TLDR

When considering property investments, understanding your motives is crucial. Factors like accessibility to amenities, remaining lease, transaction history, rentability, rental yield, and layout play significant roles in decision-making. Proximity to MRT stations can impact rentability but doesn’t always guarantee higher returns. Assessing amenities within a kilometer radius is essential, considering both benefits and drawbacks. Beware of lease decay in older properties and review transaction histories for insights. Rental yield calculations involve net yields and various expenses. Lastly, the layout of a property should align with current trends for optimal value. Understanding these factors can guide you towards making informed decisions in the real estate market.

Properties that appear to have it all – located near an MRT station, close to top-notch schools, in the heart of Singapore with all the conveniences – even freehold – often don’t bring as much value as you’d expect.

When it comes to property investment, location can seem like a major factor – but it isn’t that simple. It takes a sharp eye to really appreciate a property’s potential; someone could look at a dilapidated building in a Geylang alleyway and see the hidden value, while someone else might have all the facts and figures at their disposal, yet still make subpar choices.

If you are just starting to explore the possibility of buying a home, here are a few fundamental concepts that you need to be aware of.

Although knowledge of these basics will not make you an expert, they can help you begin your journey down the path of homeownership.

What You Need From A Property Depends On Your Motives For Purchasing It – That’s The ‘Right’ One For You

Prior to starting to browse through the various properties, it is important that you have a clear idea of your purpose.

Those properties that may be an excellent investment could be completely wrong for somebody looking to purchase a home.

For instance, an individual hoping to make their home there may not appreciate living in a busy integrated development with a shopping center, even though it could potentially bring in high returns.

Are you in search of true homeownership, need to downsize, or planning to upgrade from a flat to a private condo for investment purposes such as capital gains and rental income?

The qualities you emphasize depend on your purpose for buying a house. Homeowners aren’t as worried about rental yield as they’re not planning to rent it, while those planning to move in five years may overlook certain features, like being in an area with fewer connections, if the price is projected to rise in the near future.

Knowing what you’re looking for in a property is the first step to making the right choice. When searching, it’s important to consider factors such as accessibility, amenities and disamenities, remaining lease, transaction history, rentability and rental yield.

1. Accessibility

Although the proximity of a property to an MRT station could potentially lead to better returns, this is not always the case. Long before these stations are opened, developers often have time to anticipate and account for this change. Therefore, the impact of an MRT station on rental yields can be unpredictable.

Investing in properties near MRT stations not only boosts rentability, but it also increases the chance of finding tenants quickly and for longer leases, since accessibility is not an issue. Plus, there’s a bigger pool of potential buyers, which makes it easier to find the right one – though it may not necessarily bring higher returns considering you had to pay a premium for it.

Given that owning a car is becoming more costly (check out Budget 2023 on taxes on cars and the wild COE prices), living near an MRT station can help you save money. The maximum distance that most healthy adults would feel comfortable walking is one kilometre – a 10 to 13 minute walk. Beyond this distance would be considered too far from the MRT.

As a homeowner, don’t forget to consider any children or mobility-impaired family members when making your decision. The five-minute walk to the MRT might not be feasible for them. Moreover, remember that the convenience of a location on a map isn’t necessarily accurate – Google Maps can’t account for inclines or unsafe pathways, which can drastically increase the time it takes to travel.

2. The Pros And Cons Of Amenities

Within a kilometre, search for the essential stores like groceries, clinics and malls, plus schools, offices (especially business parks or tech hubs), entertainment spots such as cinemas and sports complexes, and take a leisurely stroll in the parks, park connectors or nature walks!

The greater number of the above facilities you can find within a kilometer radius, the more appealing a location is. But, here’s something you may not be aware of: they can be either beneficial or detrimental to an area. Places of worship, hospitals, airports, nightlife, malls, offices and schools – these are the sites to pay attention to if you wish to make an informed decision.

The Ola EC, located in front of Sengkang General Hospital, presents a unique dilemma for potential homeowners: while it is close to a healthcare provider, ambulance sirens at night may be a concern, and from a Fengshui perspective, the entrance of the morgue should not be faced.

All of this, coupled with the potential for increased noise and traffic congestion, can make this a tough decision for some – after all, amenities such as offices nearby are not always beneficial if you don’t work or rent them out.

3. Balance Lease

Due to the potential risks associated with older leasehold properties, new investors should avoid them. Though some investors may be tempted to take advantage of the low purchase price of a decaying lease, their strategy of hoping to rent at close to market value is high risk and provides no easy way to exit should things go wrong. For a safer option, look for leasehold properties that are no older than 30 years.

When it comes to buying a home, if you purchase one with a high level of lease decay, your options later on may be more limited, for instance, if your retirement savings take a dip, you may not have the ability to downsize. To truly grasp the difference between leasehold and freehold properties, I suggest you take a look at my earlier articles.

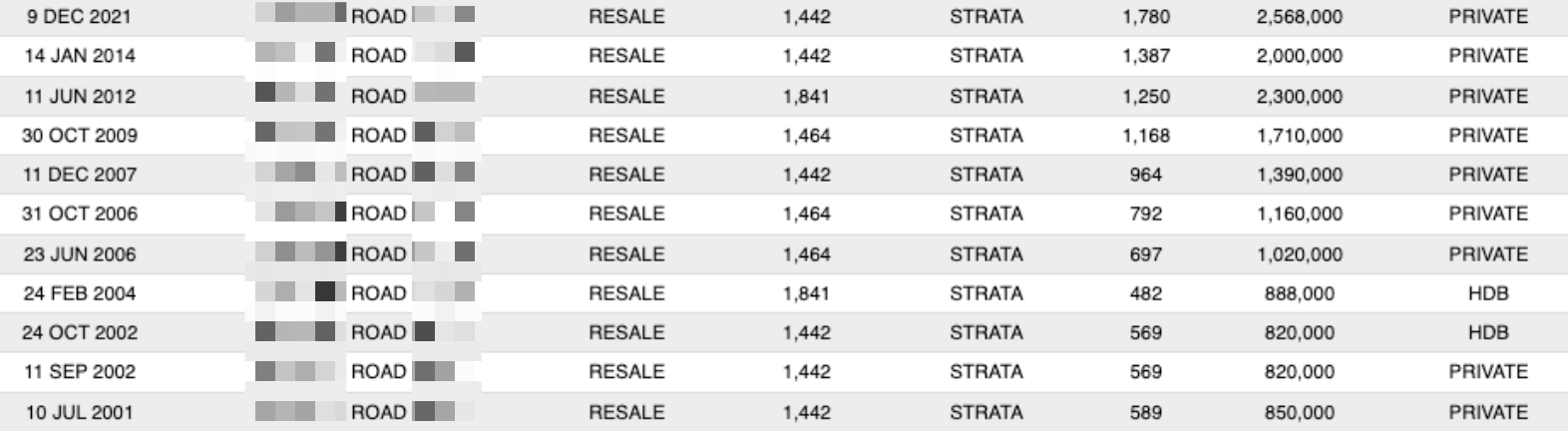

4. Transaction Volume History

By reviewing the transaction history of the property, you can get an idea of what to anticipate regarding a reasonable cost and potential returns.

Additionally, it is beneficial to compare the transaction history of the property with neighbouring units within a one kilometre radius to better understand its performance.

If you need to obtain information about a certain caveat lodged with the URA, it can be a difficult task to sort through the data – don’t worry, though, I am here to help!

Generally, you’d want to find out the transaction flow, such as if there are any units consistently being transacted each month, or if there are any years with no transactions at all – contact me directly and I’ll provide you with the information you need.

Source: Square Foot Research

If you’re looking to purchase a unit in a boutique condo with only a few units in 2023, and the last transaction was in 2019, you’d want to be careful when assessing the value of the unit.

To feel more secure, it’s beneficial to have many transactions occurring around the same price as yours, instead of setting a new, record-breaking high for the development.

5. Rentability And Rental Yield

The ability to easily secure tenants is referred to as rentability, while rental yield is the ratio of a property’s annual income to its cost. Although related, these two metrics are distinct. To calculate the gross rental yield, simply divide the annual rental income by the total cost of the property and multiply by 100.

In Singapore, net rental yield for condos is typically between two to three per cent for most units, or 3% to 4% for more compact units (510 sq. ft. or less), calculated by subtracting recurring expenses (e.g. property tax, maintenance fees, and utility bills) from the rental income and adding one-off costs such as stamp duties, legal fees, and renovation to the total cost of the property.

On average, net rental yields range from 1% to 2% or even 2% to 3% for compact units – a result of the present rental market’s peak. However, these remarkable yields likely won’t be sustained in the long run.

If you find something that rivals this, you could be on to a real winner! But remember, the higher the yield, the lower the value – this could be due to a decaying lease, a less than desirable location or limited amenities, all of which affect rentability.

- For maximum rentability, do your research and consider the following:

- Past vacancies – have there been long, unexplained gaps in occupancy?

- High volume of short-term leases – this might indicate that tenants view the property as transient and expect to haggle on rent.

- Incidents of tenants breaking leases due to issues with the development – are these issues still present?

Doing research on a property’s rentability can be a tedious task, so it’s a good idea to enlist the help of a knowledgeable real estate agent!

6. Layout

No matter how perfect the location, tenure, and facilities of a home may be, if the layout isn’t up to par, it can really be a deal-breaker. After all, the layout is the part of the home where you will be spending the majority of your time.

If you’re trying to determine what the current living trends are, keep in mind that there was a time when 2-bedroom units of 1,000 square feet were considered desirable, often coming with yards and utility.

But these days, there’s less need for such a large space, meaning it might be harder to sell despite the lower price-per-square-foot. When considering what to look out for, think about these factors.

When making a decision regarding your property, it’s important to take into account certain key elements such as the layout’s efficiency, possible renovations, dual key units, the functional vs open space ratio, and the long-term suitability.

If you’re looking for more help, join me on my blog for an in-depth exploration of the latest developments.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …