TLDR

The 2022/23 property market is experiencing high prices, making it challenging for individuals to decide whether to upgrade their homes. While selling your flat could yield record-breaking rewards, be prepared for equally high prices when purchasing a condo. Factors to consider before upgrading include savings to weather economic turbulence, impact of new interest rate floors on loan eligibility, stability of HDB loans, and the risk involved for owner-investors seeking short to mid-term gains. It is crucial to assess your financial situation carefully and avoid rushing into decisions based on market speculation. Upgrading now may be beneficial for some, especially with the increasing construction of HDB flats potentially leading to a drop in resale flat prices in the future. Always prioritize financial prudence over hasty decisions influenced by market trends. Feel free to seek detailed advice tailored to your circumstances for a better understanding of your options.

Low supply and sky-high prices have made the 2022/23 property market a daunting one.

Many are now questioning whether this is the right time to make their move and upgrade their home.

Selling your flat may bring record-breaking rewards, but you should be aware that the condos you buy may come with similarly high price tags.

So, before you take the leap and make the upgrade this year, here’s what you need to know.

You May Sell High This Year, But You’re Buying High As Well

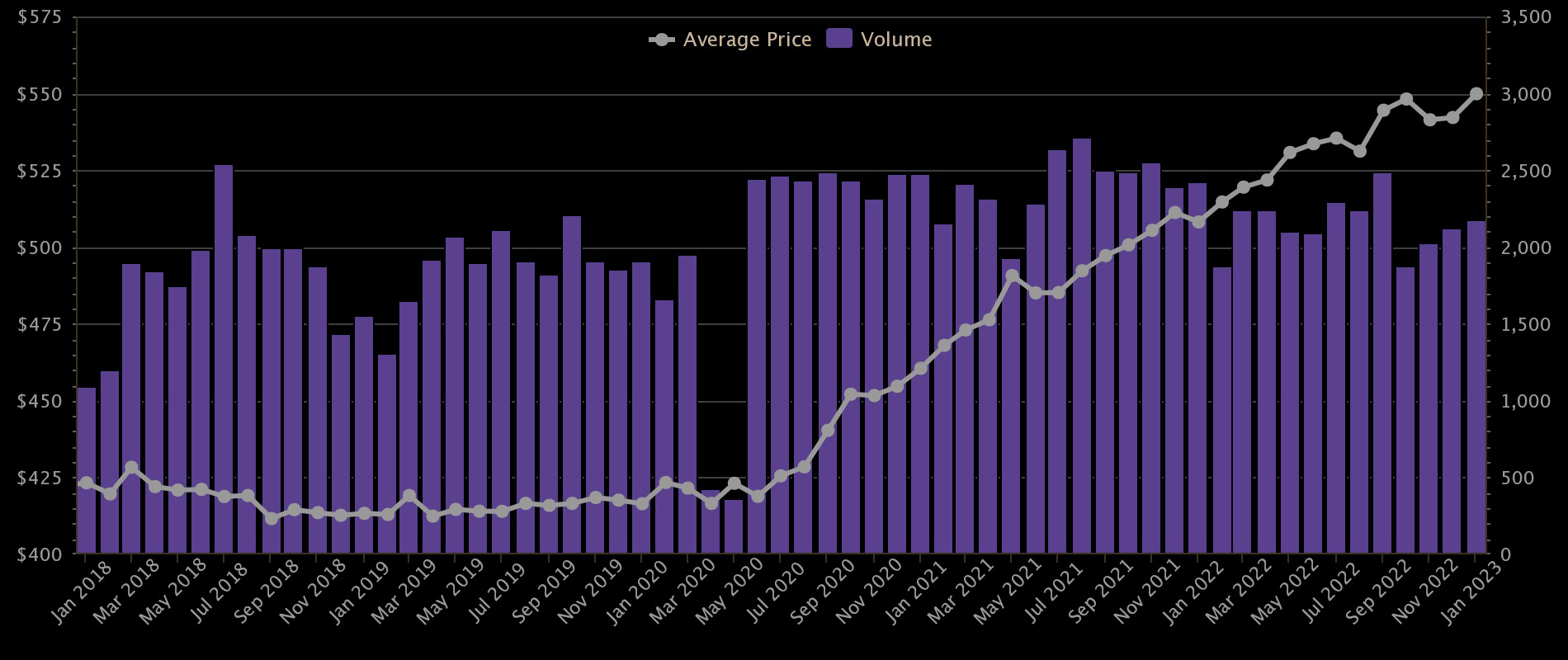

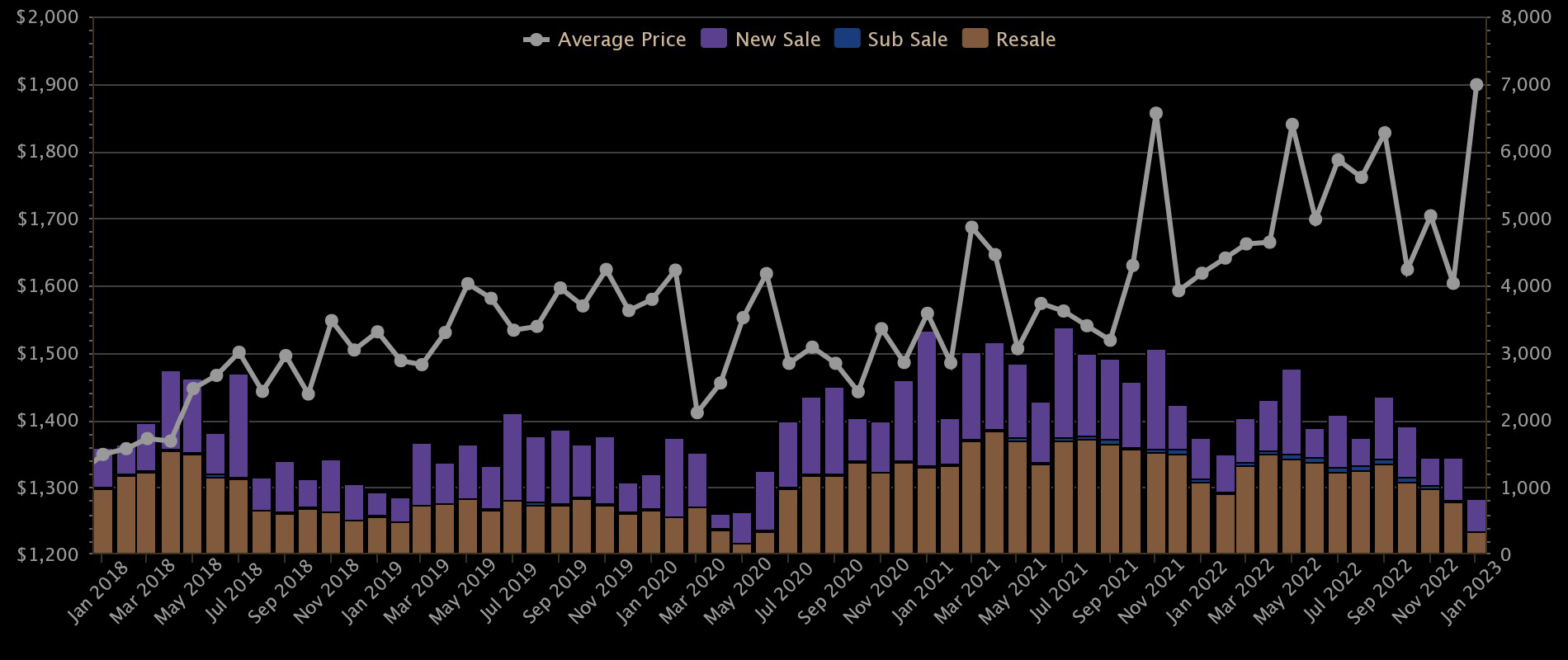

Although these two charts may not be too detailed, they are enough to illustrate the overall trend in HDB flat prices over the past five years.

Without taking into account the distinction between new launches and resale, these prices represent the overall private non-landed market.

Since 2018, private non-landed resale flat prices have skyrocketed from $443 psf to $550 psf – an astounding 24% surge. Even more incredible is the surge in prices per square foot to $1,899, an increase of over 40.7% from the $1,349 mark.

Despite a significant rise in resale flat prices, private homes have generally kept up with HDB flat prices. However, this isn’t always the case and depends on a variety of factors such as district, new launch versus resale, age and more. Therefore, even in times of high flat prices, upgrading may not be easy for everyone.

Many People Could Upgrade This Year, But Let’s Look At Who Should Not Upgrade

“Who could benefit from an upgrade? It’s a large and vaguely defined group – but perhaps it’s more helpful to focus on those who should not be considering it at this time.”

- Anyone without sufficient savings to weather a turbulent economy,

- those paying too much due to new interest rate floors,

- anyone in need of the stability of an HDB loan,

- and owner-investors looking for short to mid-term gains

1. Anyone Without Sufficient Savings To Weather A Turbulent Economy

It’s important to have a savings fund of six months’ worth of mortgage payments in case of a total loss of income – be it in your bank account or CPF.

If you’re looking to upgrade to a private property, keep in mind that the amount should increase to accommodate for this period.

Should you be unable to meet this requirement, 2023 could be a turbulent year and you may not want to take any chances.

When it comes to prudent real estate investment, the 3-3-5 rule is a good starting point (even if it’s somewhat unrealistic).

Save up 30% of the purchase price of your new property, ensure that your monthly loan repayments are no more than 30% of your monthly income, and don’t pay more than 5 times your combined annual income.

For first-time property buyers, HDB limits loan repayments to 30% of your monthly income. Banks, however, allow up to 55% of your monthly income to be used for loan payments, including other debts like car loans.

Remember: just because you can, doesn’t necessarily mean you should.

2. Those Paying Too Much Due To New Interest Rate Floors

To be eligible for a $1 million loan for 25 years, with an estimated monthly repayment of $5,278, you must have a minimum income of $9,596 per month. This is because the interest rate floor, set at four per cent, must be taken into account when determining your Total Debt Servicing Ratio (TDSR) of 55 per cent – meaning that your loan repayments cannot exceed 55 per cent of your monthly income, inclusive of other debts.

If the new interest rate floor leaves your income insufficient to qualify for the desired loan amount, it may mean a hefty down payment, extra cash out of your pocket, and a dip into your CPF usage.

Not to mention, it could wipe out all your savings and deplete your cash reserves. In that case, upgrading may not be a wise move – unless you can find a more affordable alternative.

3. Anyone In Need Of The Stability Of An HDB Loan

As home loan interest rates rise, reaching an average of over three percent after a decade of remaining below two percent, it’s plausible to think they may rise even further, potentially to as much as four or five percent by the end of the year. But if you’ve taken an HDB loan, you need not worry – the rate has been steady at 0.1 percent above the CPF rate (which itself has been 2.6 percent for over two decades).

Leaving the security of an HDB loan to purchase a private property or an Executive Condominium requires you to turn to banks. This can be particularly daunting for individuals facing greater financial uncertainty, like gig economy workers or small business owners whose industries are suffering in the current economy, as taking out a mortgage may involve more risks than they are willing to take on.

Furthermore, it’s worth noting that perpetual fixed-rate home loans don’t exist in Singapore; the fixed-rate loan packages available are only applicable for a limited time, usually three to five years, before becoming variable.

4. Owner-Investors Looking For Short To Mid-Term Gains

An investigation into Urban Vista serves as a prime example of what can transpire when you purchase at a peak – an unequal ratio of 61 unprofitable to 19 profitable transactions was, to a certain extent, the result of the launch timing occurring prior to the high point of prices in 2013. Unfortunately, this was followed by cooling measures that brought on declining prices and resultant losses upon reselling.

In December 2021 and September 2022, the government put two cooling measures in place to raise stamp duties and further restrict loans, a strong indication that it won’t hesitate to take action and drive prices down further if a potentially hazardous bubble is developing. This should serve as a warning to those who buy at the market peak and are expecting swift gains within a short time period (for example, less than five years).

If you’re capable of staying strong and playing the long game, it’s possible to ride out a recession and anticipate the subsequent boom. However, if you require rapid returns, upgrading today may be seen as a gamble.

If You Don’t Fall Into Any Of The Above, You May Still Be Able To Upgrade

Waiting any longer could be detrimental to the possibility of upgrading later on, but with the increased construction of HDB flats in 2020 and 2021, it is likely that the cost of resale flats will drop in the near future.

It may be wise for some to consider purchasing a condo while they still can, given the rapid increase in private property prices in comparison to the slower rise of resale flat prices. This thought may be particularly relevant for the younger generation; while they may be tempted to wait for HDB prices to go up, they may find that the condos in the area become increasingly more expensive.

If you think condominiums will keep increasing in value faster than HDBs, taking advantage of a longer loan tenure, and not having to worry about losing cash due to accrued interest, then upgrading now could be worth considering – especially if your job is secure and you’re progressing. However, don’t let market speculation influence your financial decisions – always keep your personal financials in mind and be prudent, instead of making a rushed decision out of fear of rising prices. It’s far worse to buy something you can’t afford, than to simply save up for a bit longer.

Feel free to reach out to me for a detailed explanation of your circumstances and to view my thorough assessments of both new and resale condos.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …