TLDR for “Dual-Key Condo: Analysing The Pros And Cons”

When considering dual-key condo units, it’s important to weigh the advantages and disadvantages. These units offer the benefit of no ABSD payable, privacy when renting out, and potentially higher rental yields. However, they can be more expensive per square foot, challenging to sell, and may not be suitable for a home office. Ultimately, the decision to buy a dual-key condo unit depends on your specific goals and circumstances, including rental demand, proximity to amenities, and comparable rental yields in the area.

Back in 2009, the dual-key condo unit was introduced to the market with the launch of Frasers Centrepoint Homes’ Caspian. Since then, developers have embraced the concept, rolling out multiple projects that incorporate this popular housing solution across Singapore. Among the latest launches featuring dual-key units are Enchante, Parc Clematis and Piccadilly Grand.

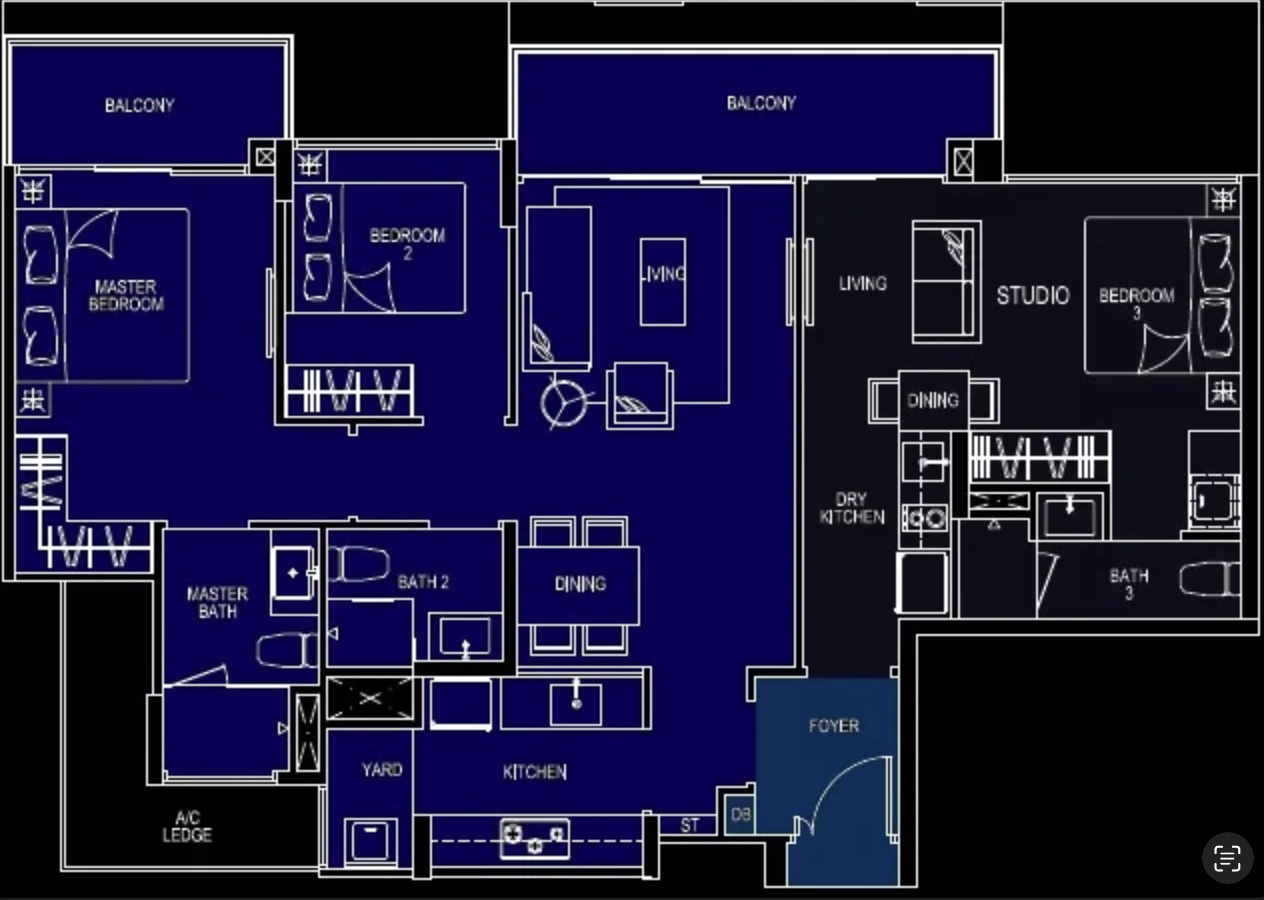

Dual-key units offer the unique advantage of providing two self-contained living spaces that merge together in one convenient entranceway and address

Dual-key condos provide an attractive option for several groups of property buyers. With a larger unit as the main unit, and a smaller unit – usually a studio – as the sub-unit, dual-key units are typically 3 to 5% bigger than a regular condo with the same number of bedrooms. For multi-generation families looking to live together but maintain their own privacy, or property investors and couples unable to purchase a second home due to affordability constraints, dual-key condos offer many benefits. However, like anything, there are also some drawbacks to keep in mind. Let’s explore the pros and cons of dual-key condo units.

