When you flip open the papers or turn on the news nowadays, the common buzzwords are “INFLATION“, ” INTEREST RATE HIKES” & ” LOOMING RECESSION“.

These aforementioned occurrences do intrinsically affect us in varying degrees. With the stability of the economy called into question, people are naturally more prudent in the way they spend their money. As much as our human instincts force us to play it safe during times of uncertainty, what if the best opportunities are present during these times?

Amidst inflation & rising interesting rates, the property market remains absolutely resilient.

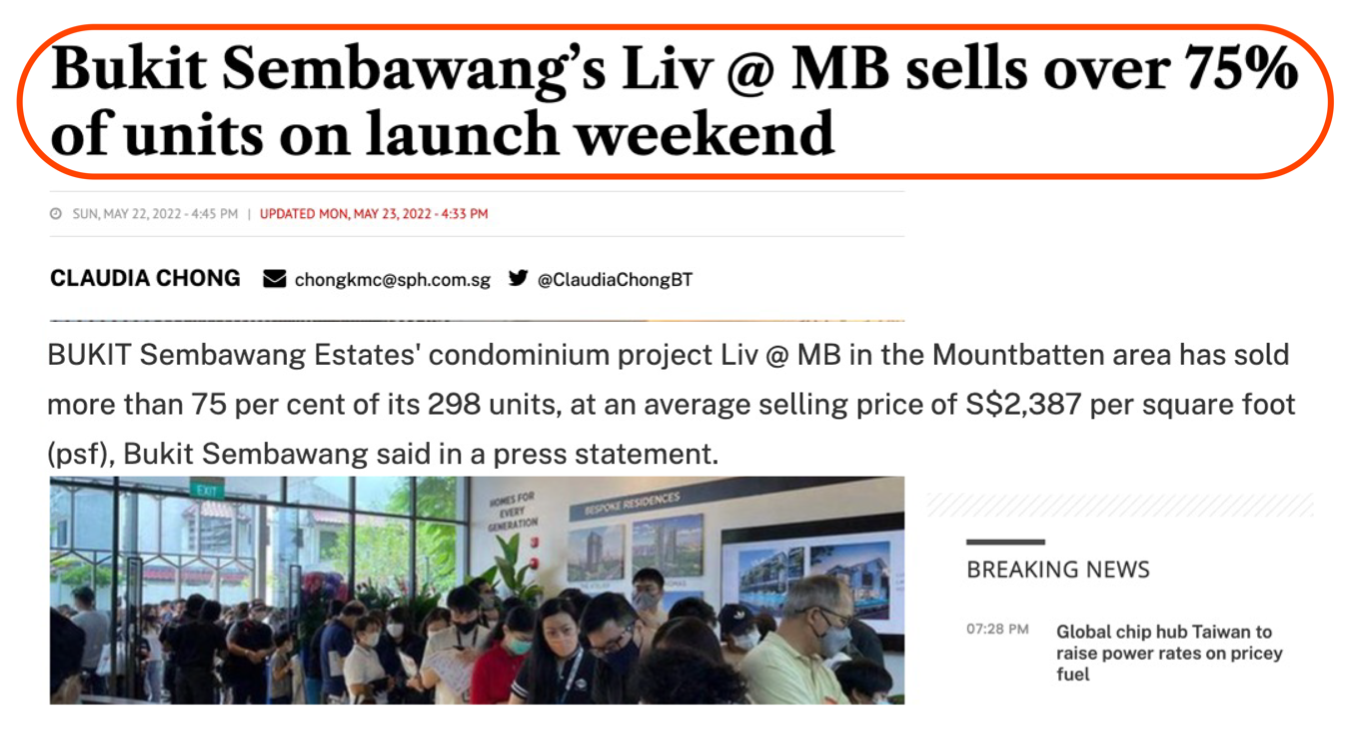

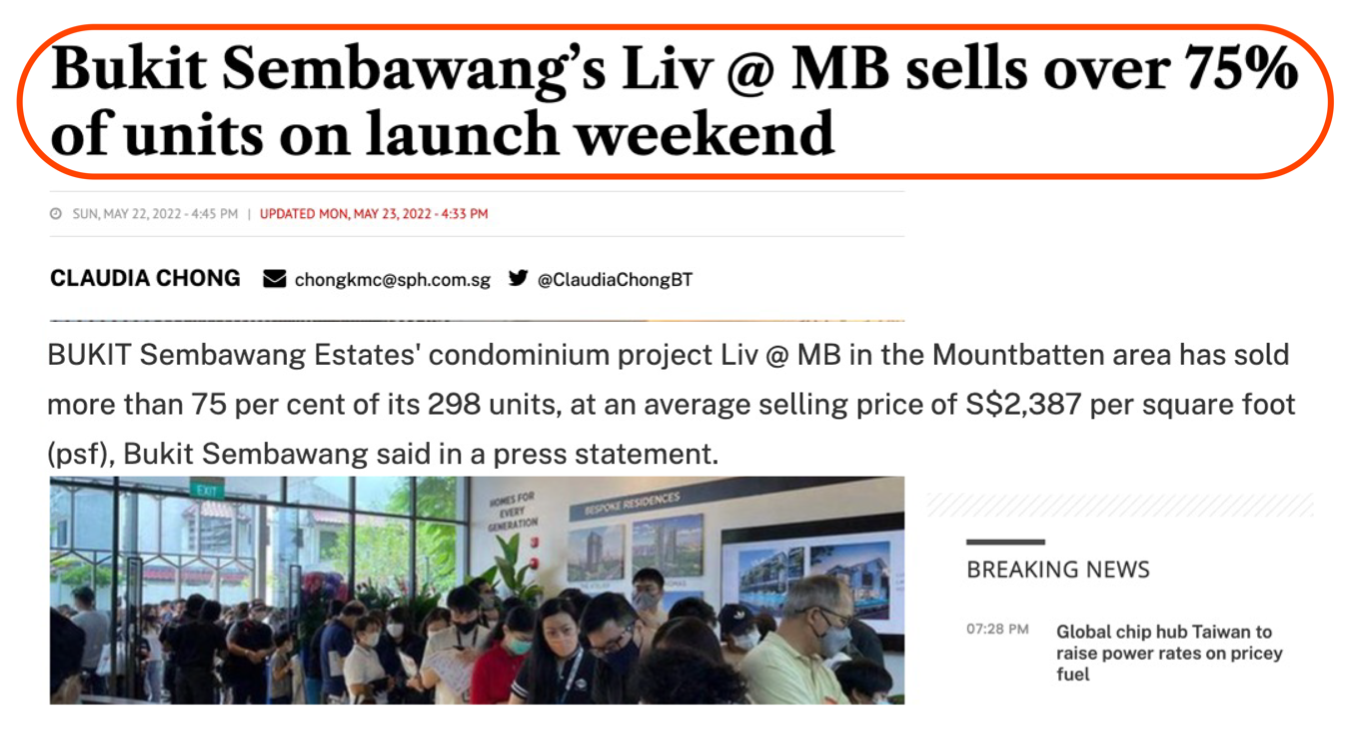

As you can see from the two articles below, Liv@MB and Piccadilly Grand are two very recent launches, and the reception was outstanding. Both of them sold more than 75% of the units in just the opening weekend alone.

Why do Singaporeans continue to spend or invest their money in real estate?

If you are sitting here wondering why, what are the secrets they know that you don’t?

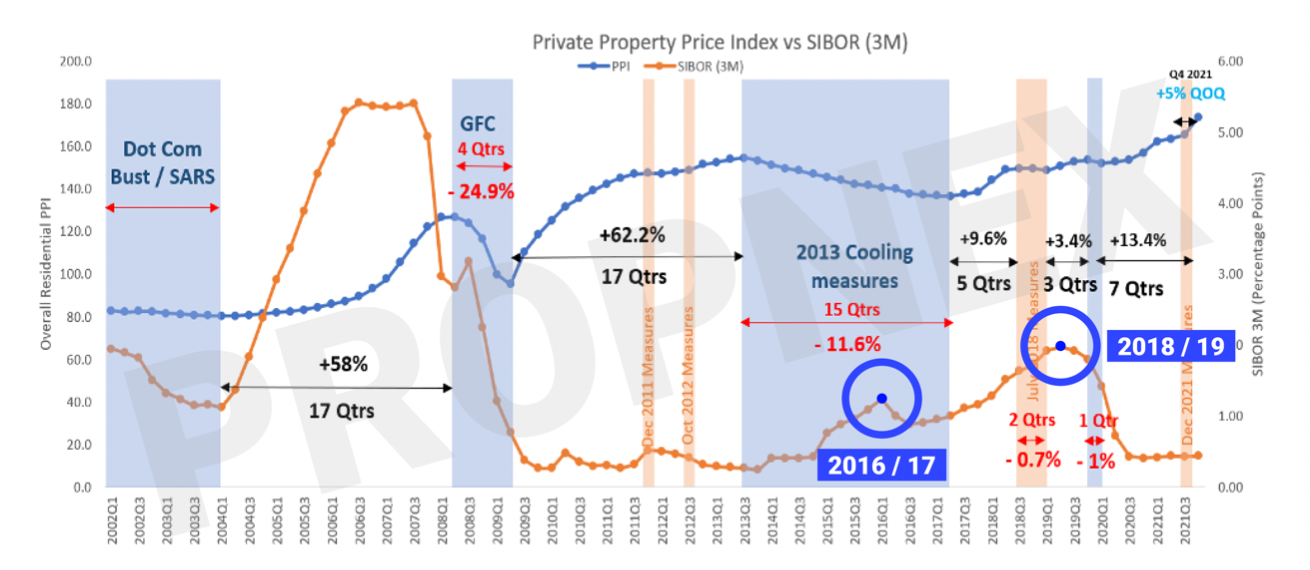

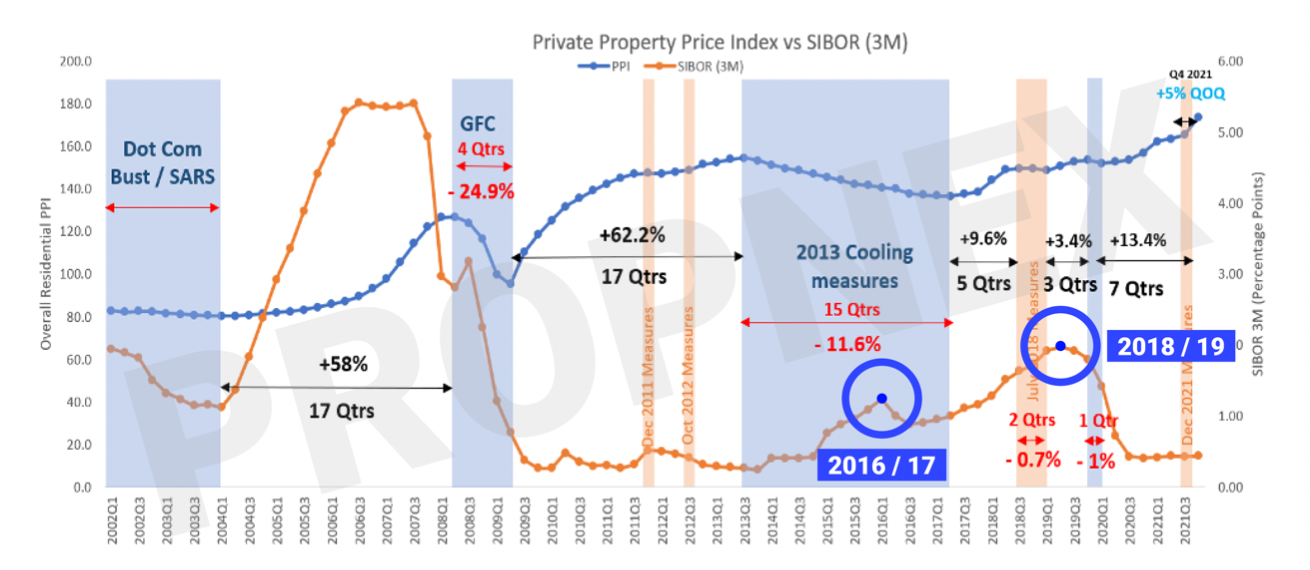

For one, people who know what they’re getting into and take action during a crisis or times of uncertainties tend to make more money. If you’d take a look below and see, in the 2016/17 and 2018/19 periods, you’ll notice that the interest rates were at one of their highest points in recent years. See Chart > Private Property Price Index VS SIBOR chart

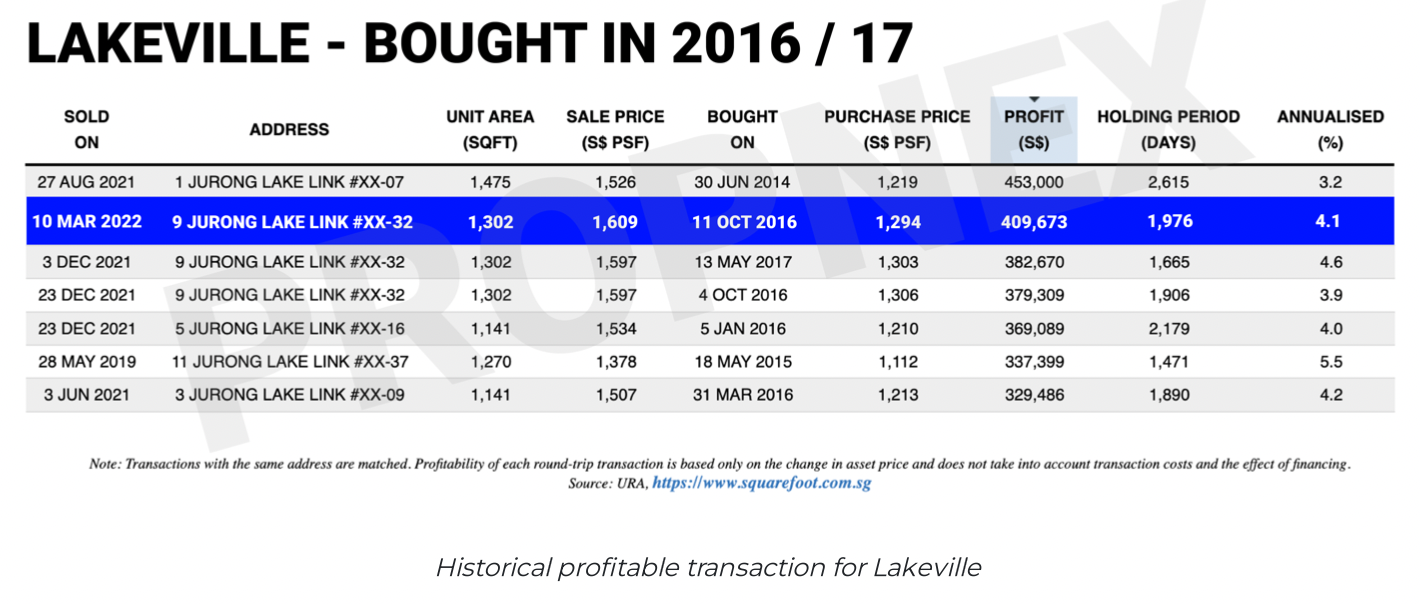

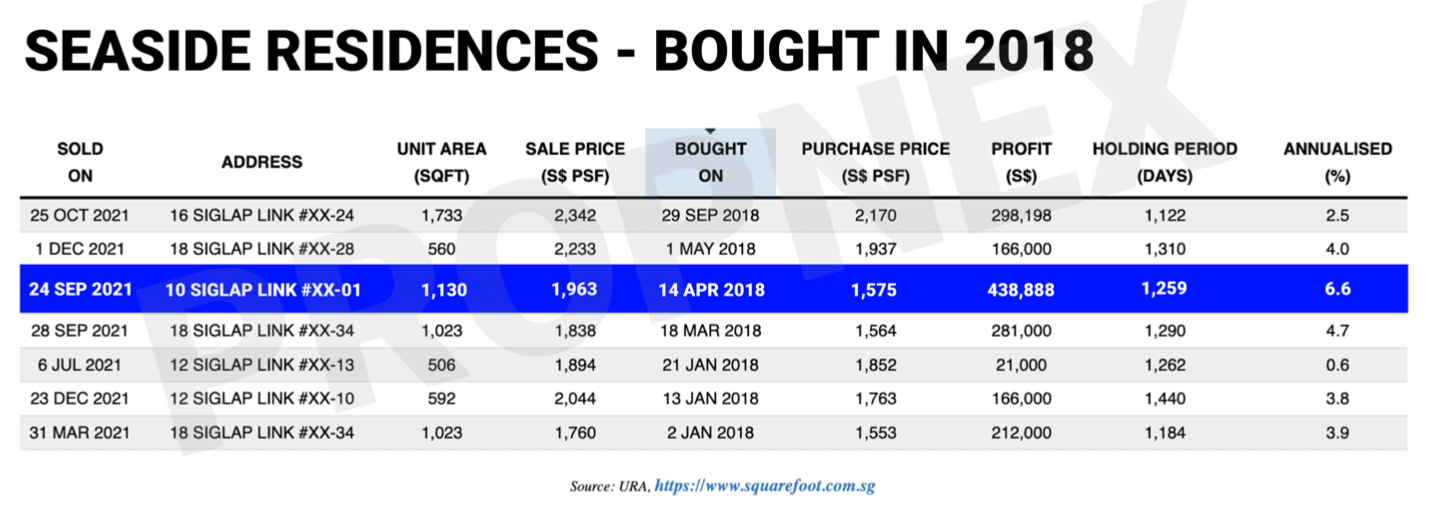

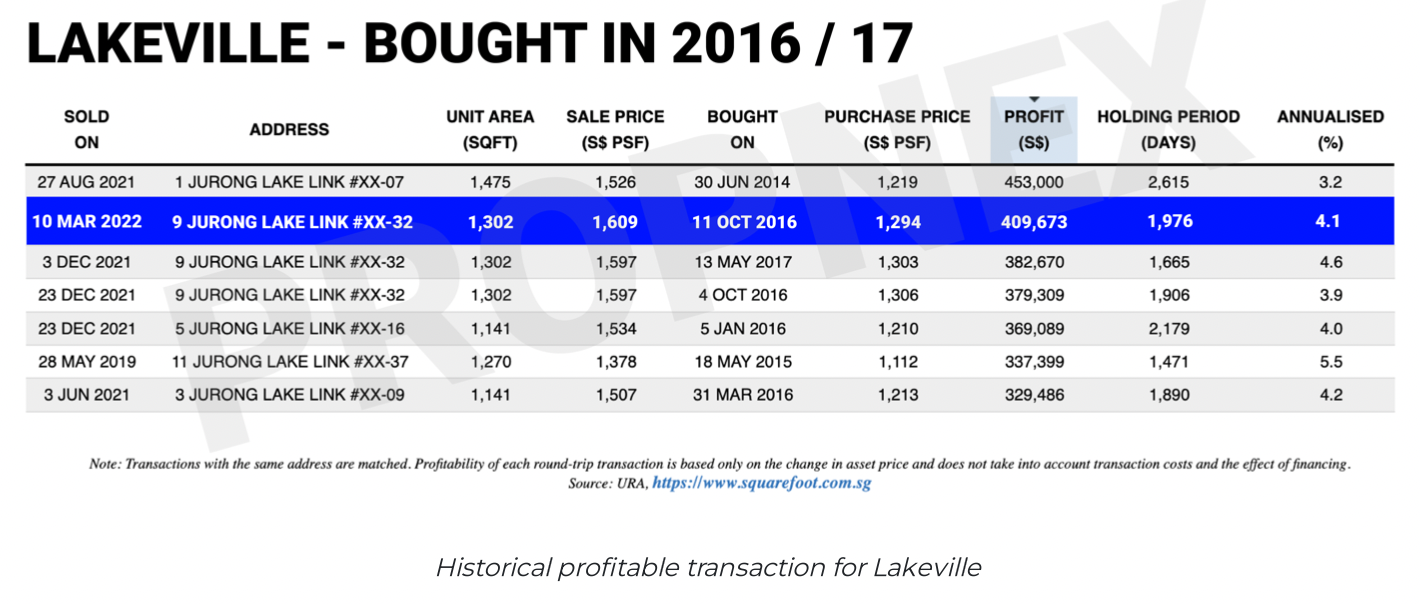

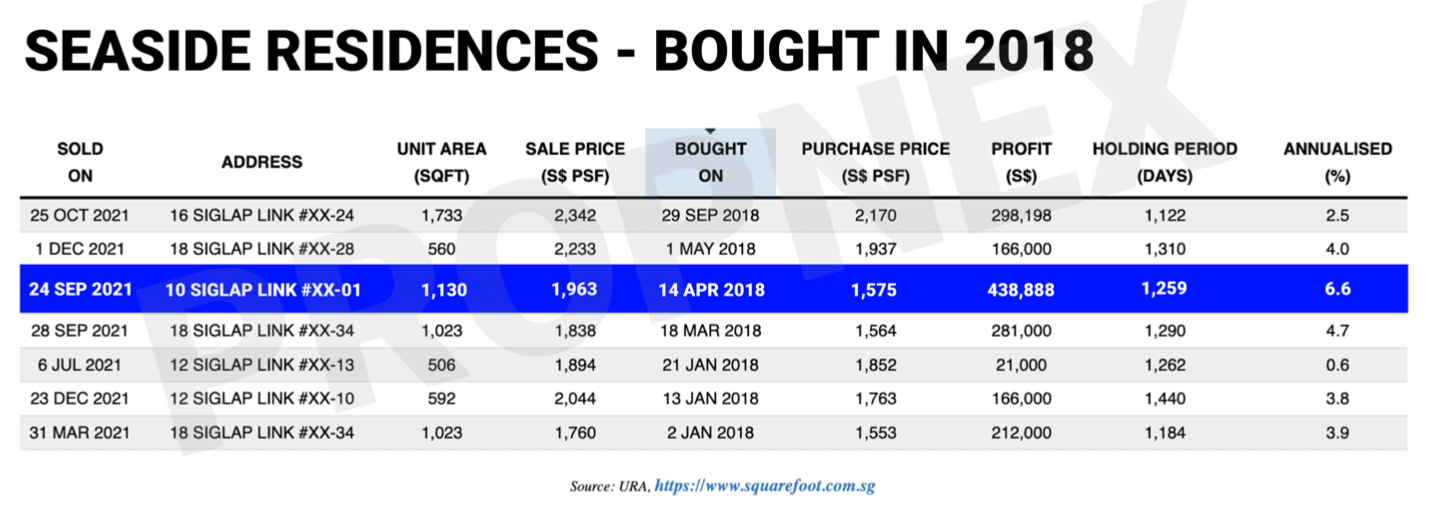

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

You must be asking yourself, why did these people dare to take action?

It is simply because they have knowledge of the real estate market and did their due diligence by assessing their finances & risk involved. That is why it is essential for you to learn before you take any action, especially during this period when there are many lingering uncertainties.

There is a general rule of thumb that 80% watch on as 20% of the people makes money

We can always design our own future instead of falling into the wrong side of the spectrum by default.

What is Your Next Step?

Wait & See?

Make a Move Now?

DM me here, you’ll learn how you can navigate through crisis and make the right moves on your property journey.

You May Also Like …

Jayson Ang – January 18, 2023

TLDR Considering the Singapore property market trends and financial factors, it's crucial to make informed decisions about upgrading from an...

Read More

Jayson Ang – January 4, 2023

TLDR When it comes to investing in real estate in Singapore, traditional beliefs may not always hold true in today's...

Read More

Jayson Ang – February 14, 2024

TLDR When it comes to property investments, timing is crucial. Buying at the right moment is only half the battle;...

Read More

