TLDR

Jayson Ang discusses the essential factors to consider when seeking a property for investment. By analyzing the safe entry price and price gap, clients can make informed decisions. The case study of Cairnhill 16 highlights its attractive entry point compared to other regions, positioning it as a smart investment choice. With the narrowing price gap between different regions and the potential for high returns, investing in freehold properties like Cairnhill 16 in the Core Central Region could be a wise move. Jayson also offers personalized advice, data-driven insights, and strategic real estate solutions tailored to individual needs, guiding investors through their property journey effectively.

What two factors should clients consider when seeking a property to purchase, in order to decide if it is a worthwhile investment?

Safe Entry Price & Price Gap

Let’s make use of Cairnhill 16 as a case study to determine these two key factors.

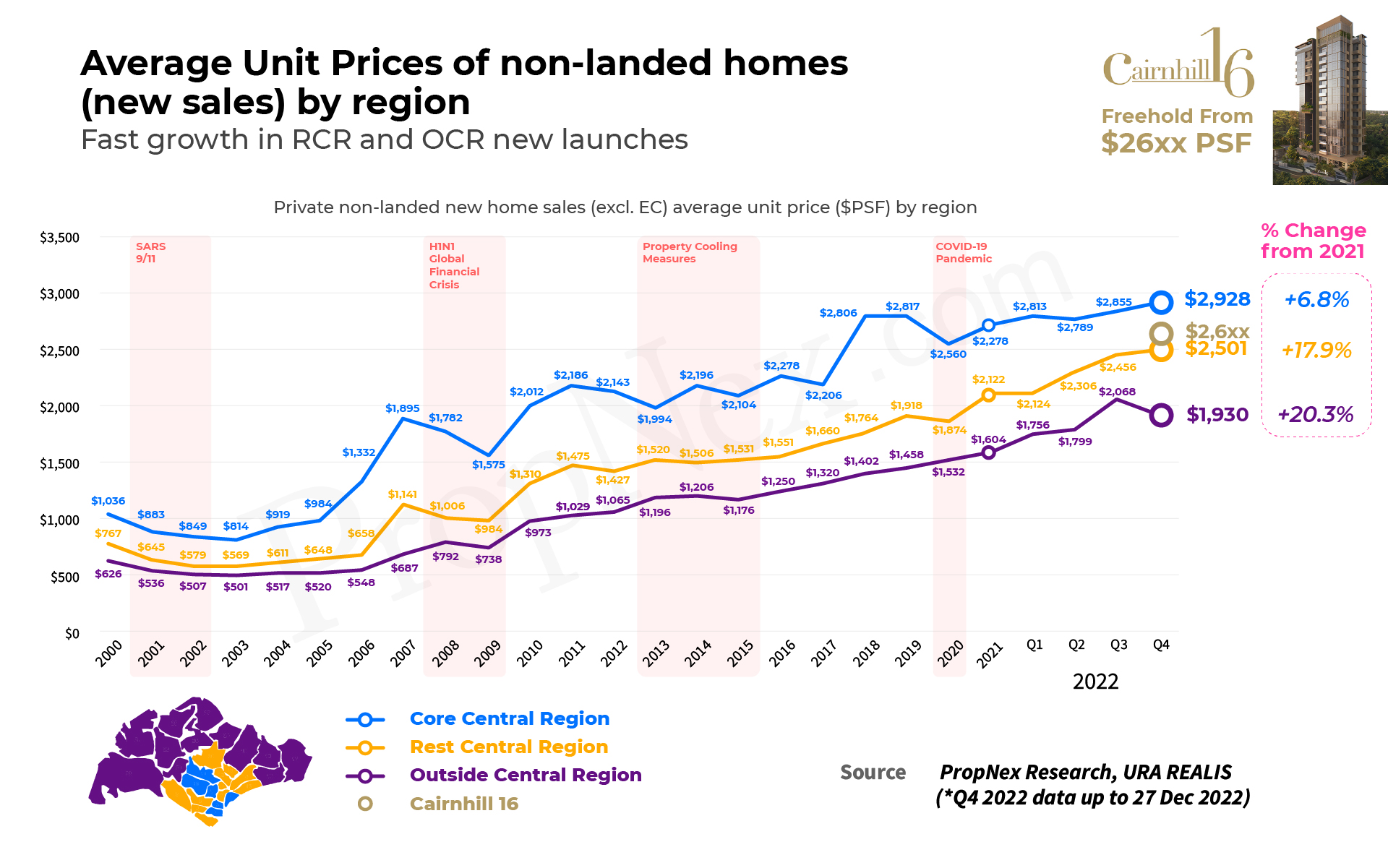

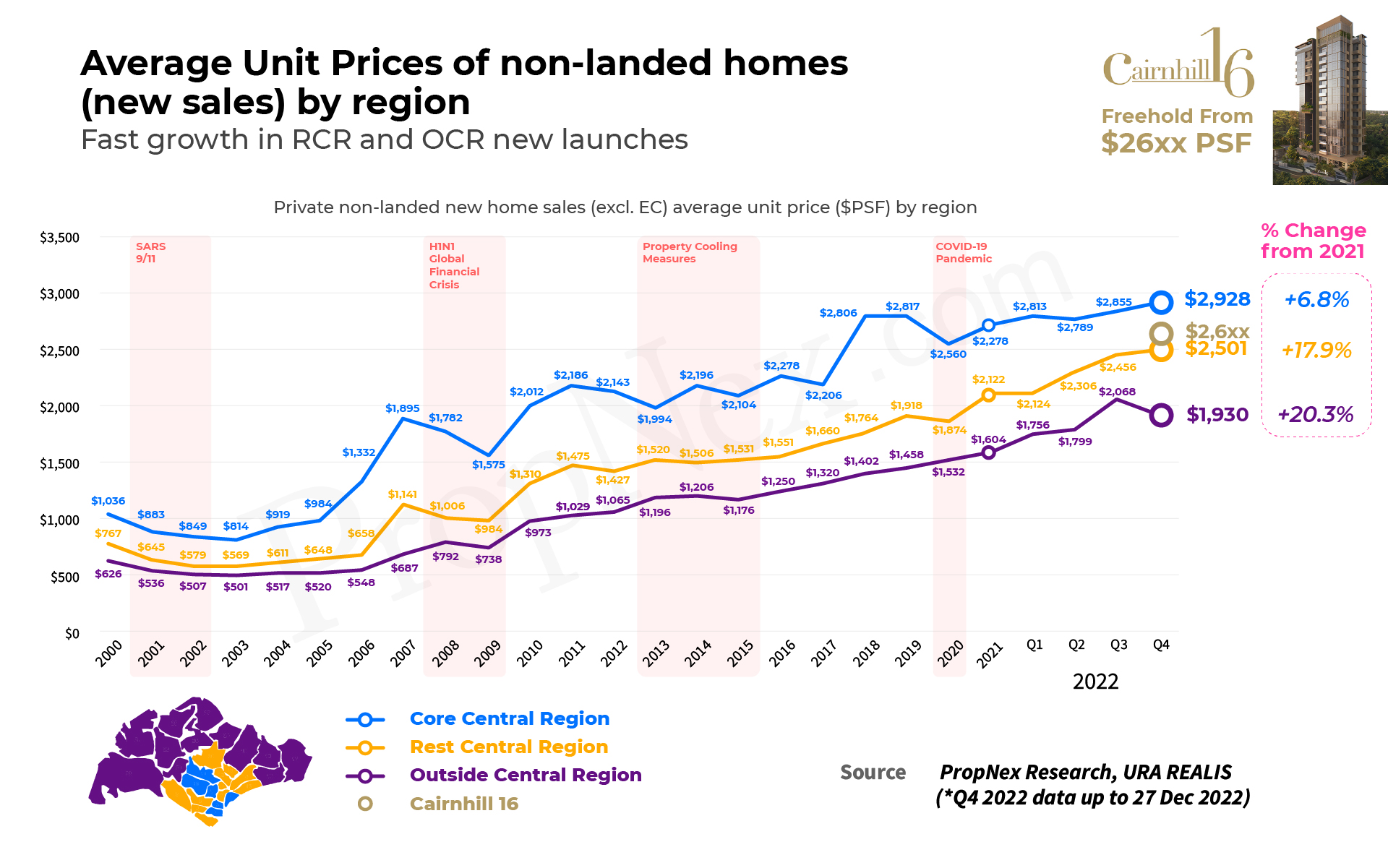

It’s already quite clear that Cairnhill 16, as a freehold property, offers a relatively secure entry point at $2,6XX psf – an attractive proposition compared to 99-year leaseholds in the Outside Central Region (OCR) and Rest of Central Region (RCR), starting from $2,1XX and $2,4XX psf respectively, and with Core Central Region (CCR) properties averaging $2,8XX.

