TLDR

When it comes to new property launches, timing is crucial. Early buyers often secure the best prices due to developer strategies like loss leader pricing. However, waiting post-launch can lead to better deals during cooling measures or approaching ABSD deadlines. Factors like developer profit margins, demand-supply dynamics, and developer reputation play key roles in price fluctuations. While early birds might benefit from initial discounts, late buyers could face limited choices or higher premiums. Always do thorough research to make informed decisions and consider factors like market trends and future growth potential.

The year 2021 was filled with new launches, but 2022 might bring even more surprises! Last year saw 27 new launch projects, and this year could see close to 40. Notable new launches to look out for include Piccadilly Grand, which was just launched in April, Ang Mo Kio Avenue 1, slated for June, and the Lentor Central parcel to kick off the transformation of Lentor. Get ready for an exciting new year of real estate opportunities.

The thrill of new launches is often followed by the realisation of the increasingly high prices being set. Undoubtedly, this is a result of developers’ confidence in the market sentiment, coupled with their dwindling land reserves.

Last year, GuocoLand made headlines when they won the tender for a land parcel at Lentor Central. Their winning bid of $784.1 million, which translates to $1,204 per sqft per plot ratio, was 4.5% higher than the second highest bid of $750 million.

Despite the additional cost being passed on to buyers through the eventual sale price, which is expected to reach $2000 psf on average, this hasn’t deterred hopeful buyers. New launch sales remain strong, as evidenced by the numerous people who attended the preview of Piccadilly Grand in late April.

Are you considering investing in a new launch? If so, you’ll want to find the best deal and maximize your capital gain. So, when is the optimal time to buy? Is it at the beginning of the launch, or when the developer is attempting to get rid of the remaining units?

Earlybird Discounts?

Real estate agents will typically tell you that early buyers of a new launch tend to get the greatest discounts and lock in the best prices – and it’s true to some extent.

Developers employ a loss leader strategy, pricing the initial units at discounted prices to entice customers and create buzz about the project. This increased interest brings more people to the showflat, resulting in increased sales.

With construction loans typically disbursed to developers when around 30% of units are sold, it is critical for them to swiftly generate sales and receive the disbursement to lighten their financial burden. To do so, developers price their first 30% of units competitively to acquire the necessary amount of sales to qualify for the loan disbursement.

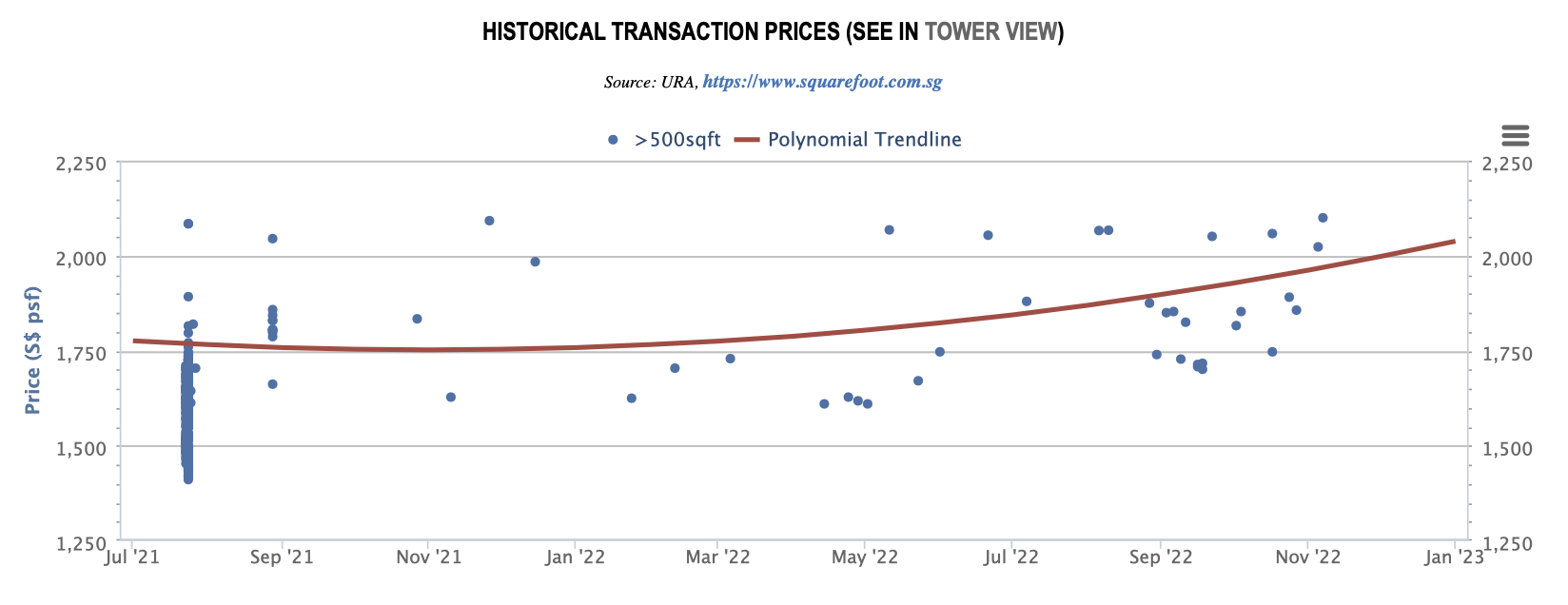

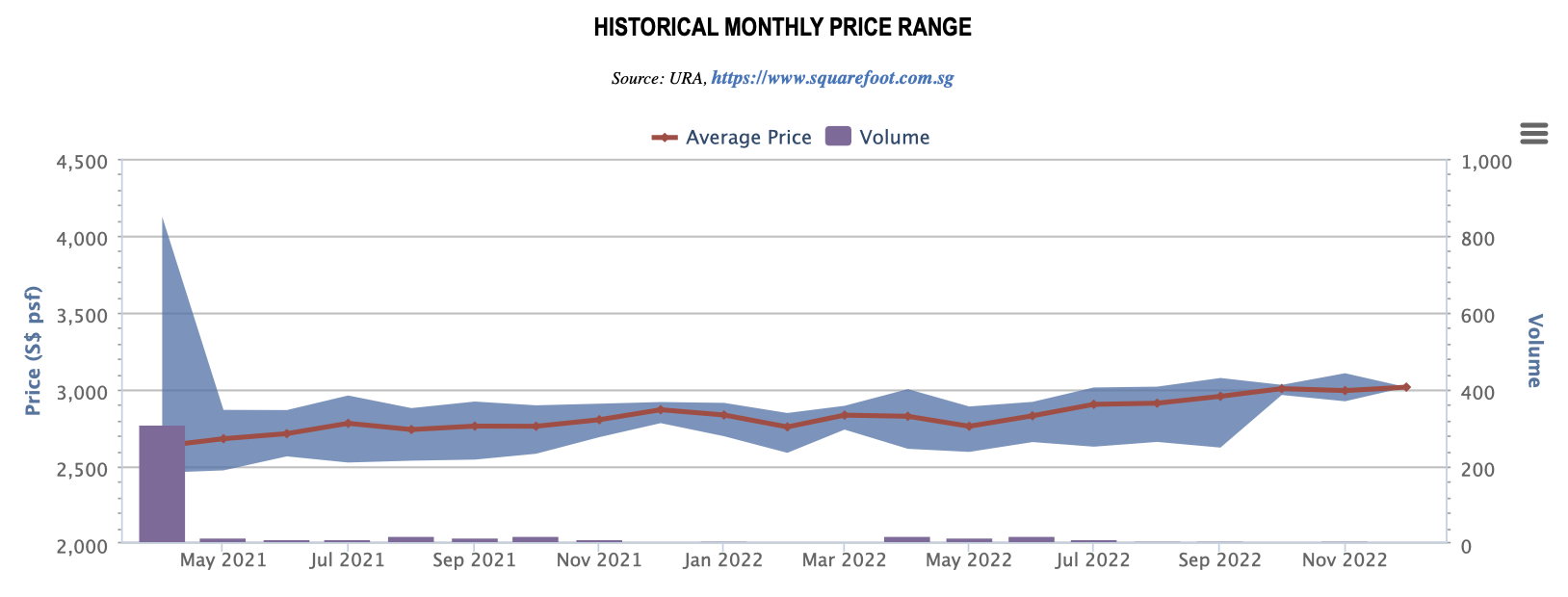

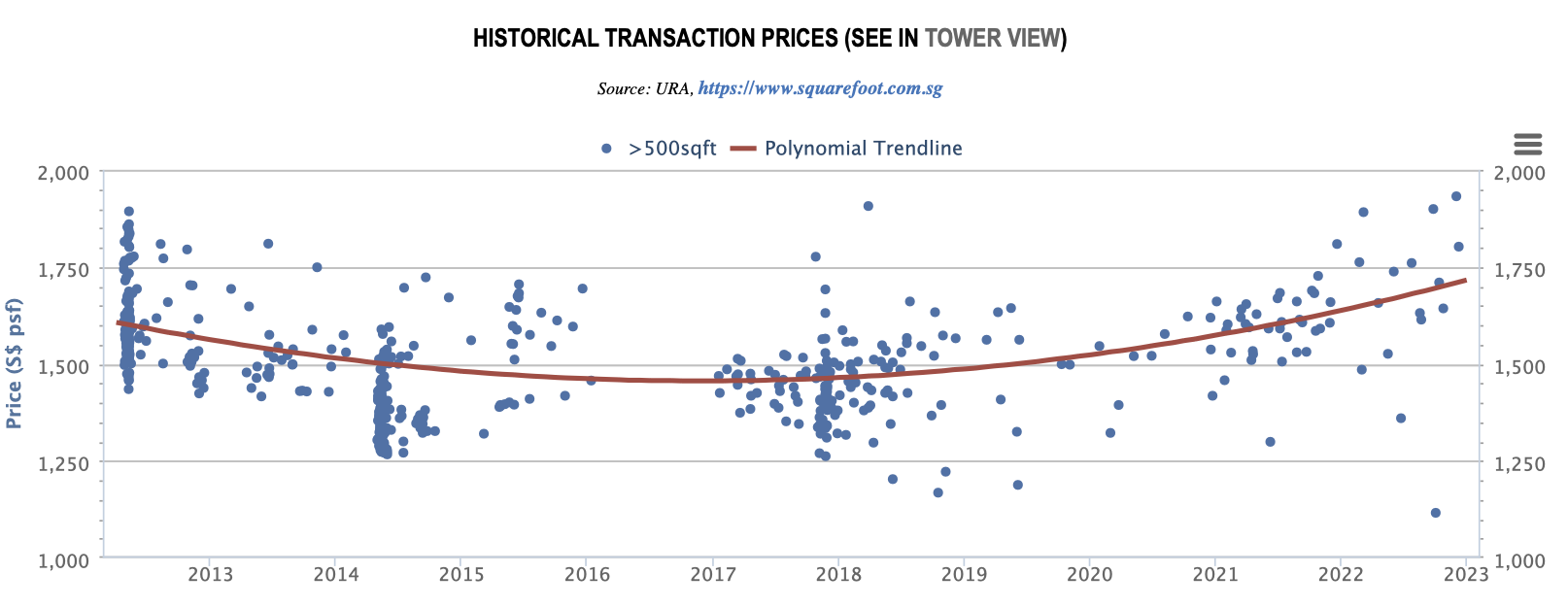

Normanton Park serves as a prime example of how developers, being business entities, prioritize profits. Once the construction loan was secured, prices for subsequent units saw a steady increase from around $1700 psf to a soaring $1900 psf – the sole objective of driving profits never far from their minds.

At Irwell Hill Residences, the average launch price was $2500 per square foot, but within 5-6 months, prices had skyrocketed to a peak of $2900 per square foot – a clear demonstration of the significant price increase this project experienced.

Yet, There Is Also A Contrary View

Supporters of the “wait-it-out” approach firmly believe that holding off until the initial hype surrounding a project has settled down can result in much better prices.

There is definitely merit to this argument as developers often reduce prices in two circumstances :

Situation 1: Introduction Of Cooling Measures

Whenever a new round of cooling measures are announced, it is not unusual to observe a trend of lowered prices for new launches. These discounts are intended to help cushion the blow to purchasers and reflect the current downturn in the market – the most prominent example being Sky Habitat.

When it launched in 2012, it was celebrated for its remarkable architecture, but also gained a lot of attention for its high prices, which were the highest for any condominium project in the RCR/OCR area, with an average launch price of around $1600 psf – due to the expensive amount the developer paid for the land.

The launch of Sky Habitat was met with the Total Debt Servicing Ratio (TDSR), one of the toughest cooling measures around, a year later. This sharp 60% limit severely limited buyers, effectively reducing demand and turning the market on its head. Unfortunately, the project was hindered by these measures.

The high price tag of the development at launch was beyond the means of many potential buyers, causing demand to plummet. This forced the developer to reduce prices to a mere $12xx per square foot in order to clear their remaining units.

To add to the woes, Sky Vue, the development right next to Sky Habitat developed by the same team, was launched a year later with prices at $14xx psf. This caused the prices for units at Sky Habitat to remain stagnant for a few years, fluctuating between $14xx to $16xx psf. For those that got into Sky Habitat in 2013 or 2014, they had the pleasure of watching their investments increase from the initial buyers who purchased at $16xx psf.

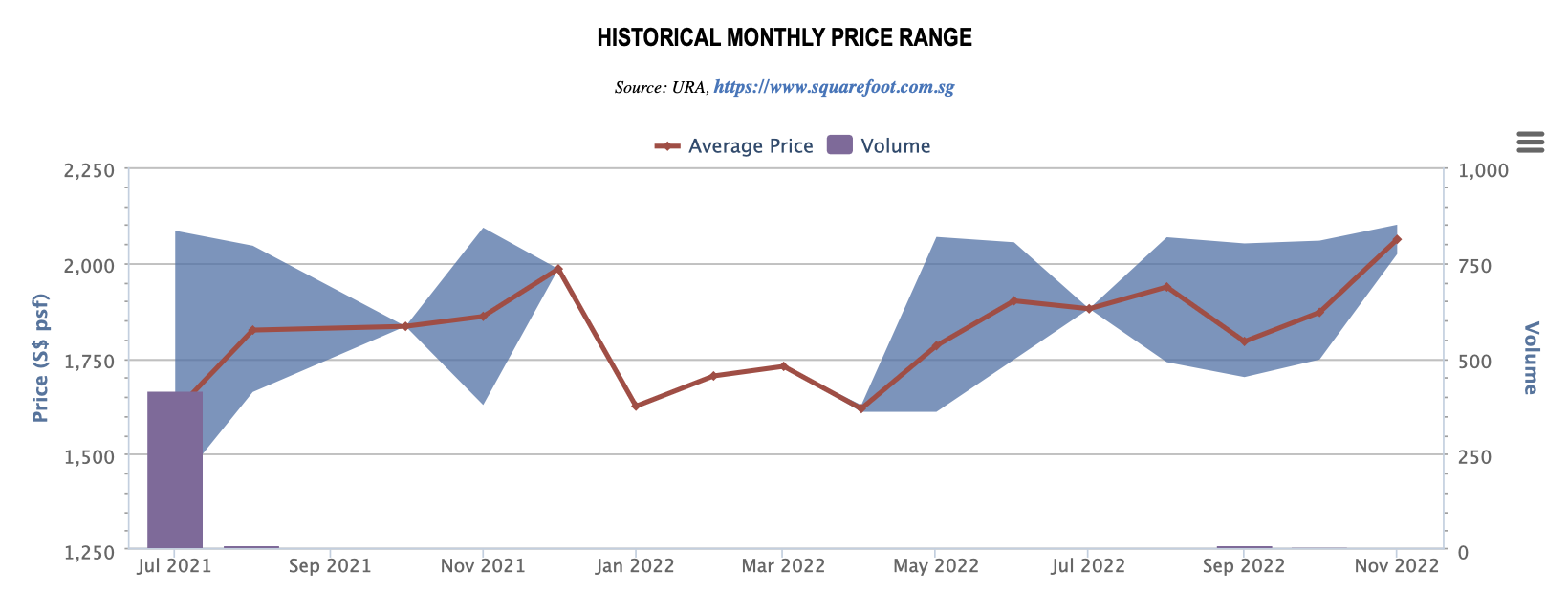

In 2018, when the Singapore government raised the Additional Buyer’s Stamp Duty (ABSD) and tightened the Loan-to-Value (LTV) limits, buyers became more prudent and Woodleigh Residences, also launched in the same year, saw the brunt of it.

Initially launching with an average of $19xx psf, the development had to relaunch at $17xx psf. However, those who had the foresight to purchase the property during late 2019 to early 2020, despite the market sentiments, emerged as the real winners as the psf prices climbed up during the pandemic years.

Situation 2: The Approaching ABSD Deadline

Developers are obliged to pay Additional Buyer’s Stamp Duty (ABSD) just like everybody else, however they have the advantage of getting remission if they comply with certain conditions.

ABSD was first instituted in 2011 with the aim of controlling developers, stopping them from snapping up land at inflated prices and transferring the cost to buyers. It further ensured that the developments were completed on schedule and prices were kept competitive.

Come December 2021, the ABSD rate for developers is going up yet again – 40%, with 35% of it potentially waived if all criteria are met. This includes a five-year window to develop and sell all units; if even one unit is left unsold, the developer is on the hook for the full 35% of ABSD on the land price – a steep price indeed!

That’s why you often see developers offering hefty discounts on the remaining units as they approach their ABSD deadline.

By 2022, two highly-anticipated launches – Normanton Park and Amber Park – are due to reach their ABSD deadline, having both been sold in 2017. At present, Normanton Park boasts 100% sold status, while Amber Park has about a few units left, pending the larger units.

Timing The Entry Of A New Launch Project Is Not Easy

However, there are a couple of drawbacks to this plan: the units that are left over often don’t boast desirable qualities such as orientation or floor level, which means that if you wait until the later stages of a new launch, you could be stuck with a limited selection and find yourself choosing units that are harder to sell.

Although you might save money with more affordable prices, the unit may end up being sold at a lower price than the higher priced, premium-facing units.

Not only is it difficult to determine whether a development will be successful or not, but some projects have even sold well without needing further discounts, due to factors such as a prime location, potential for future growth in the area, or an iconic design.

A great example of this is Canninghill Piers, which made a huge splash in the news due to its remarkable design and prized location, and saw over 77% of its units sold off in just one weekend. Those who opted for a wait-and-see approach were left with the remaining few units.

Waiting to buy into a project during the hype may bring some benefits, but there is no guarantee that the price will be lower if you wait.

Could We Be Eligible For A Refund If We Purchase At A More Expensive Price?

Though not legally obligated to do so, developers have been known to show ‘goodwill’ by granting partial rebates to early-bird buyers, such as the 5% rebate given by CapitaLand for the Tanamera Crest condominium in 2001. While there have been few such instances in recent years, it does demonstrate that developers can offer some form of compensation.

Developers often offer promotional or loss-making prices to early buyers in order to stimulate sales, but if the developer’s profit margins are slim and they’ve just about broken even on the other units, finding extra money to compensate these buyers can be a challenge.

Unless the developer has written documentation saying “this is the lowest price ever” it is hard to prove a claim of misrepresentation, leaving buyers with little legal recourse.

What Steps Can We Take To Ensure We Don’t Come Out On The Losing End In Either Case?

It’s impossible to forecast with absolute certainty how developers will set the unit price at the start or afterwards, but we can assess a few factors to decide if the cost is likely to go up or down.

Factor 1: Developer’s Profit Margin

The developer’s decision on whether to reduce prices in the future is largely dependent on their profit margin, which is calculated by factoring in land and construction costs that are usually set in stone. The resulting difference between these expenses and the sale price will determine the developer’s profit margin.

By understanding the breakeven price for the developers, we can determine their lowest acceptable price. If the sale price is far ahead from the breakeven price, we can assume that the developer has incorporated a sizable cushion in case prices fluctuate.

This could mean that the developer might offer larger discounts during future launches in the event that the project doesn’t sell as anticipated.

Whereas if the developer’s selling price is nearly the same as its breakeven cost, it’s unlikely that there will be huge discounts. To estimate the breakeven cost of a development, one can follow this approach:

Land Cost : Calculate the $psf by obtaining the sale price of the land and dividing it by the Gross Floor Area (GFA).

Construction Costs : A mass-market condominium should command around $350 psf as a benchmark, but for luxury projects boasting top-notch finishes and fittings, expect a higher price tag.

In today’s market, high profit margin developments are no longer commonplace – land costs have skyrocketed and competition from other new developments has become fierce.

Factor 2: Interplay between Demand and Supply of units in the area

The demand and supply of units in the area has a huge influence on the level of interest and uptake rate of new launch units; this can be clearly seen with the example of the past two years.

Before the pandemic hit, many potential buyers were trying to time the market, expecting a decline in the property market; however, what we witnessed instead was a boom in both resale and new launch units.

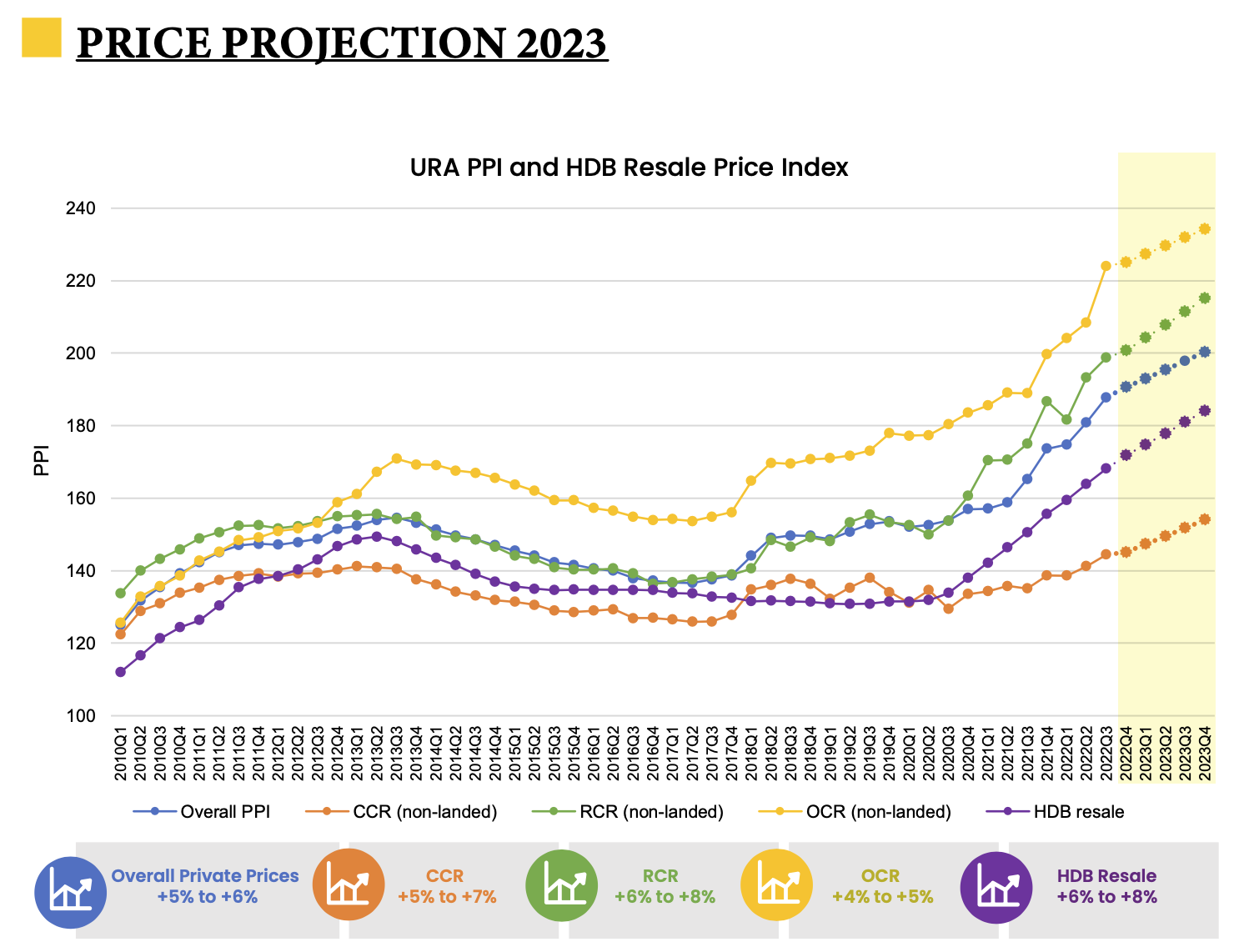

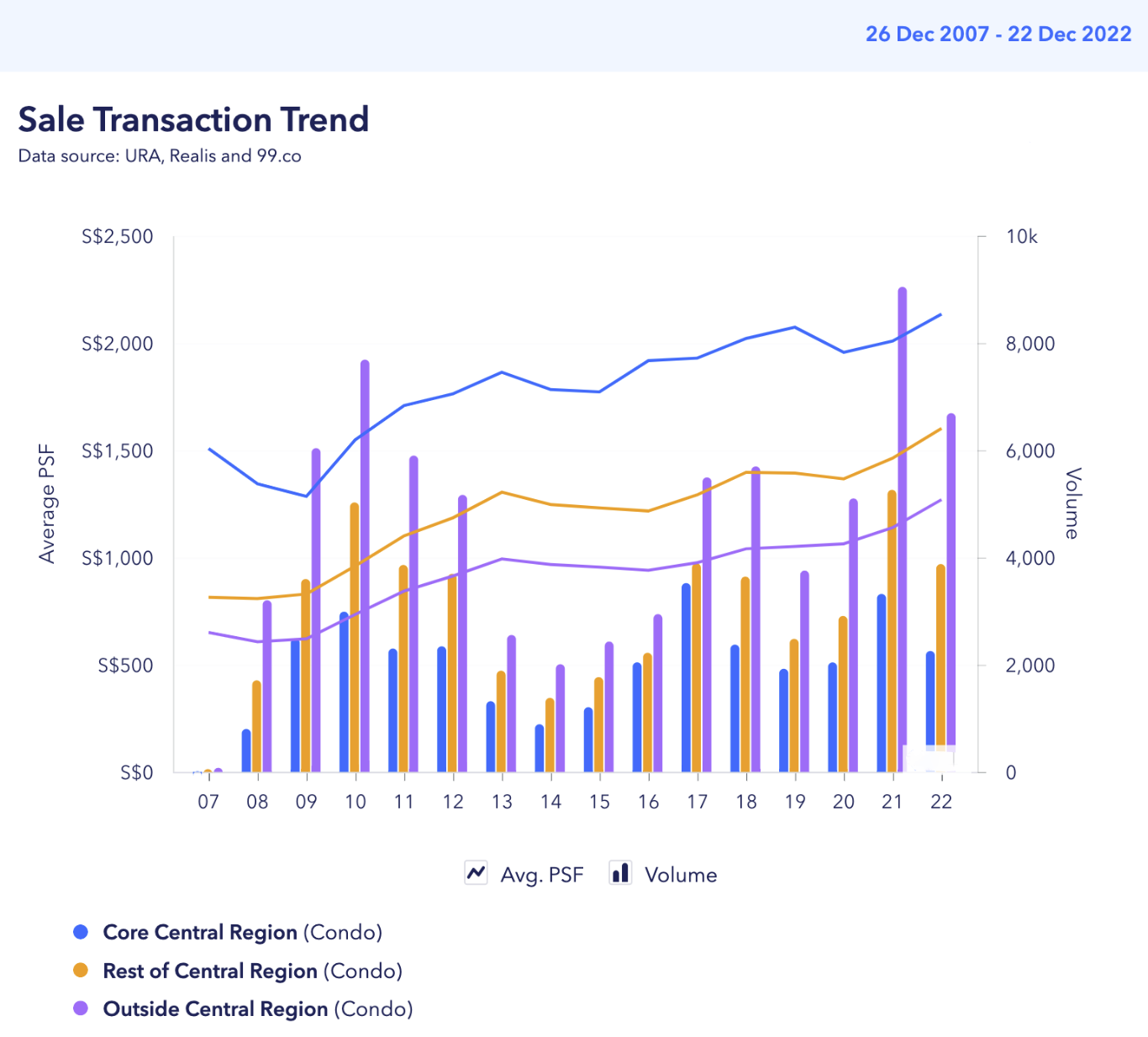

Despite the discounts offered by some new launch projects, the majority had tremendously successful launches. Surprisingly, the prices of new launch units in the Rest of Central Region (RCR) and Outside Central Region (OCR) were on a steady climb.

Prominent OCR projects that garnered attention include Pasir Ris 8, and the Watergardens at Canberra. This was mainly attributed to the shifting preferences of local purchasers, coupled with their willingness to shell out extra money for units in the RCR and OCR.

The Core Central Region (CCR) typically attracts a large number of foreign buyers for new launches, however due to travel restrictions and widespread work from home arrangements, foreign demand has decreased.

Local buyers, meanwhile, are looking for bigger units to better facilitate working from home; these units are more readily available in the RCR and OCR, and more affordable too. Thus, RCR and OCR projects have seen an uptick in demand, while CCR projects have suffered a decline.

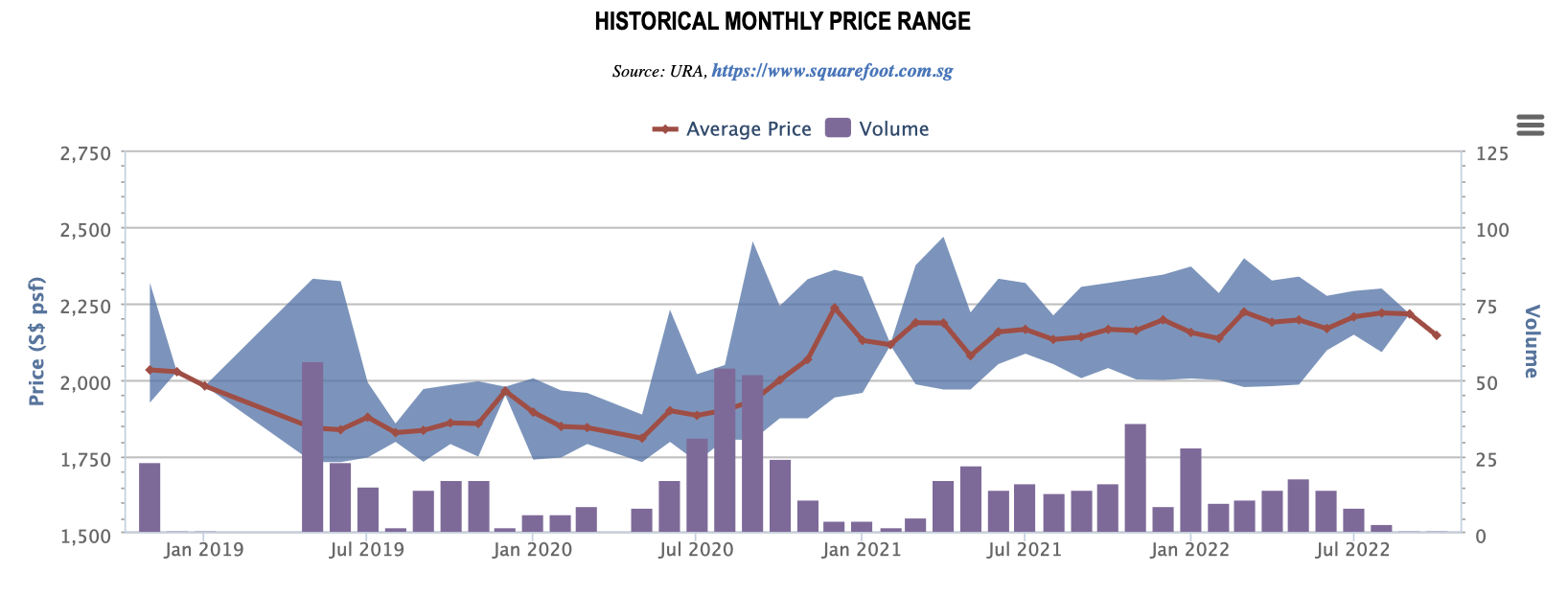

These highly sought-after projects in RCR and OCR would have seen their prices continuing to rise as the launch progressed. A case in point is Pasir Ris 8, where prices started at an average of $1600 per square foot and quickly rose to $2000 per square foot towards the conclusion of the launch.

The lower per square foot price in January 2022 was due to the remaining five units of the development, which were known as “star-buys”, and some of the larger units. Had you bought early in the project, you would have seen your paper gain as subsequent units were sold at a higher per square foot rate than your purchase price.

Although RCR and OCR’s new launch projects may appear to be the best option moving forward, this wasn’t always the case. In the past, buyers were drawn to RCR and OCR areas as a result of the cheaper prices compared to CCR.

However, as demand for these properties has skyrocketed, prices have been steadily climbing – an effect that CCR has not seen as acutely.

As the price gap continues to shrink, buyers are increasingly compelled to consider CCR projects. This will eventually drive both demand and prices in the CCR up, creating a cyclical effect. Therefore, I believe investing in CCR projects may be the next big opportunity for buyers.

To sum it up, it’s essential to comprehend the evolving trends of supply and demand before investing in a new launch. If the project has strong demand, the developer is likely to raise prices, and as an early investor, you will have already made a significant profit in only a few months!

Factor 3: The Developer’s Reputation

Developers often avoid discounting or providing rebates, unless a situation like a nearing ABSD deadline necessitates it, or they are having difficulty selling the remaining “star buy” units due to unfavorable orientation or design.

When developers offer hefty discounts on a great deal of units, industry watchers will take notice, sparking speculations about the developer’s finances and criticisms of their marketing strategy.

Unfortunately, this often leads to a hit to the developer’s reputation and a decline in buyer confidence in their upcoming projects. As a result, buyers become hesitant to purchase units from this developer, not wanting to run the risk of being in the same boat.

Developers with deep pockets usually take measures to avoid getting caught in a bad situation – like taking their units off the market until the market sentiment improves.

They have conducted extensive market research regarding sentiment and price, and they price their units fairly in order to stay out of this situation. As a result, prices are expected to rise, and later buyers will likely have to pay a premium for their units.

At The End Of The Day, Be Sure To Do Your Due Diligence

Waiting to purchase a newly-launched property may have its advantages, but bear in mind that external factors such as cooling measures, which are oftentimes out of our hands, can influence the final deal.

Thus, the risk of not being able to secure the ideal property or having to pay an extra premium may be too high to take. It’s always better to be an early bird than a late one!

Getting in early on new launches can often result in the best deals and more selection, but don’t just jump into any launch without first doing your due diligence. Make sure to compare the new option to its competition, analyze the numbers, and then make an educated decision.

Reach out to me if you need expert insight – I’m here for you. Come and talk with me and I’ll be more than delighted to explain things in depth.

Final Thoughts

- Carry out an in-depth financial analysis to guarantee you are making wise decisions for the near future and can confidently stand behind your decisions.

- Also take your timeline and family wishes into account, plan ahead and provide your family with a sense of security so that you can proceed with peace of mind.

If you’re curious about the prospect of relocating to private property and would like expert advice, I’m just a message away!

You May Also Like …