Advantages Of Dual-Key Condo Units

No ABSD payable

Dual-key condo units may seem like two apartments side-by-side, but they are legally one single property. Therefore, buyers don’t need to pay any Additional Buyer’s Stamp Duty (ABSD) for the extra sub-unit!

An example layout of a dual-key condo unit in Singapore.

With Singapore’s government introducing a hefty ABSD hike in 2021, buying a dual-key unit could be a more appealing option for first-time homebuyers and those purchasing multiple properties. This is because a dual-key apartment allows you to avoid paying the ABSD which can be as high as 20% for Singapore Citizens who are buying a second home (30% for Permanent Residents and 60% for foreign buyers). Let’s say you’ve got a S$2 million budget and are deciding between two separate condos – a S$1.2 million two-bedroom for yourself and a S$800k one to rent out – and a dual-key unit. If you choose the former, you’ll be faced with an additional cost of S$136,000 in ABSD. But with a dual-key unit, you can skip paying the tax if it’s the first property you’re buying.

Renting out without sacrificing privacy

Dual-key units allow landlords to remain in their properties while renting them out, without compromising too much on their own privacy. Unlike regular condo units, tenants will have separate keys and individual access to the living space, bathrooms, and kitchen amenities – meaning you’ll never have to worry about running into them in your nightgown! With dual-key units, you can take full advantage of having as much personal space as you need.

Higher rental yield (compared to standalone studio units)

Rather than simply renting out a room in your unit, why not consider leasing out a sub-unit? Not only can this provide you with a greater degree of privacy, but it has also been seen to yield a higher psf rental rate than that of a standalone studio unit.

To illustrate this point, let’s take a look at Riverbank @ Fernvale – a development with dual-key condo units that has a current listing for a studio.

A studio of a dual-key unit at Riverbank @ Fernvale for rent.

- Rent: S$2,000/month

- Floor area: 250 sq ft

- Price psf: S$8

At D’leedon, dual-key units measuring between 450 and 550 square feet are available for rent at a price per square foot of S$4, in comparison to other one-bedder units.

A studio of a dual-key unit at D’leedon for rent.

- Rent: S$2,000/month

- Floor area: 300 sq ft

- Price psf: S$6.67

At D’leedon, one-bedder units are being rented at a lower price per square foot than what we’ve seen for Riverbank @ Fernvale. These units are ranging from 650 to 750 square feet and are currently priced at S$4.83 per square foot. Therefore, a prospective landlord looking to invest in a dual-key condo unit can enjoy higher rental yields with less upfront cost – perfect for own-stay properties.

Disadvantages of dual-key condo units

Dual-key units can be more expensive per square feet

Doing your due diligence to determine the worth of a dual-key unit is a must – particularly if you’re buying one on the resale market. The price of these units can vary wildly – with some developers pricing them at a whopping 20 to 25% more than regular units with the same number of bedrooms. For instance, Kingsford Development charged a premium for their dual-key units at Kingsford Waterbay, yet Aurum Land didn’t do the same for the six dual-key, two-bedroom units at The Orient.

Dual-key units can be difficult to sell

Due to its appeal only to a select group of buyers, dual-key units can be tricky to sell. Most buyers – from young professionals to retirees – don’t have the need or want to rent out their unit and thus may not be too keen on investing in a dual-key configuration. If you’re set on purchasing one, we recommend choosing a unit without a kitchenette so it can be used as a second master bedroom or junior suite; this will still make it attractive to buyers, even if it may mean a lower rental return.

Not suitable as a home office

Using a unit in a dual-key property as a home office space may not be the wisest decision for entrepreneurs and business owners, unless they are flying solo or have a small team that won’t expand in the near future. Moreover, a license under the Home Office Scheme must be applied for, allowing for a maximum of two non-residents to be engaged in the business. Additionally, signage outside the property is not allowed, hence dual-key units may not be suitable for a home office.

Should you buy a dual-key condo unit?

If being a landlord on a budget or having your parents live with you in the future is your main goal, a dual-key unit could be the ideal solution; however, it’s still important to consider other factors, such as the rental demand in the area, proximity to essential amenities, and rental yields for comparable properties in the vicinity. Ultimately, dual-key units can be a great option, but it’s best to take into account all the variables.

More projects featuring dual-key units

New launch condos with dual-key units:

- Infini at East Coast (TOP: 2022)

- Jervois Treasures (TOP: 2022)

- Neu at Novena (TOP: 2023)

- Parksuites (TOP: 2023)

- Verticus (TOP: 2024)

- Forett @ Bukit Timah (TOP: 2024)

Resale condos with dual-key units:

- Highline Residences

- Seaside Residences

- City Gate

- Park Place Residences

- Kallang Riverside

- 120 Grange

Should You Buy, Sell or Wait?

If you’re reading this, you must be trying to figure out the best course of action right now: is it the right time to buy or sell?

It’s difficult to give an exact answer since everyone’s situation is unique and what works for one person may not necessarily work for you.

I can bring you a wealth of on-the-ground experience and a data-driven approach to provide clarity and direction. From beginners to experienced investors, our top-down, objective approach will help you on your real estate journey.

I can help you by:

- Offering Strategic Real Estate Advice – I can help create a comprehensive plan to guide you through your property journey.

- Connecting Your Home with the Perfect Buyers – Through stunning visuals, an effective communication strategy, and an in-depth knowledge of the market, we’ll ensure your home is presented in the best possible way to fulfill your goals.

You May Also Like …