When you flip open the papers or turn on the news nowadays, the common buzzwords are “INFLATION“, ” INTEREST RATE HIKES” & ” LOOMING RECESSION“.

These aforementioned occurrences do intrinsically affect us in varying degrees. With the stability of the economy called into question, people are naturally more prudent in the way they spend their money. As much as our human instincts force us to play it safe during times of uncertainty, what if the best opportunities are present during these times?

Amidst inflation & rising interesting rates, the property market remains absolutely resilient.

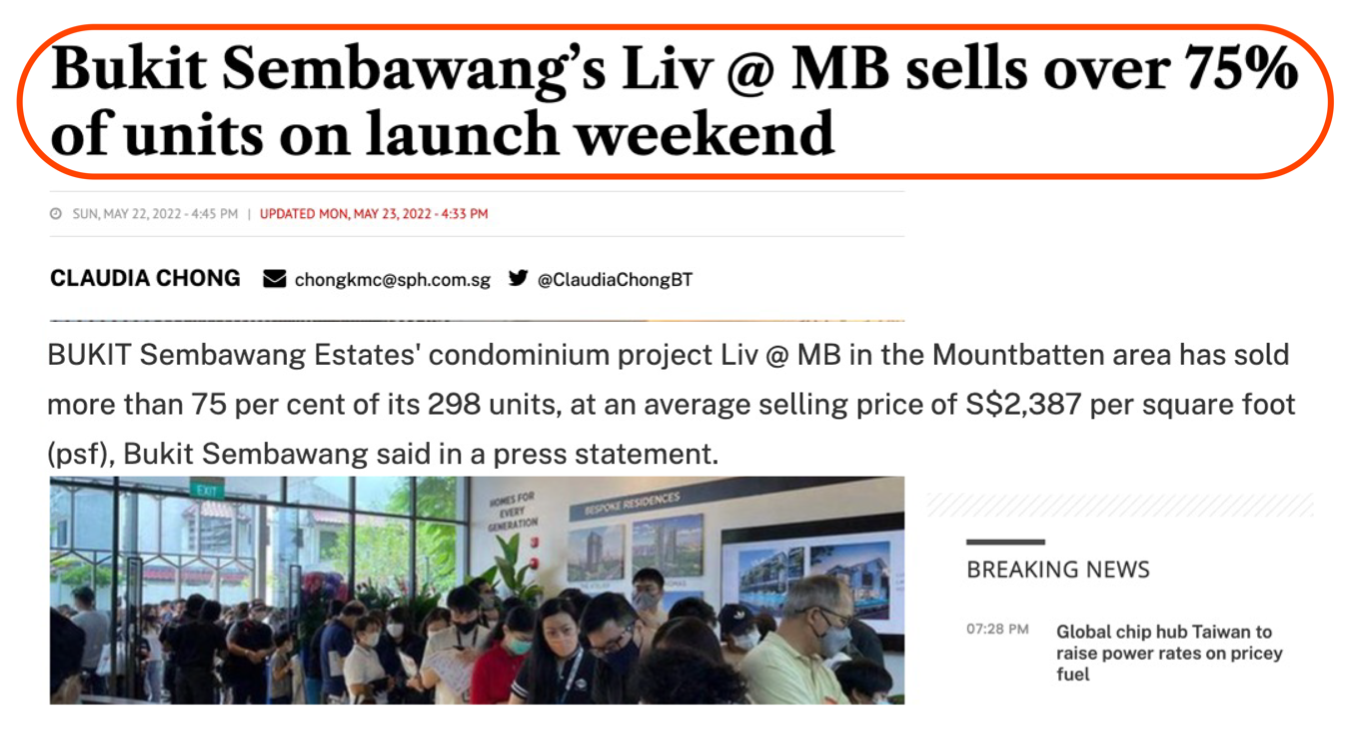

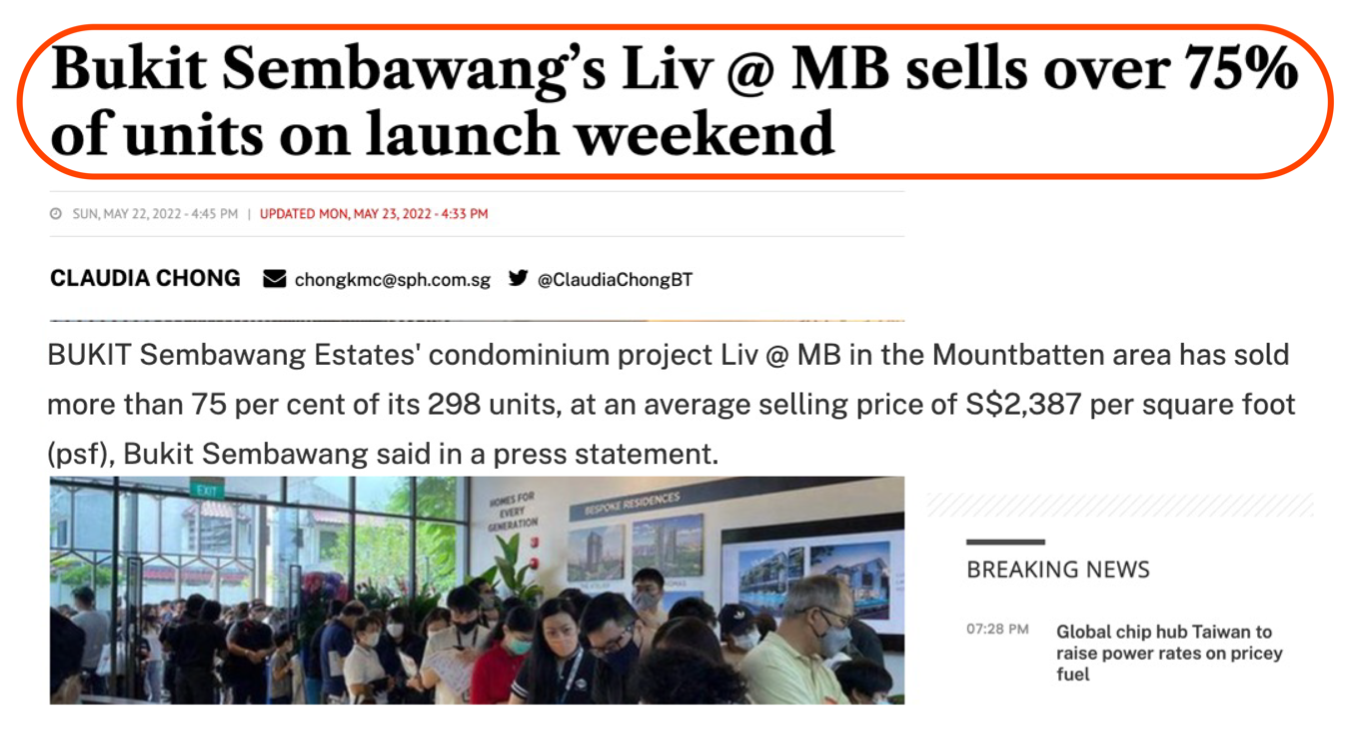

As you can see from the two articles below, Liv@MB and Piccadilly Grand are two very recent launches, and the reception was outstanding. Both of them sold more than 75% of the units in just the opening weekend alone.

Why do Singaporeans continue to spend or invest their money in real estate?

If you are sitting here wondering why, what are the secrets they know that you don’t?

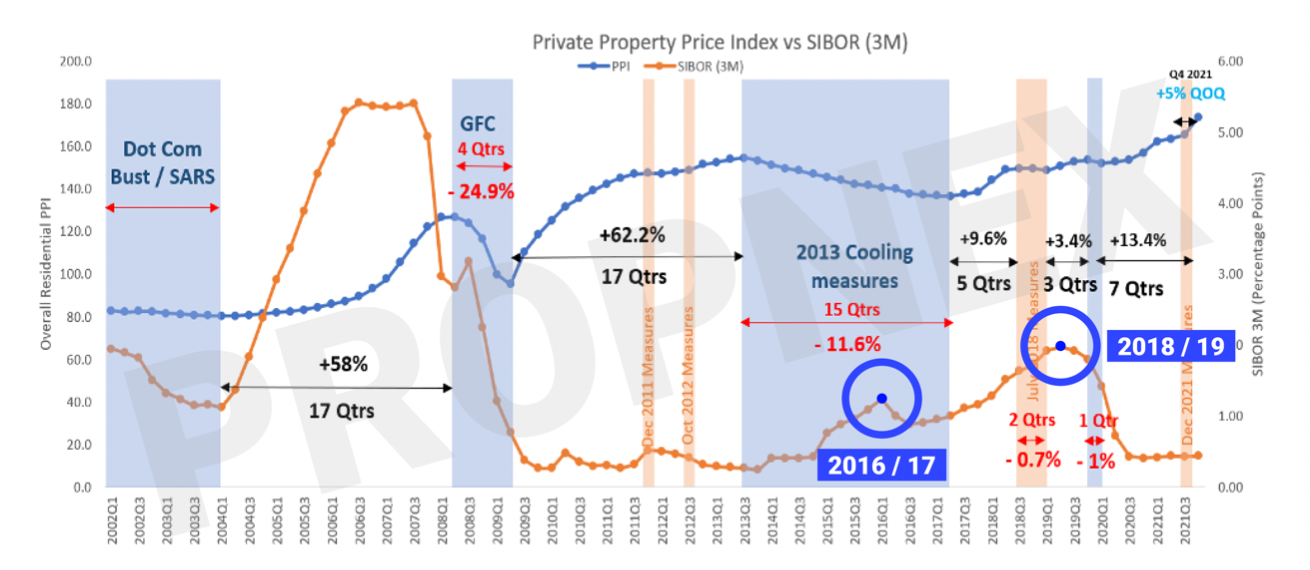

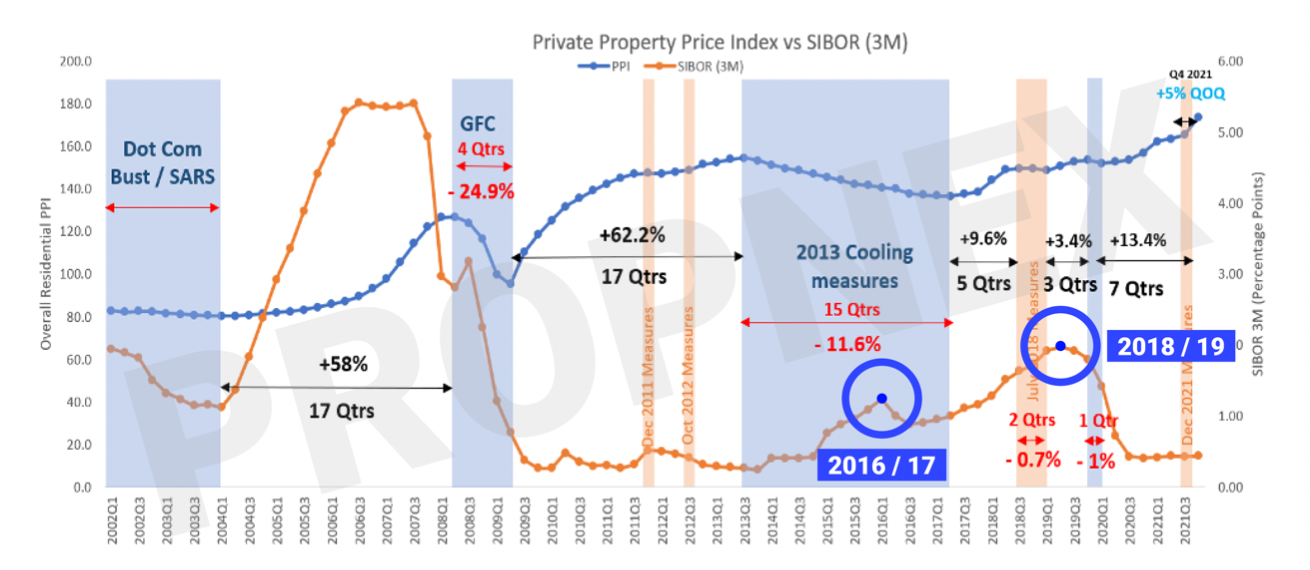

For one, people who know what they’re getting into and take action during a crisis or times of uncertainties tend to make more money. If you’d take a look below and see, in the 2016/17 and 2018/19 periods, you’ll notice that the interest rates were at one of their highest points in recent years. See Chart > Private Property Price Index VS SIBOR chart