Jayson Ang – January 22, 2023

TLDR An overview of the article discussing the benefits of Executive Condominiums (ECs) over private condos in the current real...

Read More

Jayson Ang – June 3, 2023

TLDR An open house is a valuable opportunity for sellers to showcase their home to potential buyers without pressure. It...

Read More

Jayson Ang – June 16, 2023

5 Things to Know About Singapore's Public Housing System With over 80% of Singaporeans living in public housing, it's important...

Read More

Jayson Ang – June 12, 2023

TLDR When upgrading your property, consider factors like rental rates, Buyer's Stamp Duty adjustments, higher interest rates for bank loans,...

Read More

Jayson Ang – May 15, 2023

The top 5 factors to consider when choosing a property in Singapore. Whether you're a seasoned investor or a first-time...

Read More

Jayson Ang – March 8, 2024

Singapore, the vibrant city-state known for its impressive skyline and diverse culture, is also home to an exceptional cocktail scene....

Read More

Jayson Ang – June 10, 2024

The proposed Singapore-Malaysia High-Speed Rail (HSR) is a joint project between the two countries that aims to improve connectivity and...

Read More

Jayson Ang – March 17, 2024

Singapore's urban landscape has undergone significant changes over the years, with the city constantly evolving to create a sustainable and...

Read More

Jayson Ang – June 22, 2024

Investing in Singapore's property market can be a good retirement plan for several reasons. Here are five key factors that...

Read More

Jayson Ang – March 24, 2024

TLDR The URA Master Plan entails significant shifts like the relocation of Paya Lebar Airport or creation of Punggol Digital...

Read More

Jayson Ang – March 16, 2024

Investing in property can be a great way to build wealth and secure your financial future. However, with Singapore's highly...

Read More

Jayson Ang – February 18, 2024

TLDR In 2025, owner-occupiers of residential properties can benefit from property tax relief based on the Annual Value Band. Retirees...

Read More

Jayson Ang – February 29, 2024

Singapore, known for its vibrant culture and rich history, is home to a plethora of museums that cater to art...

Read More

Jayson Ang – December 30, 2022

TLDR When considering the appeal of older properties in hipster neighborhoods in Singapore, it's crucial to understand the benefits and...

Read More

Jayson Ang – May 10, 2024

Investing in property is a great way to build wealth and secure a stable source of passive income. When it...

Read More

Jayson Ang – July 20, 2024

When investing in Singapore property, it is essential to be aware of the various tax implications and considerations. Here are...

Read More

Jayson Ang – June 20, 2024

Singapore, a bustling city-state known for its impressive skyline and modern architecture, is also home to a plethora of natural...

Read More

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences