Investing is an important aspect of personal finance and can be a valuable way to grow wealth over time. However, with a multitude of investment options available, it can be difficult to know which is the best choice for your financial goals and risk tolerance. One common decision that investors in Singapore face is whether to invest in the property market or the stock market. Both offer potential for growth and financial returns, but each has its own unique risks and rewards.

In this video, we will explore the pros and cons of investing in the Singapore property market versus the stock market, to help you make an informed decision about which investment option is the best fit for you.

Historical Performance:

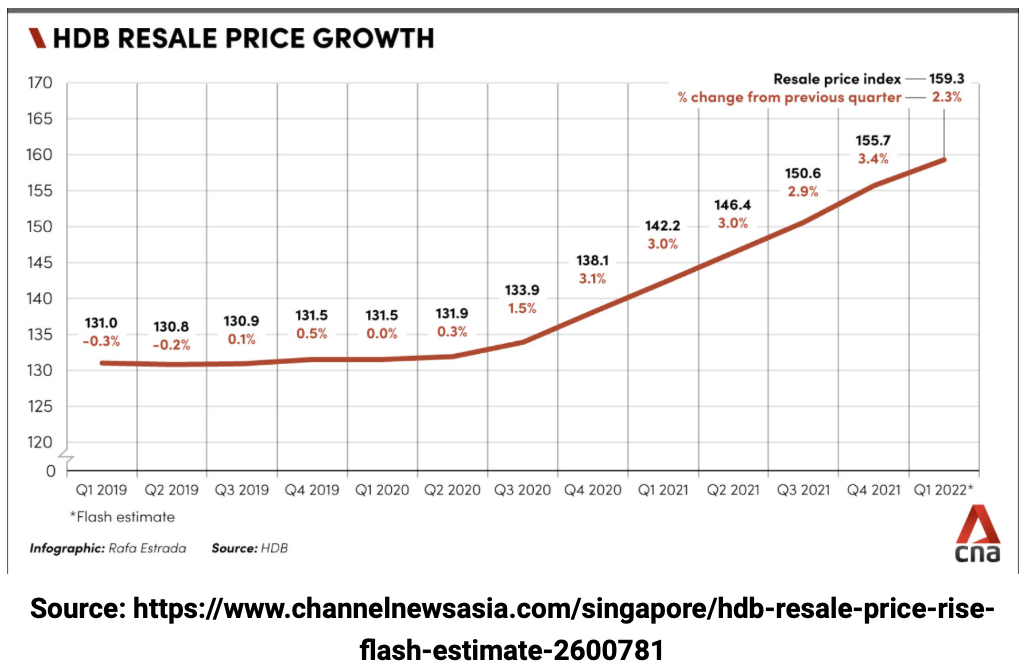

The Singapore property market has generally been a strong performer, with prices increasing steadily over the years. However, the rate of growth has slowed in recent years due to government measures to cool the market and prevent a property bubble. From 2009 to 2019, the Urban Redevelopment Authority’s property price index increased by 26.4%, while the private residential property index rose by 49.2%.

The stock market has also shown impressive growth over the long term, with the Straits Times Index (STI) delivering an annualized return of around 7% over the past 10 years. This is similar to the long-term average return of the global stock market. Many companies listed on the Singapore Exchange have also delivered solid returns to investors, especially in the technology and finance sectors.

Risk and Volatility:

The Singapore property market is generally considered to be less volatile than the stock market. Property prices are less likely to fluctuate rapidly, and tend to be influenced by factors such as economic conditions, government policies, and market forces. However, the property market is not immune to risk, and prices can fall in response to changes in market conditions. For example, the property market experienced a downturn in 2013-2014 due to government cooling measures.

The stock market can be more volatile, with prices fluctuating rapidly in response to market conditions and investor sentiment. This can create opportunities for investors to buy low and sell high, but it also means that the stock market can be unpredictable and risky.

Liquidity:

The stock market is generally more liquid than the property market, with investors able to buy and sell shares quickly and easily. In contrast, buying and selling property can take longer and involve more paperwork, making it a less liquid investment option. The process of buying and selling property can also be more expensive, with transaction fees and taxes to consider.

Diversification:

Investing in both the property market and stock market can provide diversification benefits, as these two asset classes tend to have different risk and return characteristics. By diversifying across different asset classes, investors can potentially reduce their overall investment risk. For example, if the stock market is performing poorly, the property market may be performing well, providing a cushion for the overall portfolio.

Investment Objectives:

Ultimately, the choice between the property market and stock market as an investment option will depend on individual investor objectives, risk tolerance, and investment time horizon. Some investors may prefer the stability and long-term growth potential of the property market, while others may favor the potential for higher returns offered by the stock market. It is important for investors to consider their investment goals and assess the risks and potential returns of each asset class before making a decision.

If you would like to arrange a viewing appointment with us in Singapore, do send us a DM here

And if you want even more tips and advice on investing in the Singapore property market, be sure to follow, like and share, or contact us for expert advice, and I’ll see you in the next post!

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …