge some long-held beliefs cherished by some, how will you react? It is natural to be averse to change, yet here I am offering readers of this blog 3 property investment beliefs that may be past their prime.

Investment Belief #1: Owning a Freehold Property in Singapore is a Far Superior Investment than Leasehold

Have you ever asked yourself if Singapore freehold properties are better than leasehold? Well, I hear you cry as you ponder this debate – but, trust me, I walk the ground daily, witness transactions and have exclusive data unavailable to the general public.

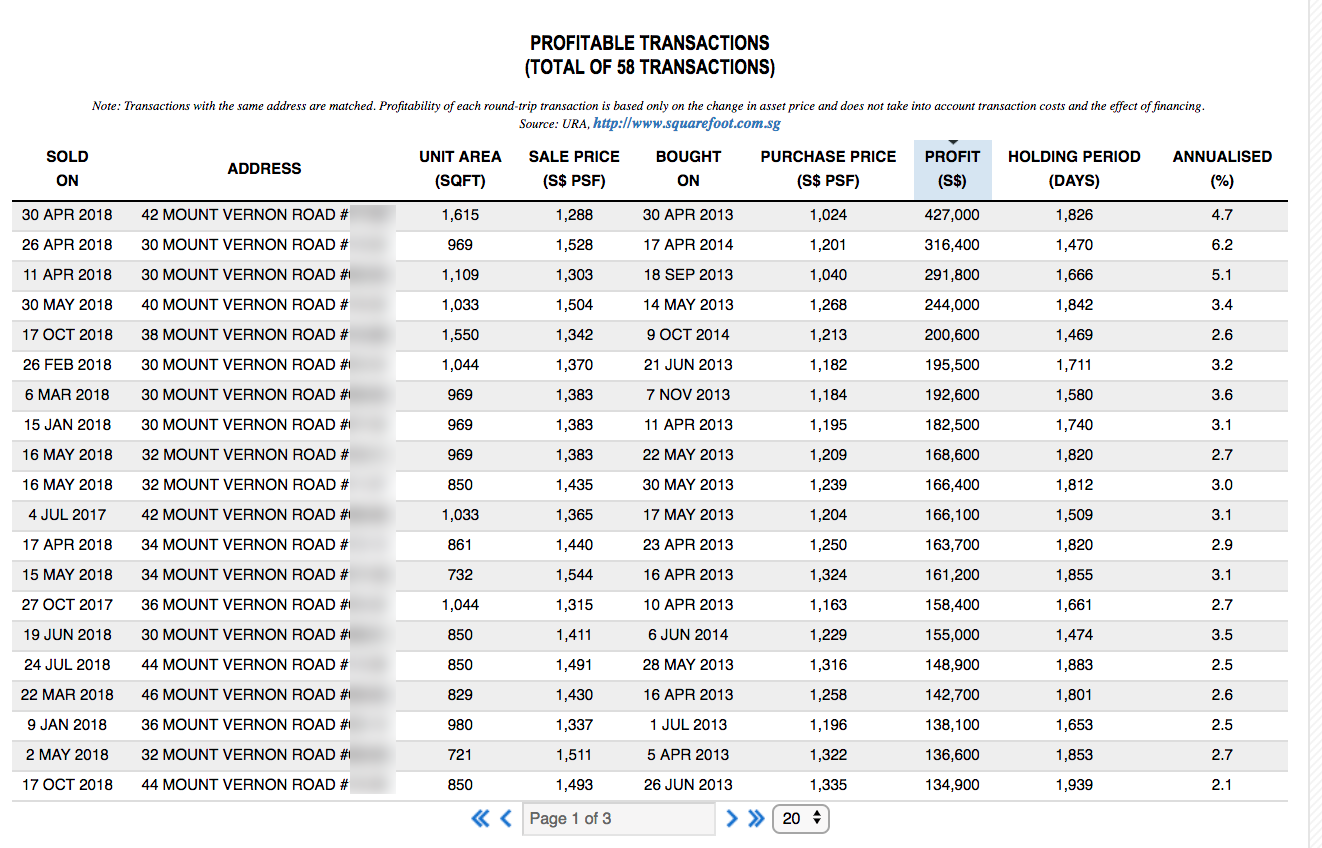

Take Bartley Ridge as an example: a 99-year leasehold condo that saw multiple transactions in 2018. So is the belief in freehold investments outdated? Absolutely not – it is still highly relevant!

Bartley Ridge (Leasehold) : 2018 Transactions

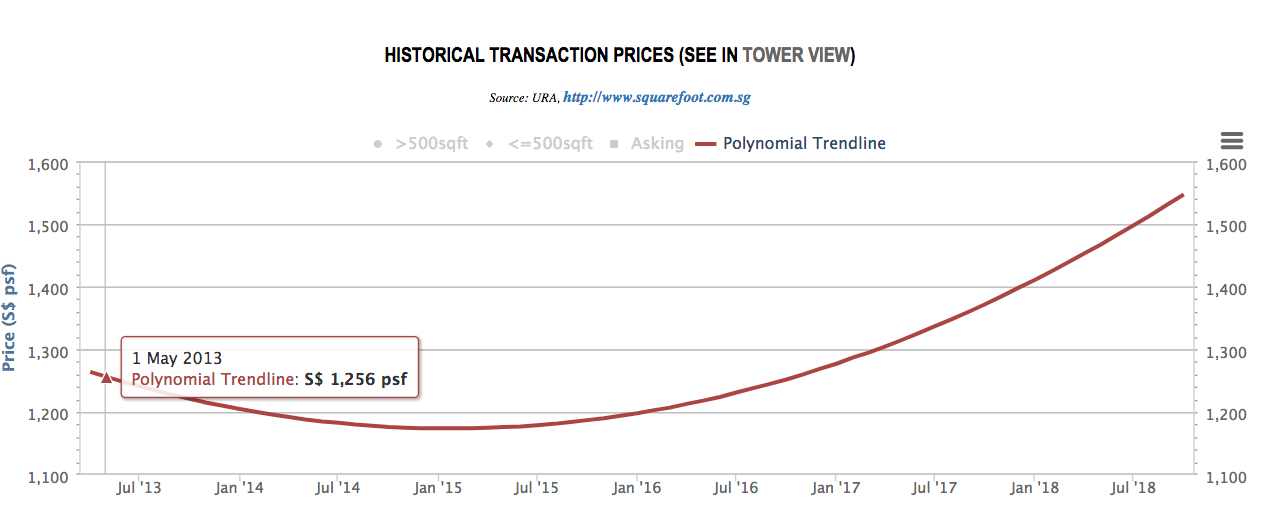

Bartley Ridge psf Pricing Trendline

Let us take a look at Oasis Gardens – a freehold development nearby– and make a comparison.

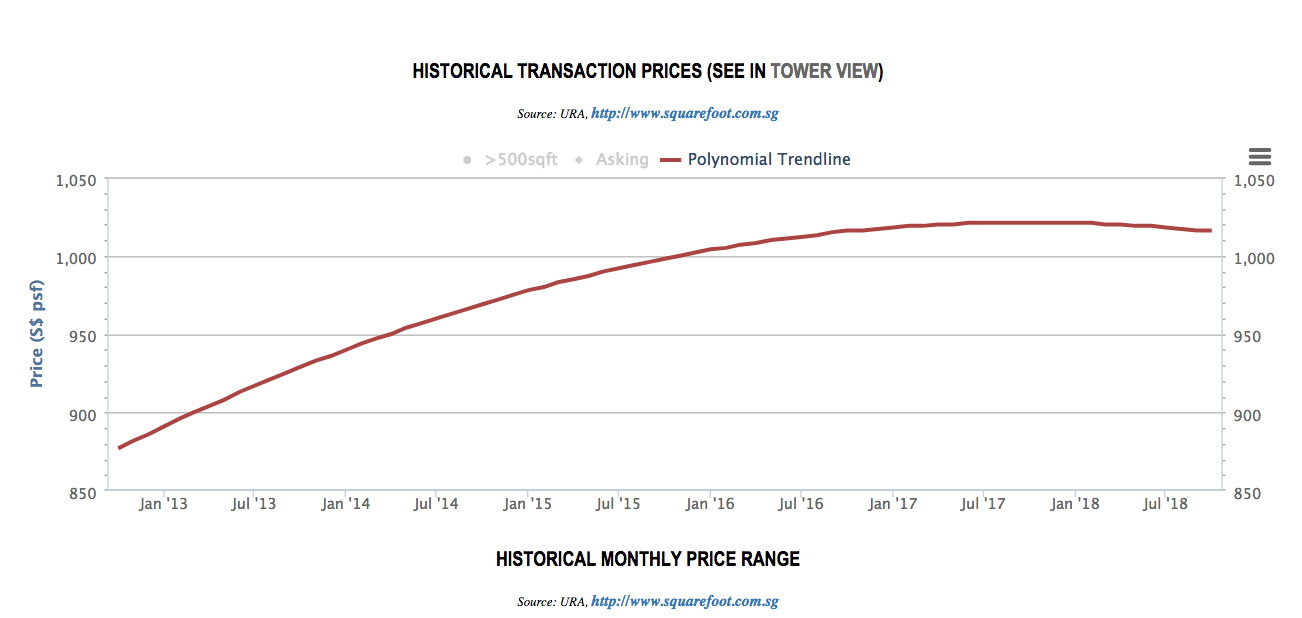

Oasis Gardens (Freehold) – PSF Trendline

The PSF pricing for this freehold development has decreased, leading to fewer transactions taking place as owners purchased at higher prices and are unwilling to sell at lower prices. The trendline is evident, with a slight decrease and a lack of significant movement. If you’re seeking a property investment for the long-term, a freehold property may be the most beneficial option; however, for a mid-term period (3-8 years), a new 99-year leasehold property may be the smarter selection.

Investment Belief #2: Buying Near MRT Is Better

It’s often said that choosing a spot close to an MRT station is a wise move, and I have to agree – in many cases, being in the vicinity of public transport has its advantages. Nevertheless, I’ve come across instances where this is not necessarily the case.

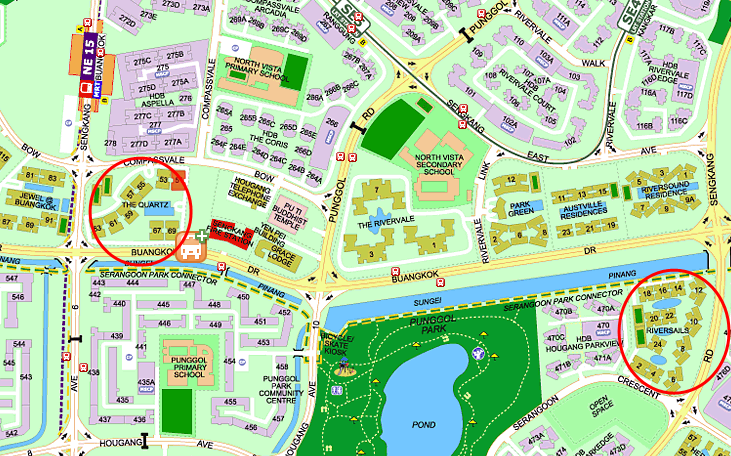

The Quartz (near MRT) vs Riversails

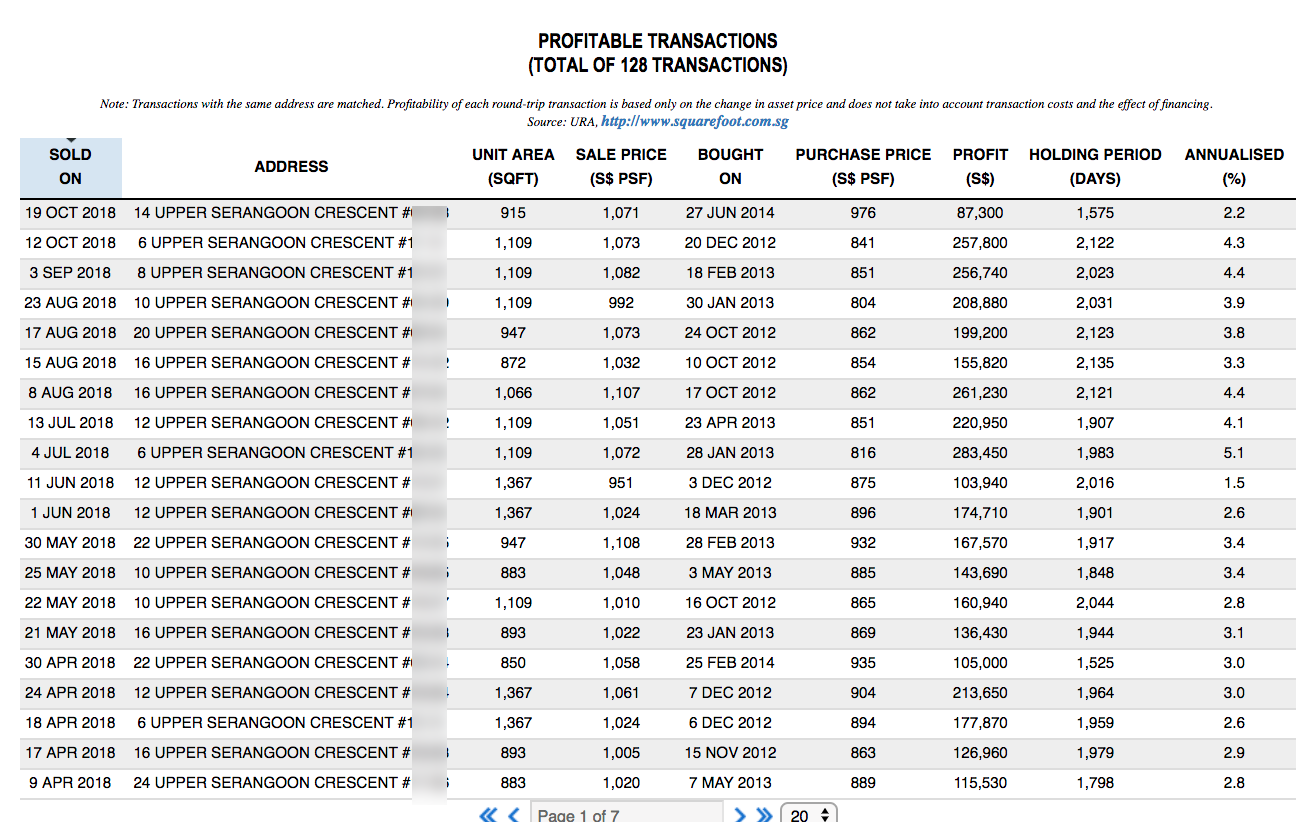

Below are the Riversails’s most recent transactions:

Riversail 2018 Transactions (Further away from MRT)

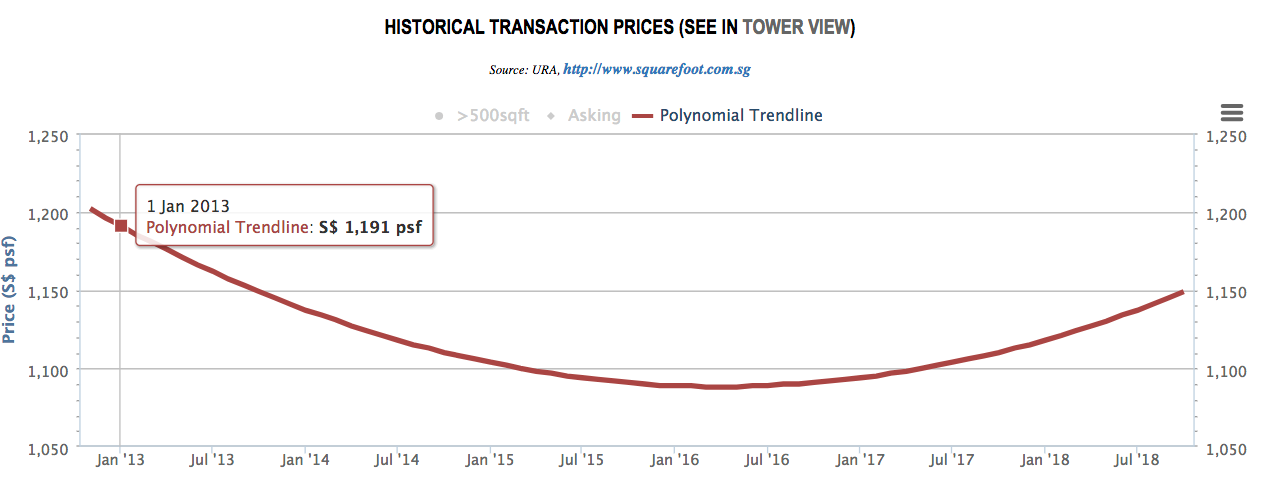

Riversales psf Trendline

Let’s take a look at the Quartz PSF trendline.

Take note the Quartz is located nearby Buangkok MRT station.

The Quartz PSF Trendline (Near MRT station)

Living close to a MRT station may not always be the best and safest option when it comes to investing. Location alone is not a surefire way to guarantee success – there are other factors that must be taken into account, such as the entry cost of the investment and which specific product to buy (when there are a variety of options in the same area).

Investment Belief #3: The Next Door Resale Condo is a Bargain!

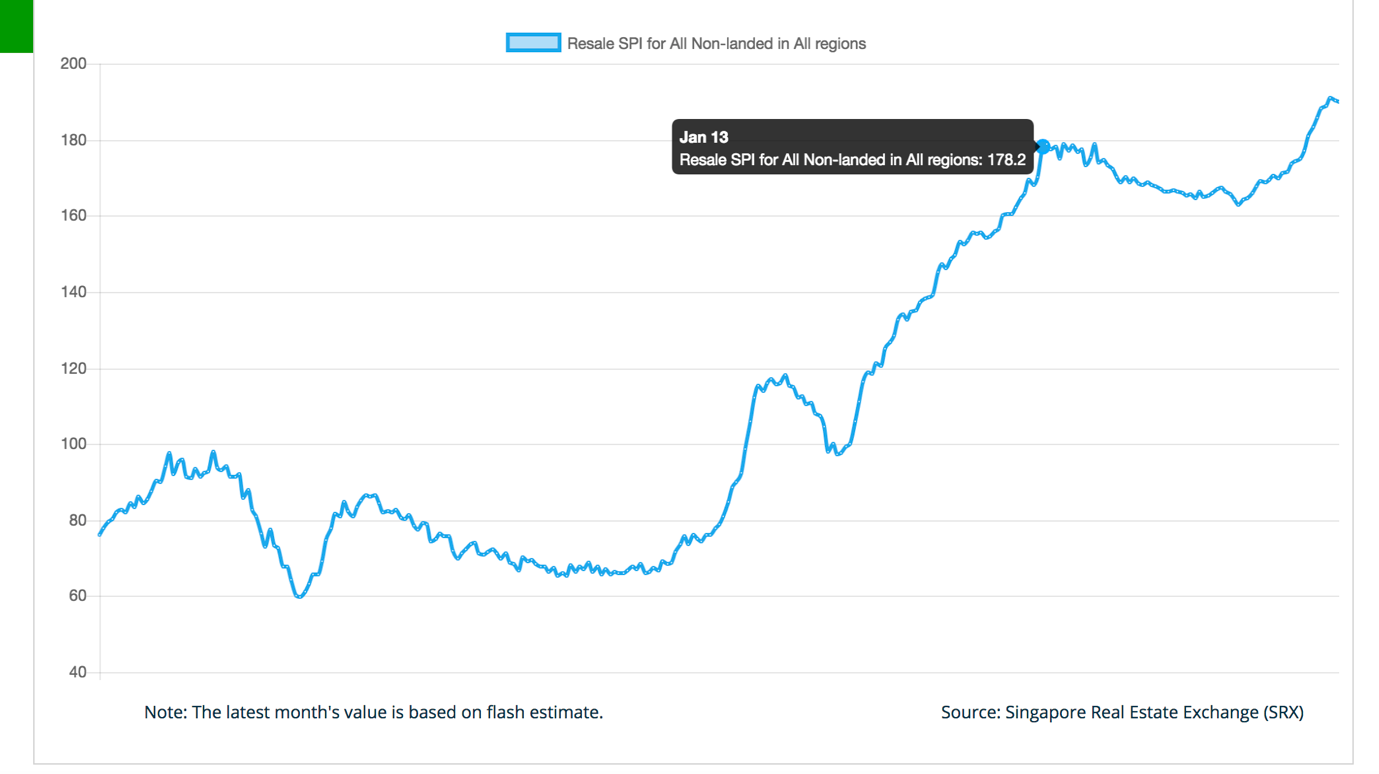

I recently had the pleasure of connecting with a couple who were curious about the current state of the property resale market, so let’s take a peek at the resale property price index!

2013 was the pinnacle of sky-high prices, with J Gateway launched that June, boasting an average PSF of a staggering $1650. I couldn’t believe it – it was just too expensive. The timing was unfortunate too, coming right before the 2013 cooling measures. J Gateway was released and sold at the most exorbitant rate. Fast forward to the present day, let’s take a peek at J-Gateway’s most recent transactions.

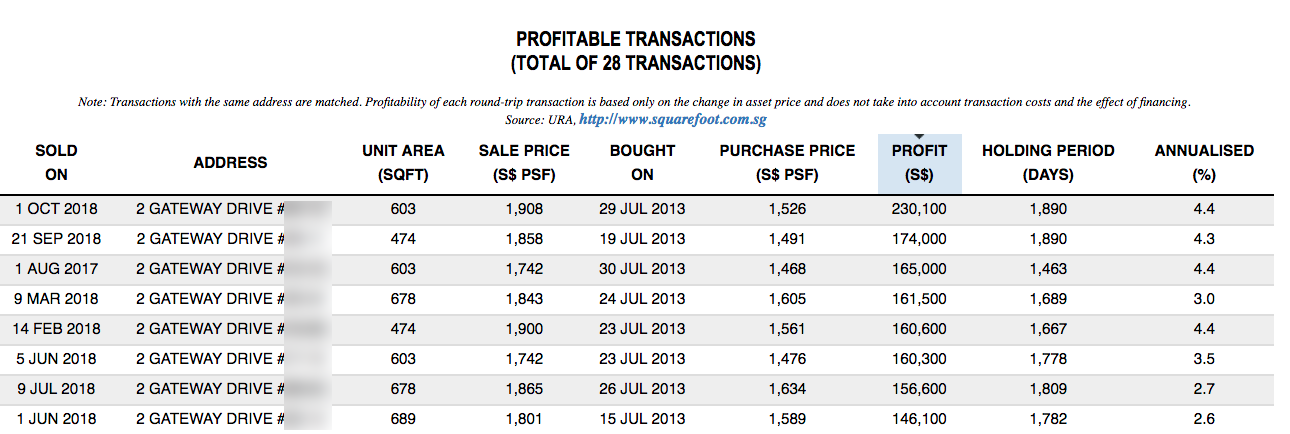

J-Gateway Most Recent 2018 Transactions

It is astonishing to witness the phenomenal sales rate of J-Gateway units, with prices soaring up to as much as $19XX per square foot! Even more impressive, some buyers have reported incredible returns of up to $200K in profits!

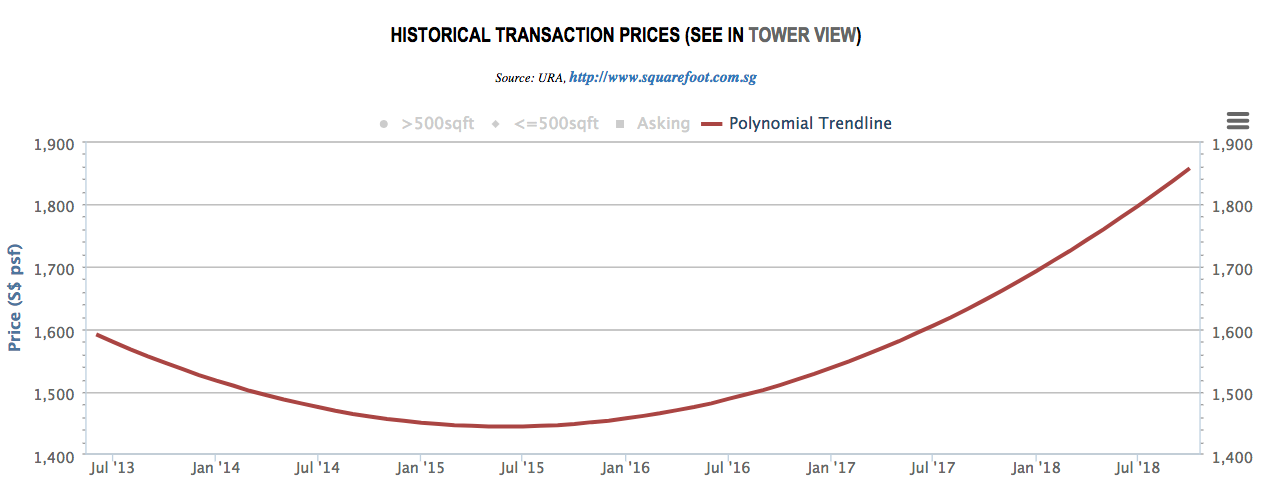

J Gateway PSF Trendline

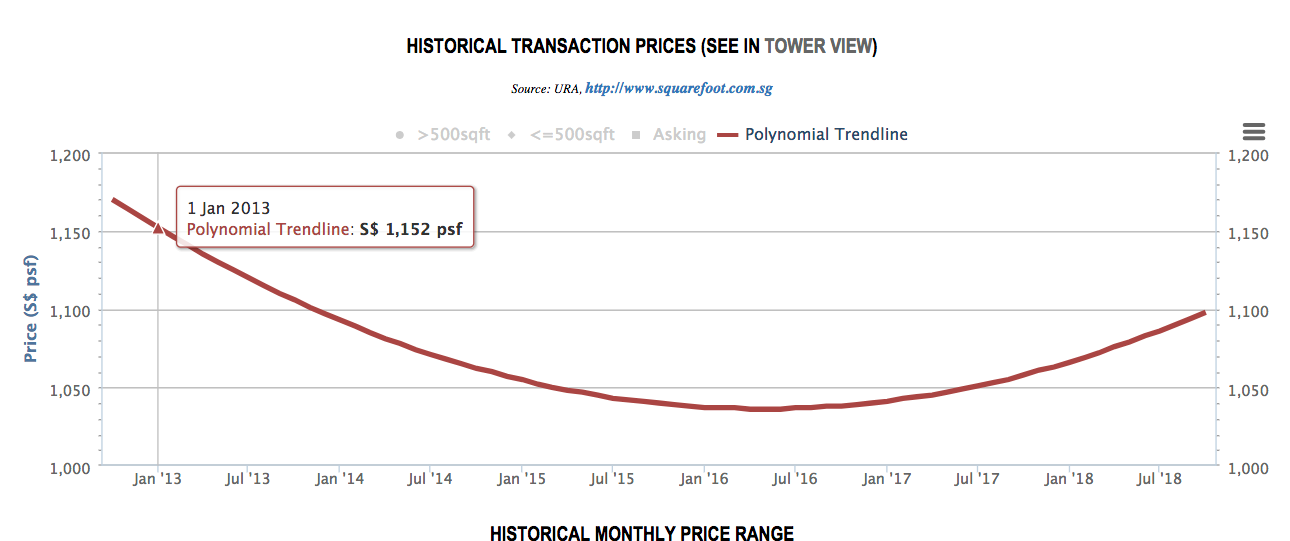

If we compare the launch of J Gateway with that of Caspian’s, we can see the clear appreciation in J Gateway’s prices over the last five years. Caspian, being the resale option, became a popular choice for people looking to buy a property in the west. Let’s take a closer look at Caspian’s PSF trendline.

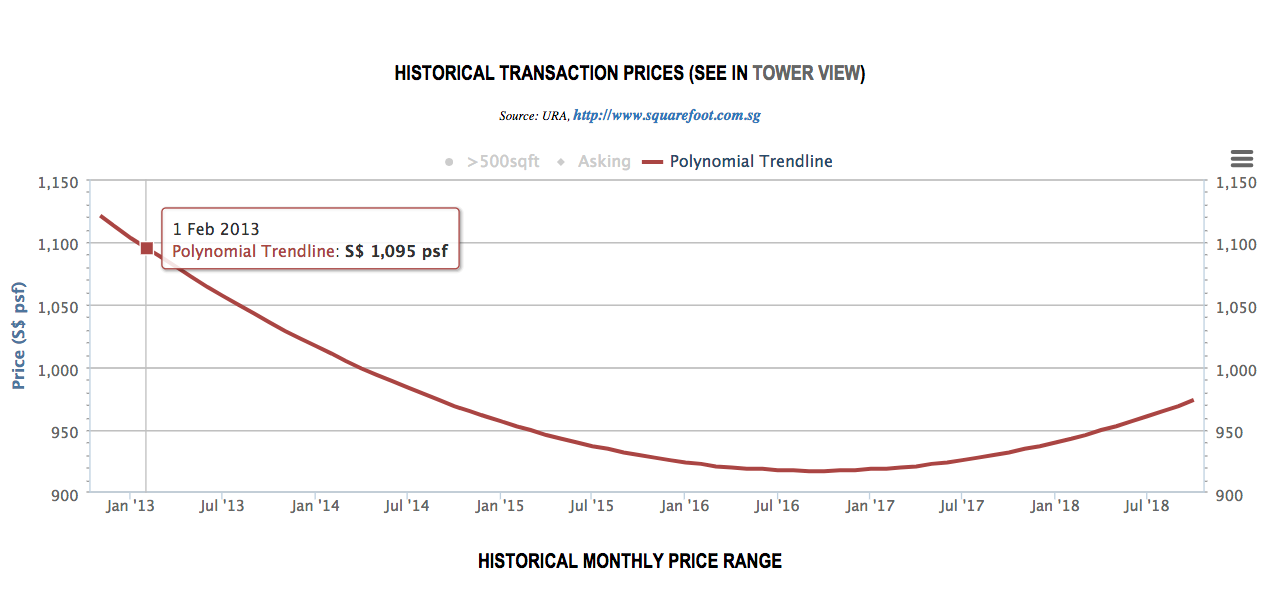

Caspian PSF Trendline

If you had purchased Caspian back in 2013, when it was available for $11XX PSF, compared to J-Gateway’s launch price of $14XX to $16XX PSF, you could have already been collecting a generous rental income of $1500 a month, and making a profit of $54K after three years! This is much lesser than the potential 6-figure profits that could have been gained from J-Gateway, which is still under construction.

Despite selling at its highest peak prices in 2013, J-Gateway property investments would still have yielded higher profits than any other form of investment in the end. There is a vast difference in the gains and appreciation between the two.

Conclusion

Gaining a better understanding of Singapore’s property market can be a tricky endeavor, and none of us have a perfect grasp of it. Nonetheless, as we gain more knowledge and insights, it is important to be able to be flexible and open-minded, having the humility to accept when we’re wrong.

You might be thinking that I’m being biased in favor of the newer properties, but what I have said is not without reason. Everyday I’m witness to the improved performance of newer properties versus their older counterparts – the evidence is all around.

No matter my bias, the evidence that slowly erodes all the “rules” we’ve made is undeniable. While these rules are not entirely wrong and should be used as a general guideline, if you’re hoping to make a property investment and exit at its peak, these so-called rules may not be quite so applicable.

Despite the introduction of the TDSR cooling measures on 29 June 2013 – the day prior to the launch of J-Gateway – Singaporeans have defied the unwritten rule of “never enter the property market at the peak price” and pushed J-Gateway to record highs in 2018, showing just how much their buying habits have changed over the years.

Are you feeling uncertain about the preference of newer properties in the market? It’s become apparent that there is much less interest in older properties, meaning they become a second choice rather than a sought-after option. This goes to show how the property market is ever-changing and rarely follows the rules or expectations.

Worried that your own biases are impacting your view of the property market?

Allow me to assist you – schedule a thorough financial assessment session with me to gain more clarity on the property market.

You May Also Like …

Top 5 Tips: Gain an Edge in the Singapore Property Market: Steps to Boost Your Investment Returns

Top 5 Factors : Why Not All Properties Appreciate Steadily

I Bought a Mega-Home : Hear 7 Homeowners Spill their Heartfelt Remorse

Explore the Benefits and Drawbacks of Holding an Open House!

Discover Singapore: 5 Must-See Attractions for a Culture Lovers’ Paradise

Snag a Sentosa Condo for 40% Off? Should You Consider It!

Top 5 Tea Rooms in Singapore for High Tea

Top 5 Reasons : Is It Still Worth It For A Foreigner To Invest In Singapore

NUS Real Estate Survey Reveals Growing Optimism Among Industry Leaders

Top 5 Tourist Attractions in Singapore

Top 5 Romantic Date Spots in Singapore

Why Can’t More People Own Private Property?

Discover the 3 Top Factors Impacting HDB Resale Valuation in Singapore: What Every Buyer Must Know!

5 Most Common Property Investment Scams To Watch Out For In Singapore

5 Reasons Why You Should Consider Investing In Singapore Real Estate

Can You Still Make Money from Older Freehold Condos in Singapore

Top 5 : Long-Term Economic Impacts Of Foreign Real Estate Investment In Singapore’s Luxury Condo Market?

5 Singapore Property Investing Myths Debunked

ANALYSIS: Unveiling the HDB Towns with the Steepest and Lowest Price Surges!