Determining A Safe Entry Price

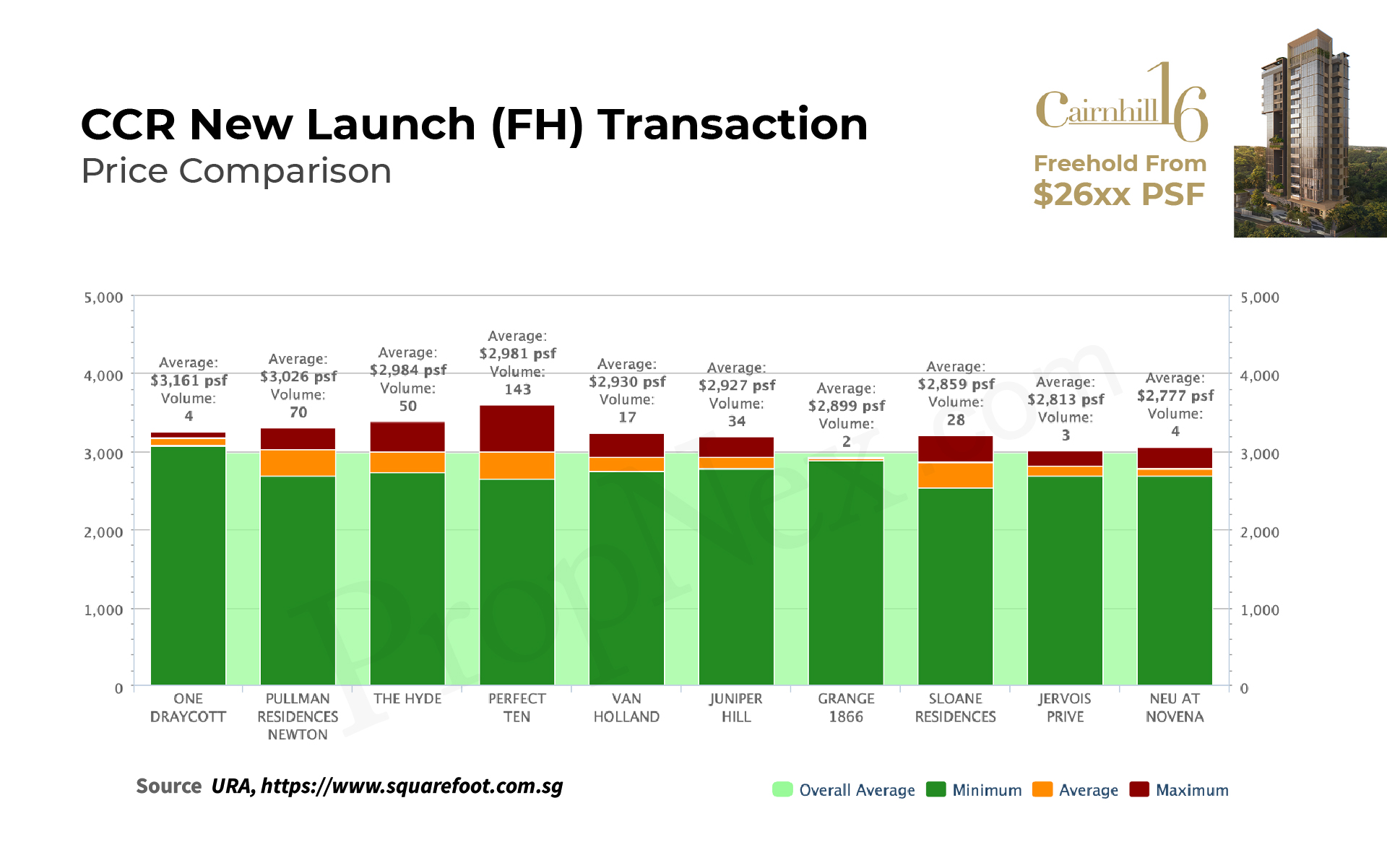

It’s clear from Figure 1 that the entry price for Cairnhill 16 is below the average for new sales in the CCR – the price gap between RCR and CCR properties has narrowed significantly. This makes Cairnhill 16 a smart choice for entry, as the rising prices of homes in the OCR and RCR have shrunk the difference between them.

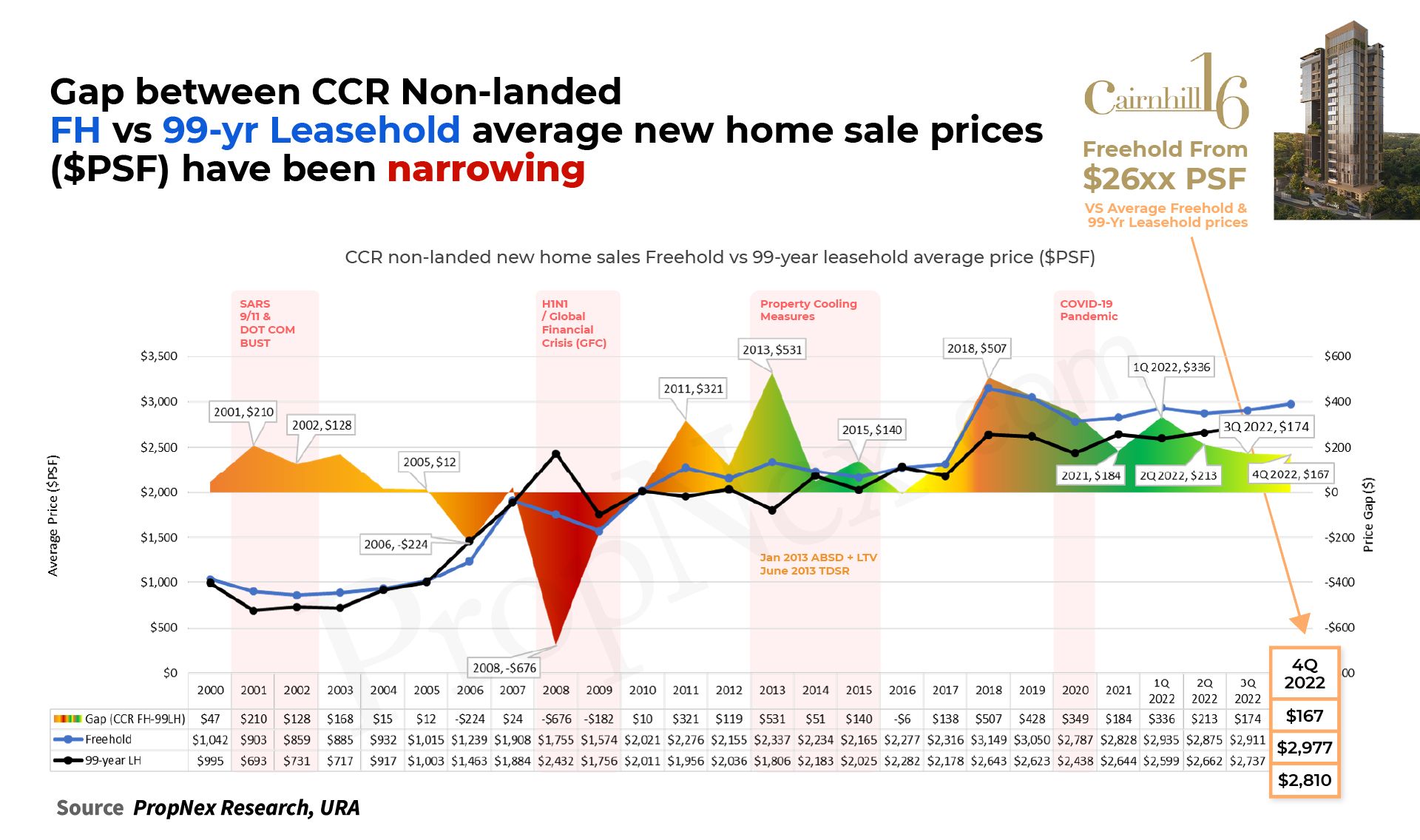

Price Gap Between RCR & CCR Narrowing

Imagine being able to buy a luxurious freehold CCR project for the same price as the average RCR home!

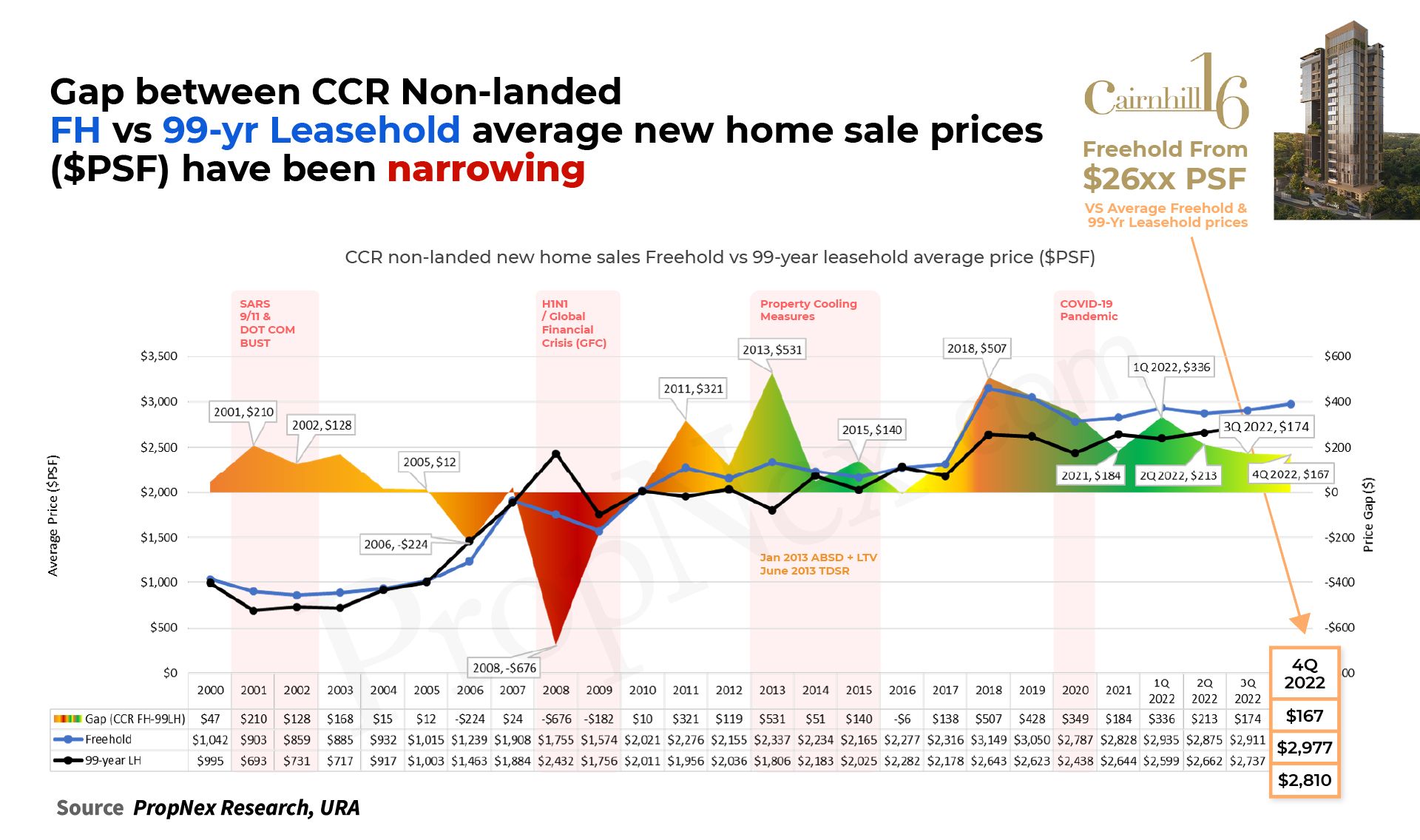

From Figure 2, we can see that the average price of a new home sale in the RCR and CCR has been narrowing throughout the years. In particular, 4Q 2022 saw the average price of a new home sale in RCR reach $2,659 – approximately the entry price of Cairnhill 16 at $2,6XX psf. What an incredible opportunity!

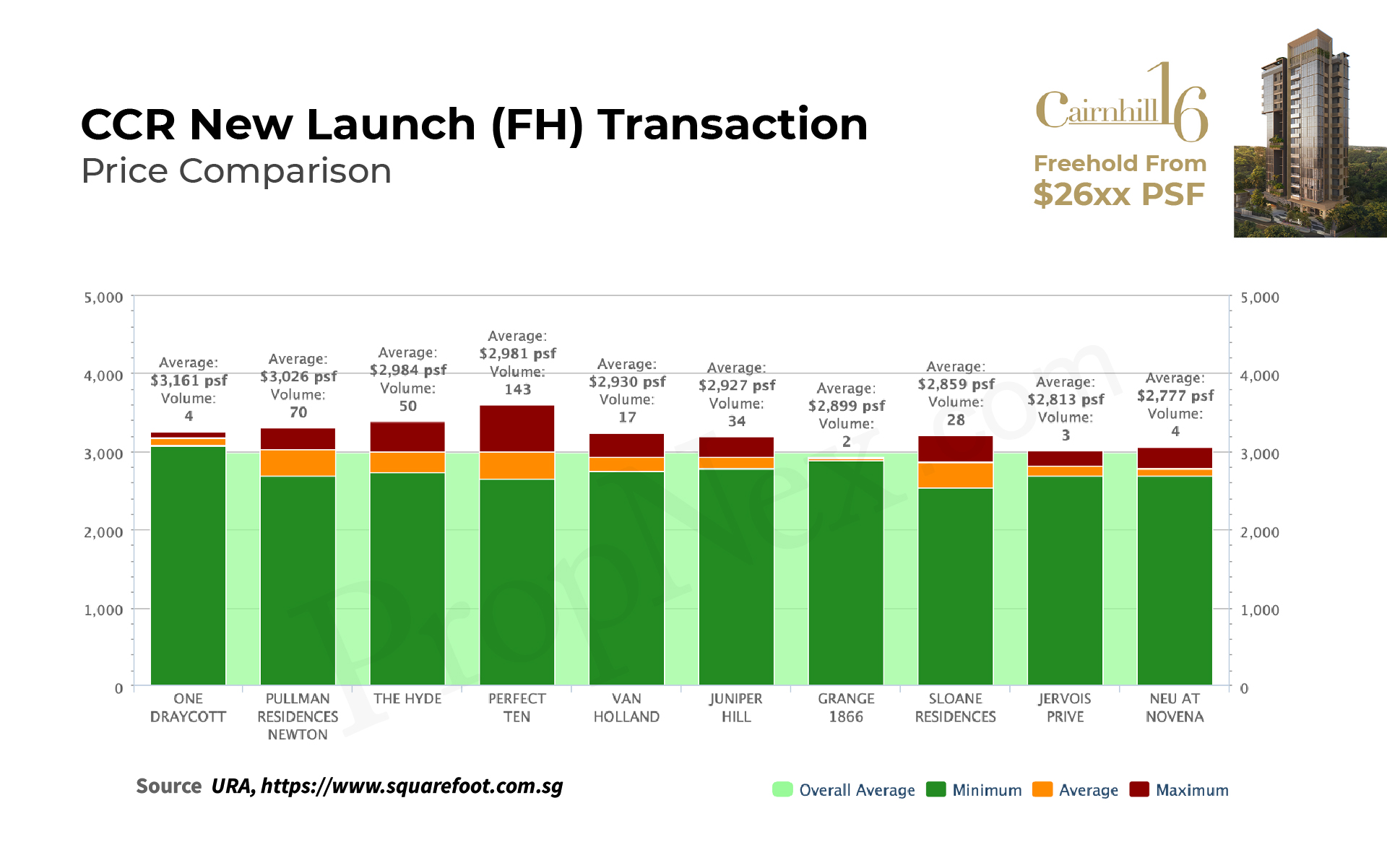

Finally, let us analyze Figure 3, demonstrating the cost of freehold new launches in the CCR; the price range runs from $2,777 to $3,161, doesn’t it make Cairnhill 16 a wise choice for investment?

This year is set to be a exciting time for Core Central Region, with its price offering an attractive alternative investment opportunity to Rest of Central Region.

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …

Jayson Ang – August 21, 2023 – Share

TLDR When considering buying a second property in Singapore, ensure eligibility by meeting the Minimum Occupancy Period (MOP) and understanding...

Read More

Jayson Ang – November 13, 2024 – Share

Singapore's property market has always been an attractive investment option for both local and foreign investors. With its stable economy,...

Read More

Jayson Ang – December 10, 2022 – Share

TLDR The Singapore real estate market is vibrant, driven by a strong economy, stable business climate, and attractive investment opportunities....

Read More

Jayson Ang – September 10, 2024 – Share

Inflation is an economic phenomenon that can have a significant impact on an individual's financial well-being. As the cost of...

Read More

Jayson Ang – July 16, 2024 – Share

TLDR In property investment, common mistakes include lack of research, overleveraging, and neglecting due diligence. To succeed, conduct thorough market...

Read More

Jayson Ang – November 16, 2023 – Share

TLDR for "Dual-Key Condo: Analysing The Pros And Cons" When considering dual-key condo units, it's important to weigh the advantages...

Read More

Jayson Ang – December 7, 2022 – Share

TLDR Foreign buyers interested in private residential properties in Singapore is a common sight due to the country's positive reputation...

Read More

Jayson Ang – March 24, 2024 – Share

TLDR The URA Master Plan entails significant shifts like the relocation of Paya Lebar Airport or creation of Punggol Digital...

Read More

Jayson Ang – February 1, 2025 – Share

Singapore's high-end rental market has been a hot topic of discussion among investors worldwide. With the city-state's robust economy, excellent...

Read More

Jayson Ang – October 25, 2023 – Share

TLDR Parents often seek homes within 1km of desired primary schools to increase enrollment chances. Consider oversubscription rates and population...

Read More

Jayson Ang – April 5, 2023 – Share

TLDR You will find detailed insights into upcoming housing developments in the East of Singapore, specifically in areas like Bayshore,...

Read More

Jayson Ang – February 26, 2024 – Share

TLDR When it comes to buying landed property in Singapore, there are three main types: terrace houses, semi-detached homes, and...

Read More

Jayson Ang – December 26, 2023 – Share

TLDR The National Day Rally 2023 introduced a new classification for HDB flats, replacing the old 'mature versus non-mature estates'...

Read More

Jayson Ang – August 25, 2024 – Share

TLDR Investing in a 99-year leasehold landed property in Singapore can be a lucrative venture due to the country's land...

Read More

Jayson Ang – August 29, 2024 – Share

TLDR The blog post delves into the complexities of market timing in property investment, highlighting the risks and challenges associated...

Read More

Jayson Ang – July 20, 2023 – Share

Powering The Lion City: The Top 5 Industries Driving Singapore's Economy Singapore is widely recognized as one of the most...

Read More

Jayson Ang – February 11, 2025 – Share

Singapore, a vibrant city-state known for its diverse culture and rich history, offers a plethora of unique experiences that go...

Read More

Jayson Ang – March 2, 2025 – Share

TLDR The Government Land Sales (GLS) program in Singapore is critical for developers to obtain development land, with sites released...

Read More

Jayson Ang – July 8, 2024 – Share

Singapore, known as the Lion City, is a melting pot of cultures, cuisines, and luxury experiences. With its rich history,...

Read More

Jayson Ang – June 20, 2024 – Share

Singapore, a bustling city-state known for its impressive skyline and modern architecture, is also home to a plethora of natural...

Read More