TLDR

When considering an upgrade from HDB to private property in Singapore, it’s essential to understand the differences and implications. Private properties offer more investment prospects and flexibility in terms of equity withdrawal and rental options. However, the purchasing process involves various costs such as Option Fees, Buyer’s Stamp Duty, Additional Buyer’s Stamp Duty, valuation fees, legal fees, and more.

Financing a private property purchase can involve a mix of debt and equity financing, with loans typically spanning 30-35 years. Planning your timeline is crucial, considering factors like age and future lifestyle changes. Additionally, understanding the housing landscape and regulations, especially regarding eligibility for different property types, is important for informed decision-making.

As Singapore’s real estate market evolves towards 2030, with changing demographics and potential housing requirements, making a well-informed decision about transitioning to private property involves thorough financial analysis, family considerations, and planning for the future.

Considering an upgrade from HDB to private property brings forth many dilemmas and questions. What is the purchasing process like? Is this a safe investment? What other factors should you take into account? To make the best decision, read on to find out the fundamentals to consider when deciding whether to move or not.

Gaining Insights into Singapore’s Real Estate Landscape

As a family’s income increases, it seems the more likely they are to relocate to private properties. Setting income ceilings may act as a stimulus for high-earning households to transition from HDB flats to other residences.

Investment prospects for private homes also serve as a viable motivation for some to move up the Singaporean property ladder, as there are several key distinctions between HDB and private housing.

The Singapore government provides grants and subsidies to encourage essential home ownership through the purchase of BTO and resale flats. HDBs are designed for the owner’s occupancy, however, the equity of an HDB flat cannot be withdrawn unless the property is sold – so if you purchase a BTO for $450k and it appreciates to $750k after five years, the paper gain of $300k will remain trapped.

On the other hand, private property owners can take out an equity term loan to access the value of their property when it appreciates.

For property owners looking to generate a steady passive income, renting out a room or entire unit is a popular option. HDB flats under the Home Ownership Scheme are generally intended for owners to stay in, however, one may rent out a flat or room with HDB approval.

Private property owners have fewer restrictions when it comes to renting out, so if you’re thinking of taking advantage of this, it’s definitely something you should consider.

Acknowledging the Costs and Expenses of Transaction and Ownership

Let us gain a clearer picture of the costs and expenses associated with a private property by examining the following summary table of initial costs.

Initial Cost of a Private Property

Prospective buyers must sign an Option to Purchase agreement to ‘reserve’ the property from the seller. By paying a booking fee (an Option Fee), they are guaranteed that the seller won’t sell the property to another party during the duration stated in the agreement.

The Option Fee to obtain and exercise the OTP is usually 1% & 4% of the purchase price respectively, depending on the buyer and seller agreement.

In Singapore, when purchasing a property, Buyers are required to pay Buyer’s Stamp Duty (BSD) tax, which is calculated based on the highest value between the purchase price and the valuation of the property.

Furthermore, an Additional Buyer’s Stamp Duty (ABSD) is then levied on top of the BSD, at a different rate. In order to find out the market value of the property, Buyers must then pay a valuation fee to a professional appraiser.

When it comes to buying a property, the cost doesn’t end at the purchase price. Other expenses to keep in mind include legal fees for lawyers, title searches, mortgage stamping fees, and Cash over Valuation (COV), which is the difference between the selling price and the property valuation.

Here’s a summary of what you need to know:

Initial Cost of Purchasing a Property

Owning property comes with the responsibility of paying property tax, no matter if the property is inhabited, leased out, or unoccupied. The amount is determined by the Annual Value (AV) of the property—essentially the expected annual rent of the property—times the designated property tax rate.

For those looking to purchase a condominium, there will likely be an ongoing monthly fee to cover the maintenance of the complex.

To transfer the risk and anxiety of unforeseen events, such as a fire, to a third party, obtaining insurance is necessary. Often, the lender requiring the asset to be financed will also require the property to be insured. Some banks even have a partner insurance provider that you can purchase from. If a third-party insurer is used, the bank may require an annual administrative fee.

With private properties not being able to access housing grants, subsidies, and HDB loans, what ways are there for owners to finance their purchase?

Financing a Private Property

Funding your dream home requires an understanding of both debt and equity financing, for oftentimes, a blend of the two is necessary to cover the upfront payments of a property.

Borrowing from an outside source, like a bank, to purchase property is known as debt financing. Depending on factors such as Loan-to-Value and Total Debt Servicing Ratio, the amount that can be borrowed can be determined.

Loans typically span 30-35 years in repayment. On the other hand, equity financing requires the use of existing assets to purchase the property, without any repayment necessary.

Any fees such as Option Fees, Legal Fees, and Valuation Fees are to be paid out of pocket.

Planning Your Timeline

Buying real estate is one of the biggest and longest-term investments one can make. Even if you’re planning on living in the property, it’s important to have a set timeline in mind to help you out with your future finances.

As you mark the timeline of your life, take a moment to consider your and your spouse’s current age and forecast when your lifestyle may be subject to change. This could be when your children are in university, embarking on a career, or getting ready for marriage. Until then, strive to pay off your loan and move into your own private property. When that point arrives, you might choose to divest and put your private property up for sale, then move back into an HDB flat.

We only have a limited amount of time to invest in private residential properties; the years that give the greatest potential for increased income and long-term loans span from 20 to 40 years old. If you choose to enter the private property market at a later date, you can expect a more sizeable monthly mortgage.

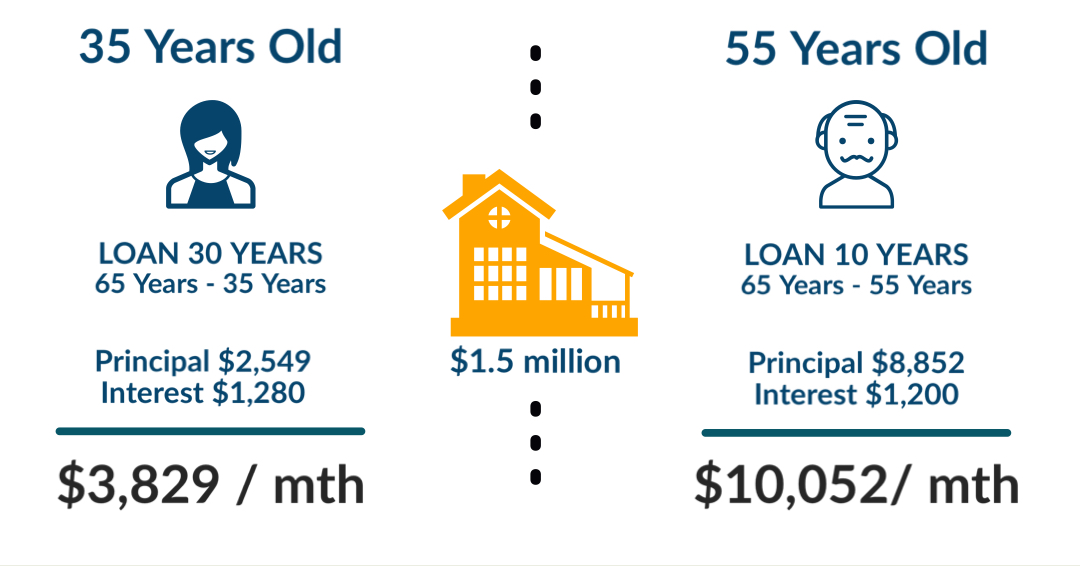

Person A, at the age of 35, is able to take advantage of the full 30-year loan term when investing in a $1.5 million property. Conversely, Person B, at age 55, is limited to a maximum loan period of 10 years.

Despite both parties being granted a 75% loan with a 1.4% interest rate, Person B is still left with a larger monthly repayment amount.

We can see a significant contrast between the two monthly payments; starting a real estate investment early may be less stressful than entering later and dealing with a more expensive instalment.

What Does 2030 Hold?

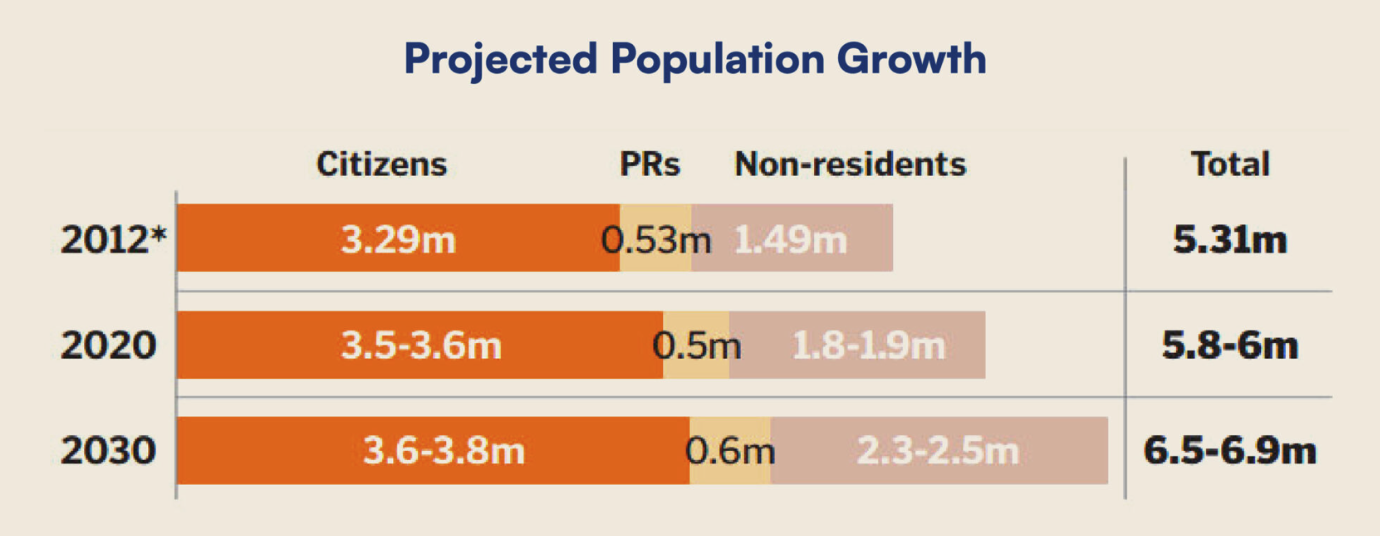

Projections from Singapore’s 2013 Population White Paper reveal that by 2030, the ratio of Singaporeans to foreigners will reach parity.

To gain an insight into potential housing requirements, we summarised the purchasing eligibility of various groups in the table below.

Eligibility of Different Purchase Groups

Surveying the entire landscape, Singaporean citizens largely possess the exclusive right to purchase landed properties and HDBs. Permanent residents and foreigners, on the other hand, face certain limitations in this regard. Fortunately, one type of real estate is available to all: condominiums and apartments.

Despite the fact that some individuals or groups may not be able to afford to purchase a private property, the limited availability and potential high demand may still be a factor in your decision-making.

By applying the basic economic principle of demand and supply, the value of private properties may increase more quickly.

As you take the next step, remember that the final decision rests in your hands. Ensuring your family is content and in agreement with the move is essential.

Don’t let your property control you; let it serve you and your family’s needs. Here are some tasks to keep in mind as you proceed:

Final Thoughts

- Carry out an in-depth financial analysis to guarantee you are making wise decisions for the near future and can confidently stand behind your decisions.

- Also take your timeline and family wishes into account, plan ahead and provide your family with a sense of security so that you can proceed with peace of mind.

If you’re curious about the prospect of relocating to private property and would like expert advice, I’m just a message away!

You May Also Like …