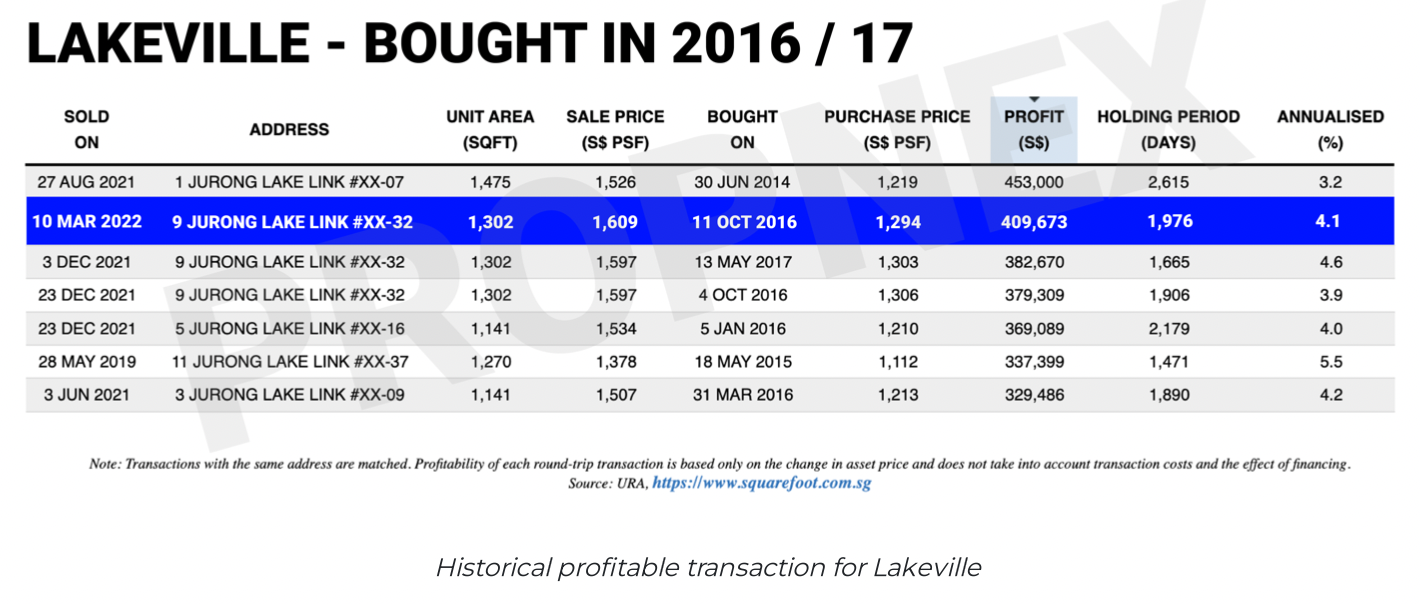

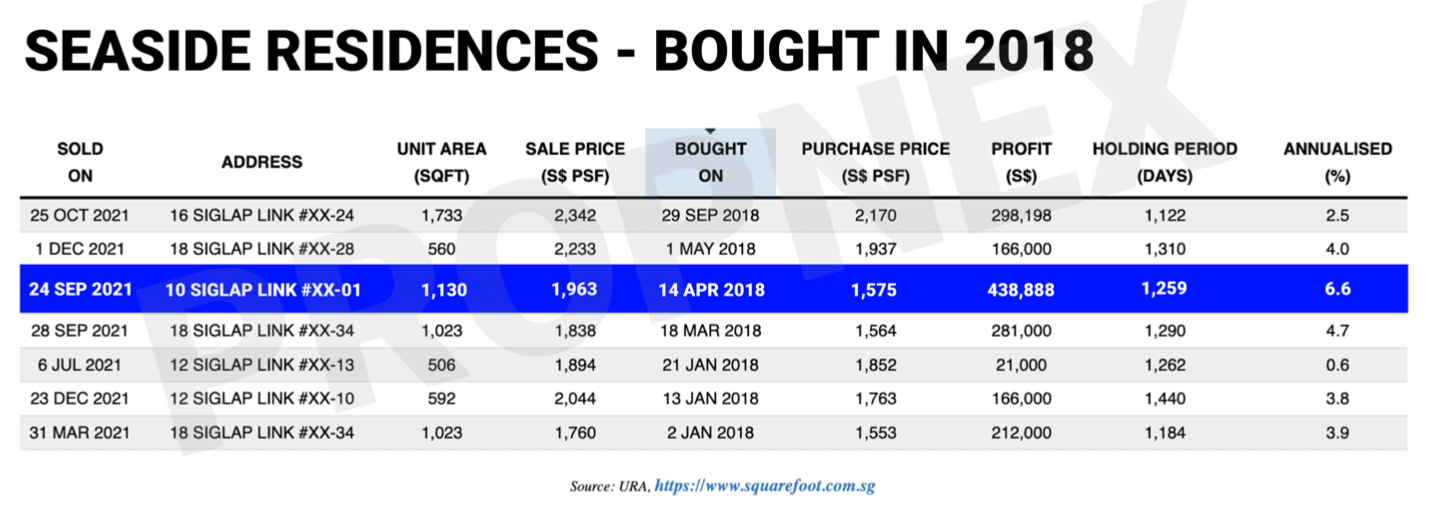

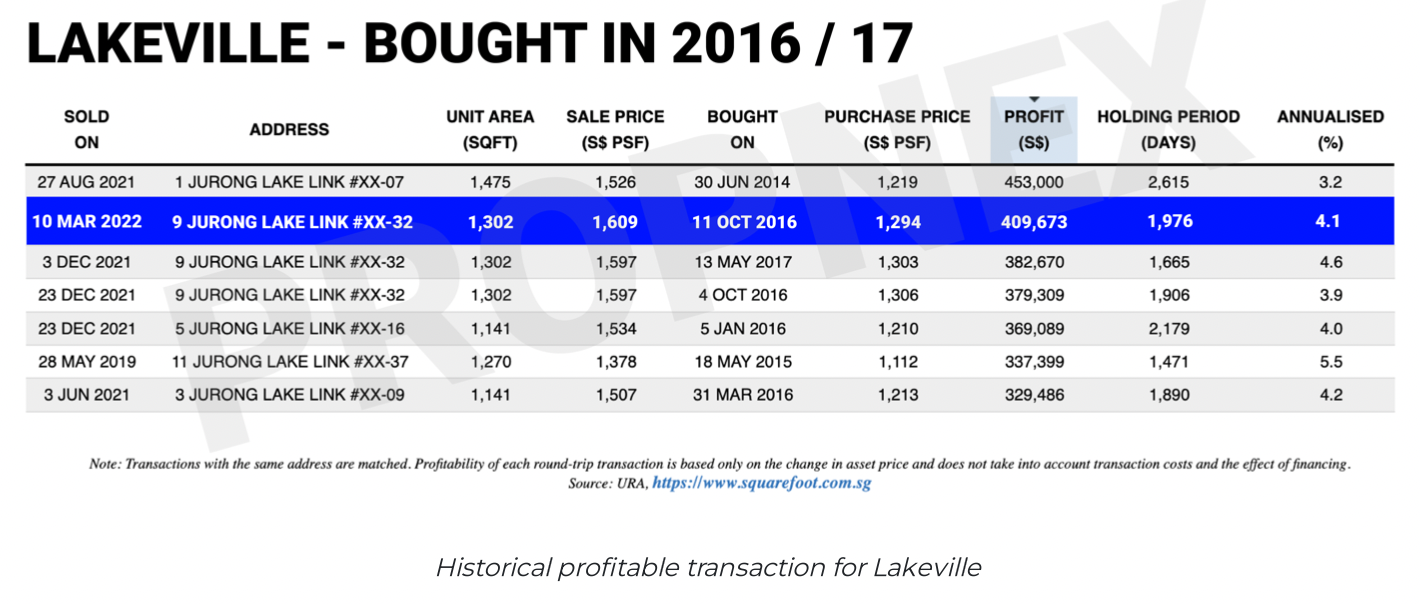

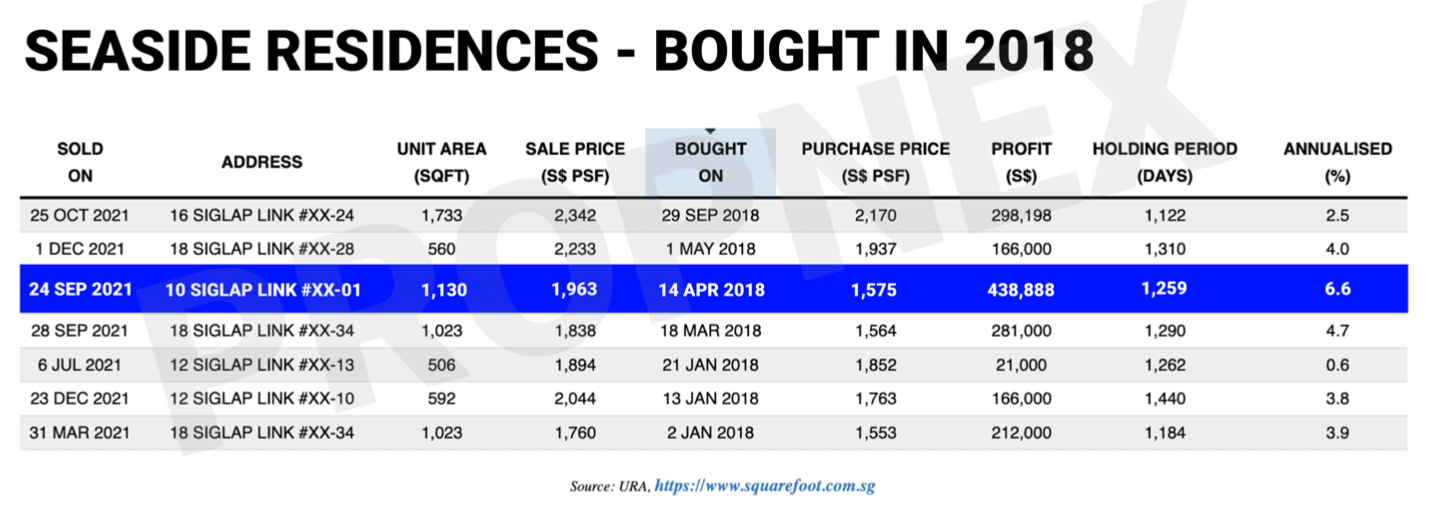

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

You must be asking yourself, why did these people dare to take action?

It is simply because they have knowledge of the real estate market and did their due diligence by assessing their finances & risk involved. That is why it is essential for you to learn before you take any action, especially during this period when there are many lingering uncertainties.

There is a general rule of thumb that 80% watch on as 20% of the people makes money

We can always design our own future instead of falling into the wrong side of the spectrum by default.

What is Your Next Step?

Wait & See?

Make a Move Now?

DM me here, you’ll learn how you can navigate through crisis and make the right moves on your property journey.

You May Also Like …

Jayson Ang – May 14, 2023

Hey everyone! Today I want to share with you the 5 hottest neighborhoods in Singapore for real estate investment. These...

Read More

Jayson Ang – May 27, 2024

TLDR When diving into Singapore's property market, expect a rollercoaster ride as trends shift drastically in 2024. Landlords and tenants...

Read More

Jayson Ang – September 20, 2024

Singapore, a vibrant and bustling city-state, is known for its diverse culture and thriving arts scene. The city's love for...

Read More

Jayson Ang – March 2, 2023

TLDR When considering purchasing an older resale condo, ensure you investigate potential en-bloc bids, lift conditions, parking conveniences, playground safety,...

Read More

Jayson Ang – March 2, 2024

Singapore is renowned for its thriving real estate market, with many desirable neighborhoods and top-notch properties. However, when it comes...

Read More

Jayson Ang – February 11, 2025

Singapore, a vibrant city-state known for its diverse culture and rich history, offers a plethora of unique experiences that go...

Read More

Jayson Ang – April 5, 2024

TLDR The blog post discusses the evolving regulations for single individuals to purchase public housing in Singapore. It highlights the...

Read More

Jayson Ang – March 2, 2025

TLDR The Government Land Sales (GLS) program in Singapore is critical for developers to obtain development land, with sites released...

Read More

Jayson Ang – March 22, 2024

Retirees have unique needs when it comes to property investments. They require properties that offer comfort, security, and easy access...

Read More

Jayson Ang – June 4, 2024

Singapore, a small yet bustling city-state, is well-known for its impressive skyline, diverse culture, and delicious food. However, not many...

Read More

Jayson Ang – July 9, 2023

TLDR When selling a condominium in Singapore, understanding the critical steps is key. First, ensure you are not liable for...

Read More

Jayson Ang – December 7, 2022

TLDR The HDB market has seen significant changes over the years, with many young owners looking to upgrade to private...

Read More

Jayson Ang – December 15, 2024

TLDR Understanding your property's annual value is crucial for determining property taxes in Singapore. The annual value is based on...

Read More

Jayson Ang – July 2, 2024

Singapore, a melting pot of cultures and culinary delights, is known for its mouth-watering food scene. From hawker centers to...

Read More

Jayson Ang – November 25, 2024

Buying an older property can be a dream come true for many homebuyers, as these homes often come with unique...

Read More

Jayson Ang – January 29, 2024

TLDR Newly launched condominium buyers face uncertainties about price changes, proximity to schools, construction methods, maintenance costs, elevator availability, commercial...

Read More

Jayson Ang – March 16, 2023

TLDR When considering buying a property in Singapore, it's crucial to understand the true costs and risks involved. High monthly...

Read More

Jayson Ang – January 10, 2025

Singapore's real estate market is known for its stability and potential for growth, making it an attractive investment destination for...

Read More

Jayson Ang – June 30, 2024

Real estate investment has always been considered a sound investment decision, as it offers long-term growth potential and a reliable...

Read More

Jayson Ang – May 7, 2024

Singapore's property scene has always been a powerhouse, effortlessly combining the new with the old. It's a real estate playground...

Read More

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences