When you flip open the papers or turn on the news nowadays, the common buzzwords are “INFLATION“, ” INTEREST RATE HIKES” & ” LOOMING RECESSION“.

These aforementioned occurrences do intrinsically affect us in varying degrees. With the stability of the economy called into question, people are naturally more prudent in the way they spend their money. As much as our human instincts force us to play it safe during times of uncertainty, what if the best opportunities are present during these times?

Amidst inflation & rising interesting rates, the property market remains absolutely resilient.

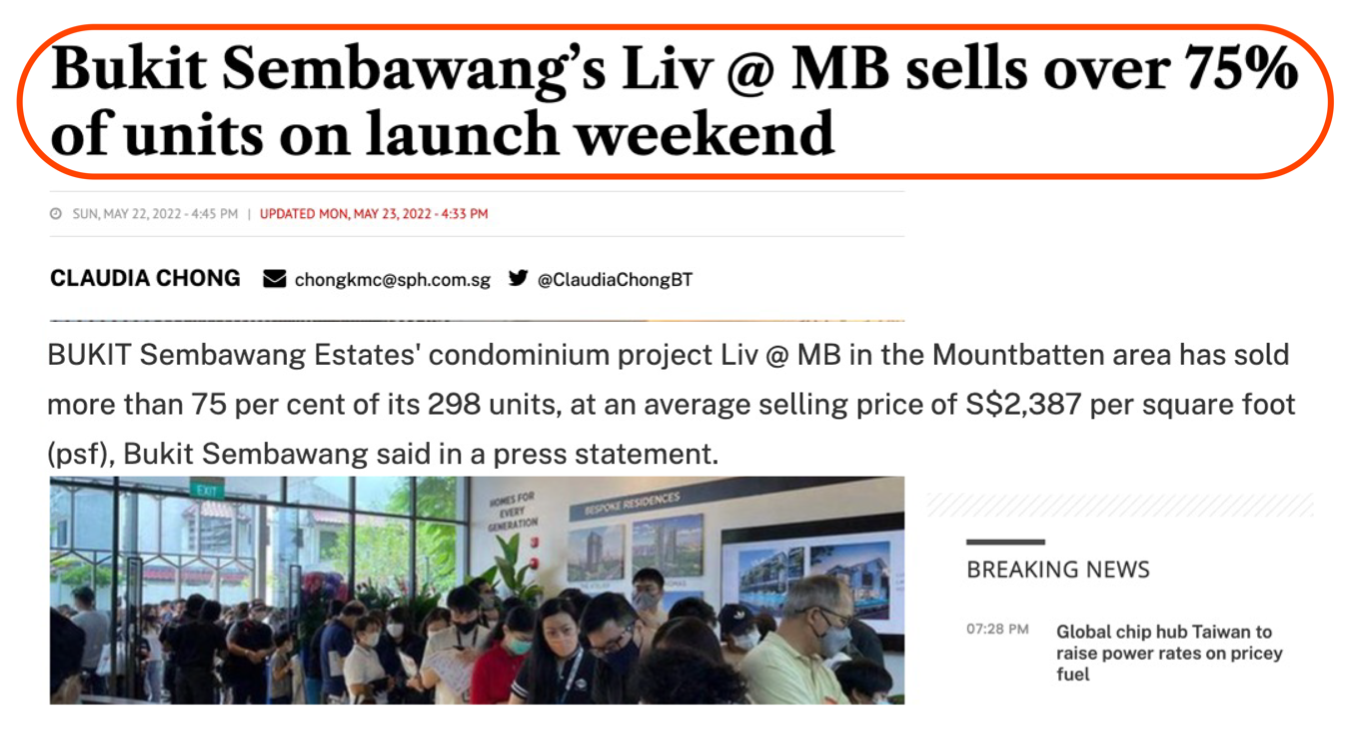

As you can see from the two articles below, Liv@MB and Piccadilly Grand are two very recent launches, and the reception was outstanding. Both of them sold more than 75% of the units in just the opening weekend alone.

Why do Singaporeans continue to spend or invest their money in real estate?

If you are sitting here wondering why, what are the secrets they know that you don’t?

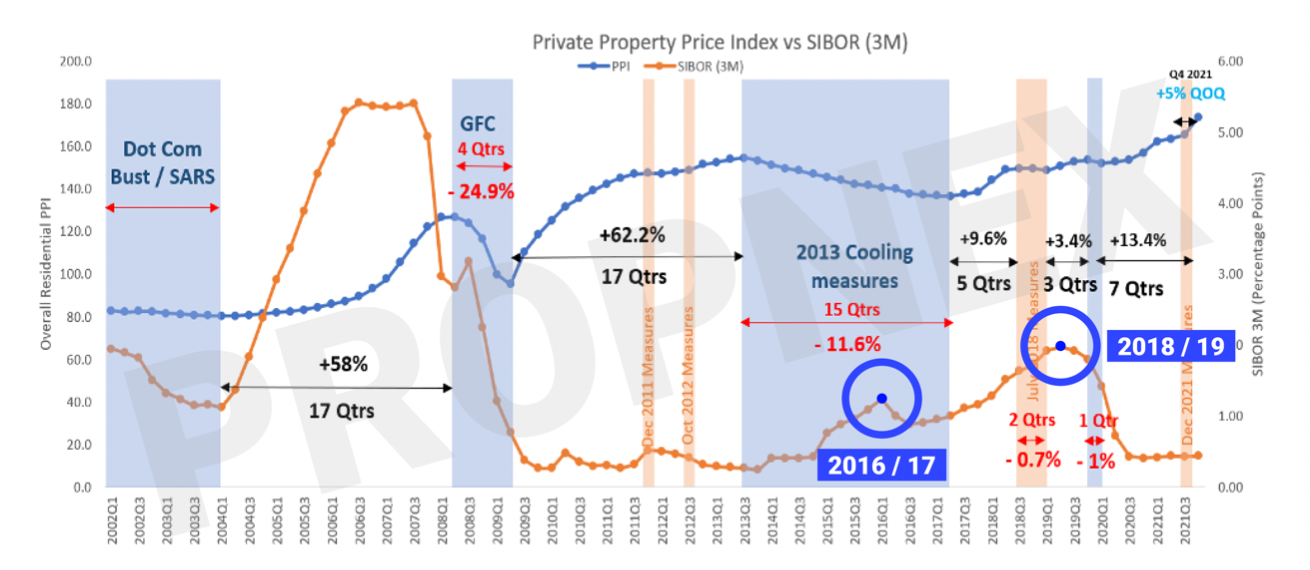

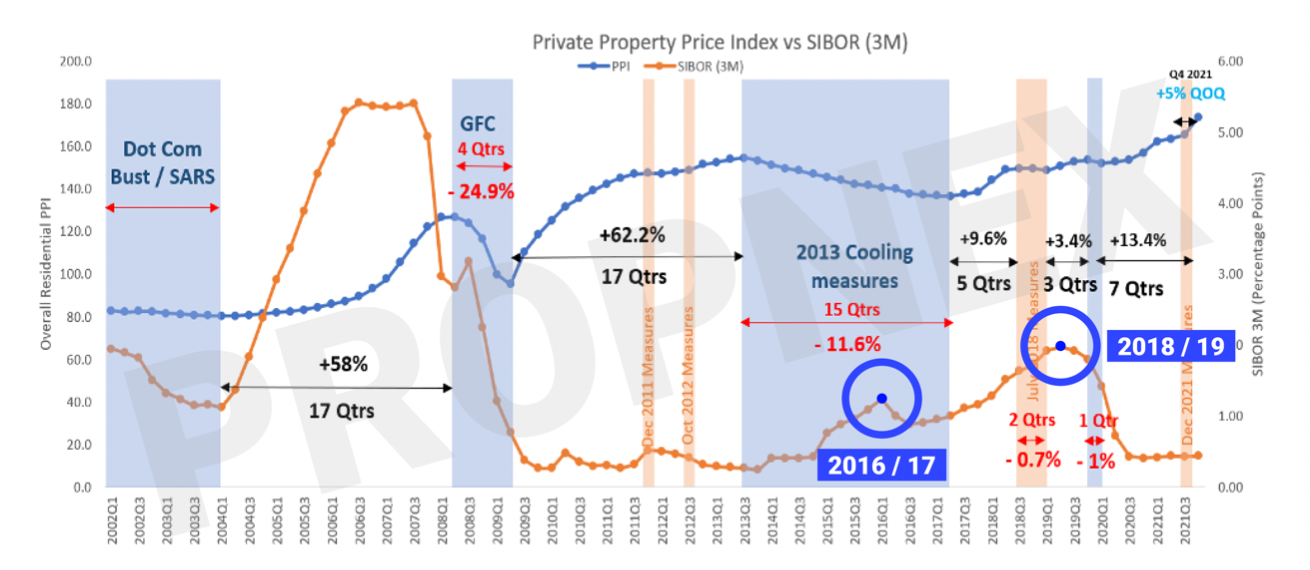

For one, people who know what they’re getting into and take action during a crisis or times of uncertainties tend to make more money. If you’d take a look below and see, in the 2016/17 and 2018/19 periods, you’ll notice that the interest rates were at one of their highest points in recent years. See Chart > Private Property Price Index VS SIBOR chart

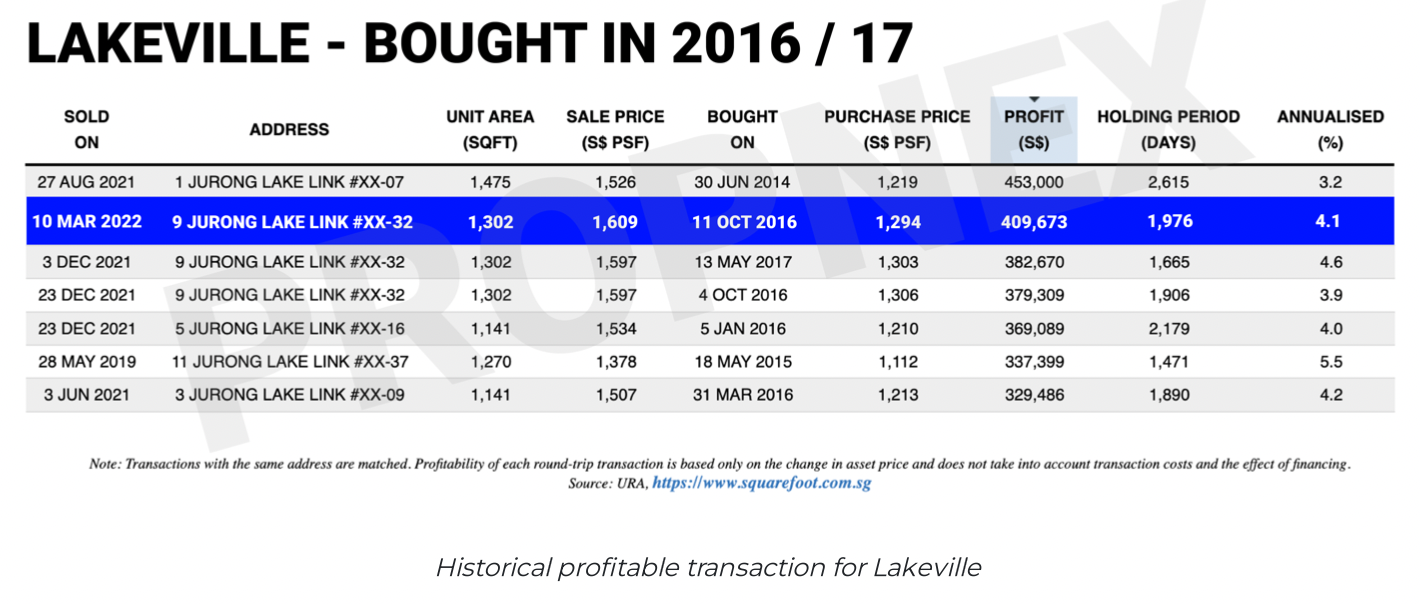

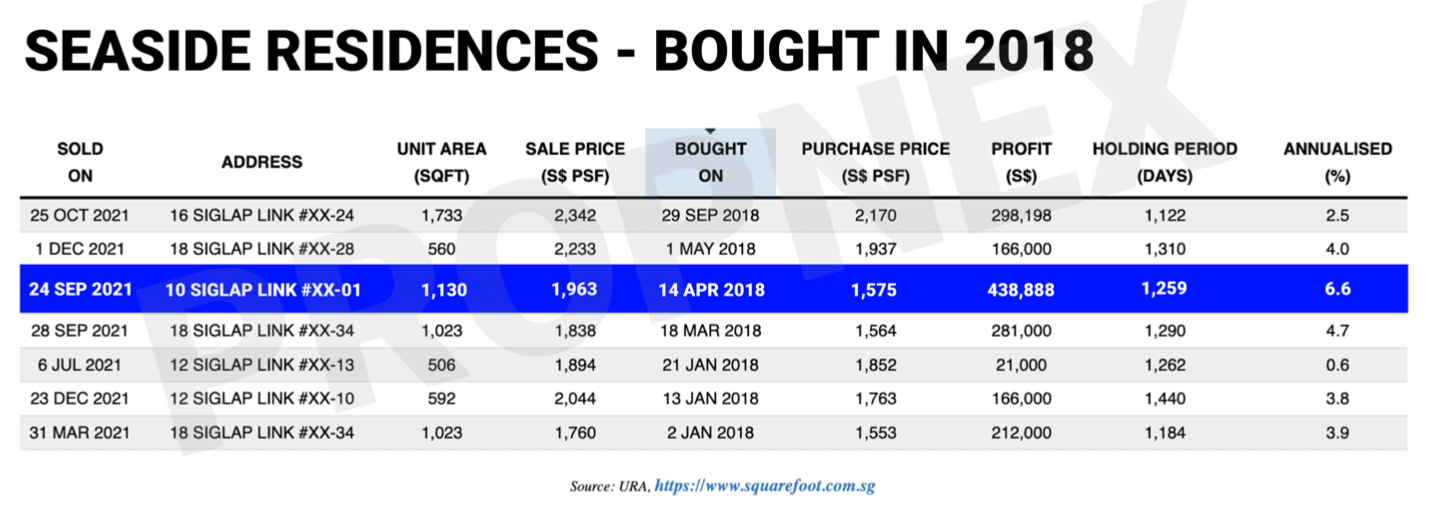

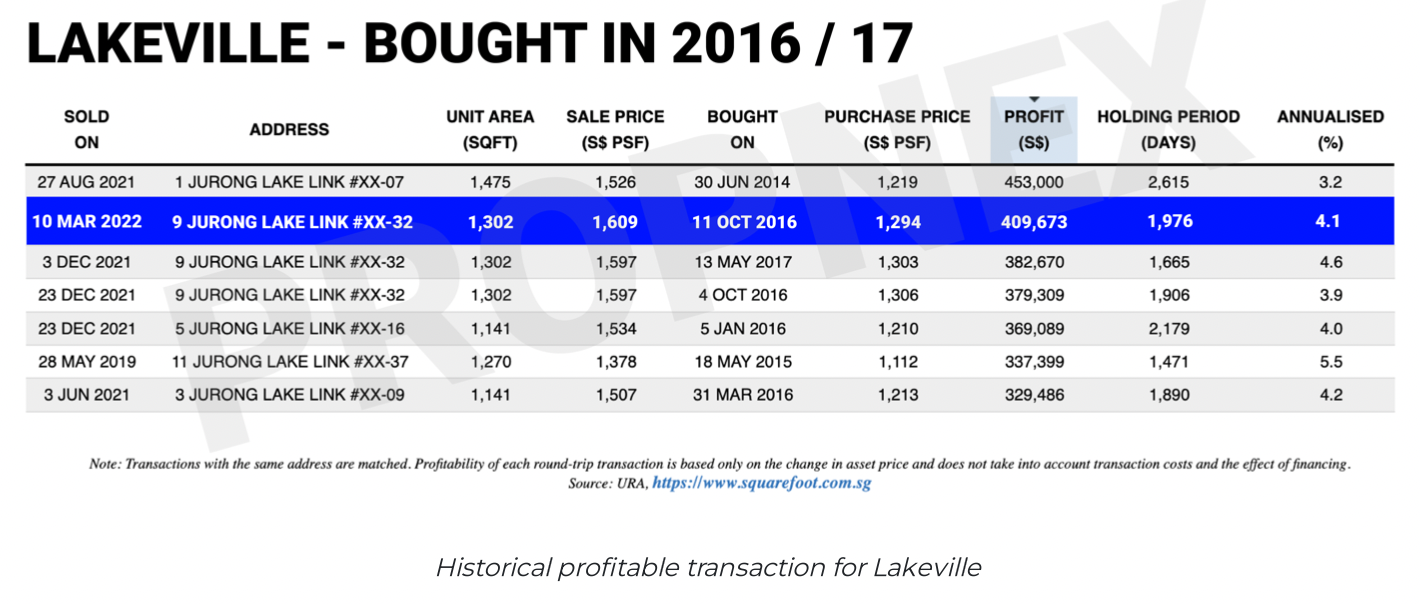

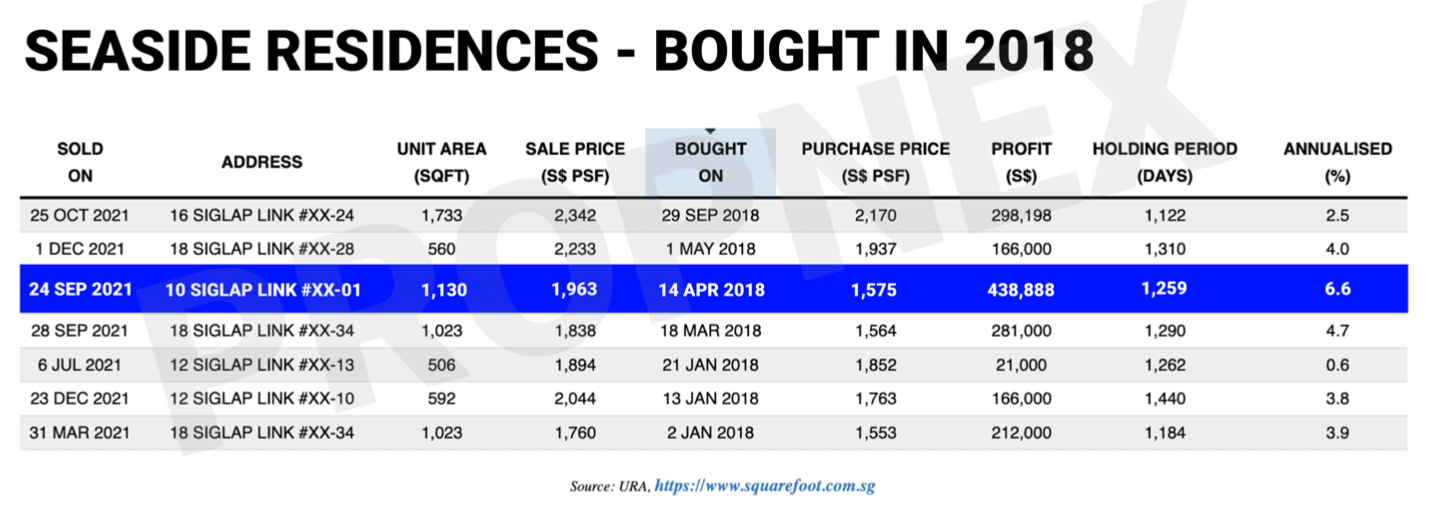

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

You must be asking yourself, why did these people dare to take action?

It is simply because they have knowledge of the real estate market and did their due diligence by assessing their finances & risk involved. That is why it is essential for you to learn before you take any action, especially during this period when there are many lingering uncertainties.

There is a general rule of thumb that 80% watch on as 20% of the people makes money

We can always design our own future instead of falling into the wrong side of the spectrum by default.

What is Your Next Step?

Wait & See?

Make a Move Now?

DM me here, you’ll learn how you can navigate through crisis and make the right moves on your property journey.

You May Also Like …

Jayson Ang – July 28, 2024

TLDR Understanding the nuances of the HDB property market in Singapore, especially the trend of million-dollar flats, requires a deep...

Read More

Jayson Ang – November 29, 2024

Singapore, a thriving city-state known for its stable political climate, excellent infrastructure, and strong economic fundamentals, has long been an...

Read More

Jayson Ang – July 1, 2024

TLDR When a seller unexpectedly withdraws from a property transaction before a contract is signed, they are legally allowed to...

Read More

Jayson Ang – December 10, 2022

TLDR The Singapore real estate market is vibrant, driven by a strong economy, stable business climate, and attractive investment opportunities....

Read More

Jayson Ang – September 10, 2024

TLDR When a property has multiple owners, the choice of ownership type is crucial to determine how shares are distributed...

Read More

Jayson Ang – February 21, 2025

Freehold properties, a term often heard in the real estate market, are properties that are "free from hold" of any...

Read More

Jayson Ang – April 16, 2023

TLDR Setting up utilities in Singapore for a new home is hassle-free. Contact SP Services for electricity and water accounts,...

Read More

Jayson Ang – April 3, 2024

Singapore, a melting pot of cultures and culinary delights, is well-known for its diverse food scene. With its strategic location...

Read More

Jayson Ang – June 8, 2024

TLDR When considering the current real estate market in Singapore, it's crucial to understand the impact of factors such as...

Read More

Jayson Ang – May 20, 2023

5 Singapore Property Trends to Watch in 2023: Expert Weigh In Top 5 Singapore Property Trends to Watch in 2023...

Read More

Jayson Ang – July 14, 2024

Singapore's prime district properties continue to be in high demand due to a combination of factors that make them attractive...

Read More

Jayson Ang – June 6, 2023

TLDR When considering selling your home, several key indicators can help you determine if it's the right time to make...

Read More

Jayson Ang – September 2, 2024

TLDR Transitioning from a BTO to a landed property necessitates understanding market trends, meticulous financial planning, exploring financing options, enhancing...

Read More

Jayson Ang – April 1, 2024

Investing in Singapore property can be a lucrative venture for investors, but it's important to avoid common mistakes that can...

Read More

Jayson Ang – January 16, 2025

Investing in a luxury condominium in Singapore is an attractive option for investors looking to diversify their portfolio and enjoy...

Read More

Jayson Ang – December 9, 2022

TLDR The pandemic-induced recession has surprisingly boosted property prices in Singapore, defying conventional economic trends. Factors like cost-push inflation, limited...

Read More

Jayson Ang – January 23, 2024

TLDR 2023 saw a roller-coaster ride in the real estate market, with various challenges like high interest rates and geopolitical...

Read More

Jayson Ang – April 4, 2024

As one of the world's leading financial centers, Singapore has always been a popular destination for property investment. With a...

Read More

Jayson Ang – January 8, 2023

TLDR: Understanding the HDB Market Outlook 2023 The HDB resale market showed resilience in 2022, with significant growth in sales...

Read More

Jayson Ang – March 19, 2025

Purchasing a property in Singapore can be an exciting and rewarding experience, especially for those looking to invest in the...

Read More

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences