TLDR

Considering the Singapore property market trends and financial factors, it’s crucial to make informed decisions about upgrading from an HDB flat to a condo. Evaluating your current property’s performance and potential resale proceeds, along with affordability for a 4-bedroom EC/Condo, is essential. Taking into account interest rates, property prices, loan eligibility, and future financial stability is key. The analysis suggests that moving to a private property now may be more advantageous than waiting due to escalating prices and affordability challenges over time. Making a well-thought-out decision aligned with your family’s needs and financial goals is paramount for a secure and prosperous future in the property market.

Hi Jayson,

I’m really impressed with the outreach that you’ve done, and I have a few inquiries I’d love to get your experienced opinion on – they may even give ideas for future content! Should we upgrade to a condo now or wait for interest rates to go down?

My husband and I have a 4-room HDB flat in Buangkok that we purchased for nearly half a million dollars in 2017. When we first moved in, it was just the two of us, but now, with two children and a helper, we’re desperate for an extra room. Space isn’t our priority, as long as we have three bedrooms and an extra room, be it a study or something else.

Considering a switch to a private property, like an EC or condo, has crossed our minds; yet, our salaries combined amount to $15,000, including CPF. On top of that, we’re only halfway through paying off our mortgage loan and we have a $900 car loan. We aren’t sure if upgrading is the right choice, or where to even start.

Despite having paid a hefty price for our current home, we’re not convinced that a sale would bring us a healthy gain, or indeed any gain at all. Although it would be great to profit from the sale and upgrade to a new property, that may not be realistic.

Should We Upgrade to a Condo Now or Wait for Interest Rates to Go Down?

My questions here are:

1) Should we stretch our finances to buy a 4-bedroom EC/Condo when home interest rates go down? Is this achievable, and what loan/cash down payment would we need, taking our income into account? Our long-term plan could then be to sell our current property and downsize to an HDB flat when our children are older.

2) Given the sky-high interest rates on home loans coupled with the government’s series of cooling measures, what impact will this have on HDB home owners who wish to sell their flat for a bigger profit?

All advice is welcome and greatly appreciated!

Greetings!

Thank you for reaching out to us with your questions. We understand that this can be a stressful time to consider moving, with inflation, mortgage rate hikes, and high property prices – especially with two little ones! We are here to help you make the most informed decision possible.

To start, let’s look at how your current HDB is doing.

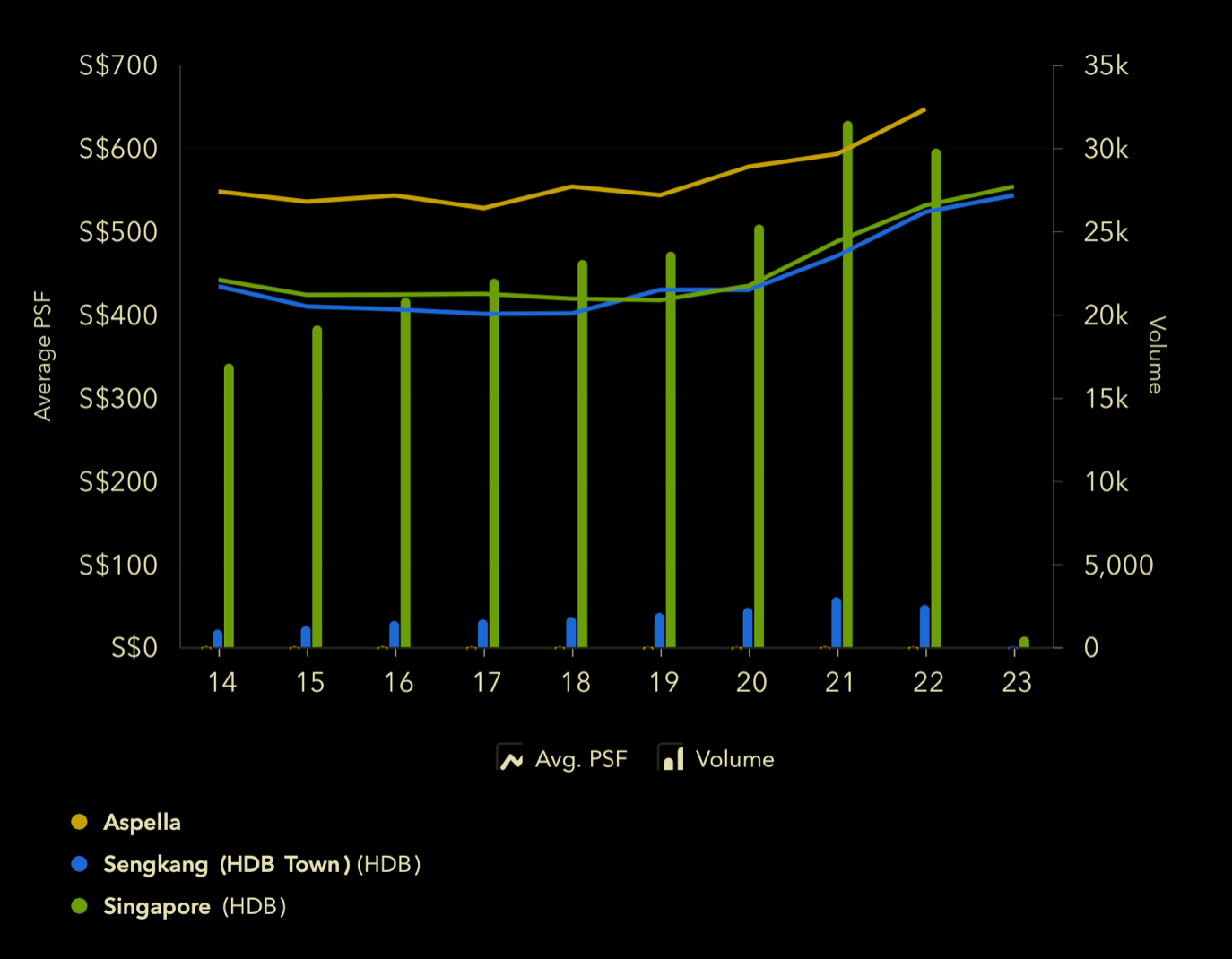

Performance of HDB

The graph above clearly illustrates that the price of flats in Aspella has generally followed the same trajectory as Sengkang and the wider market. Notably, prices in Aspella began to increase in 2019 while Sengkang’s HDB prices only started to rise in 2020.

This is likely due to the introduction of Sengkang Grand Residences, a mixed-use development complete with residential and commercial offerings. With the inclusion of a new shopping mall, the area has seen a surge in convenience, and Aspella is poised to reap the rewards from its advantageous proximity.

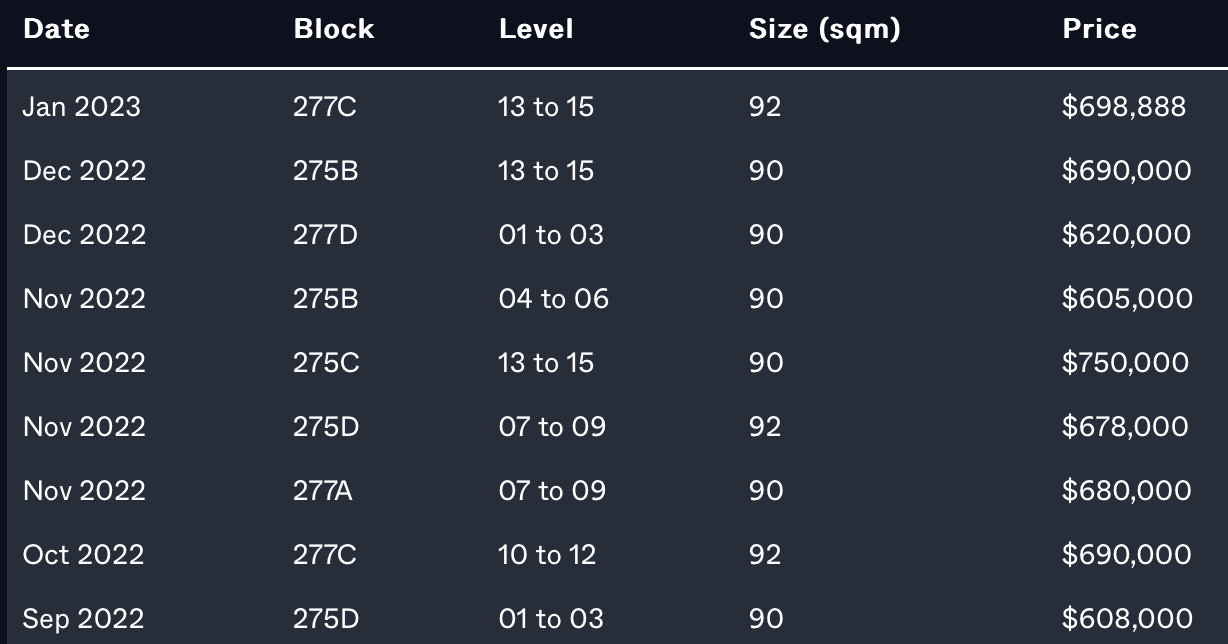

Take a look at the recent 4-room transactions in Aspella :

In comparison to six years ago, prices have risen – yet this doesn’t guarantee a profit. Therefore, if you choose to sell, let’s examine your potential sales proceeds.

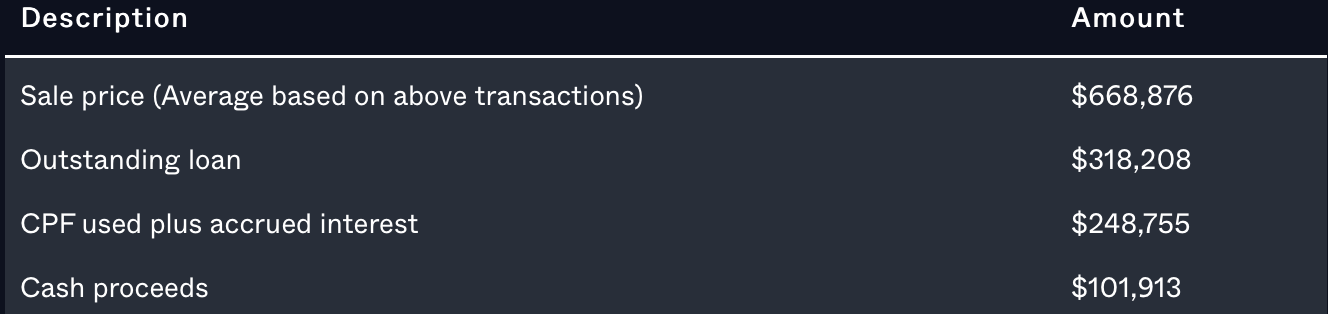

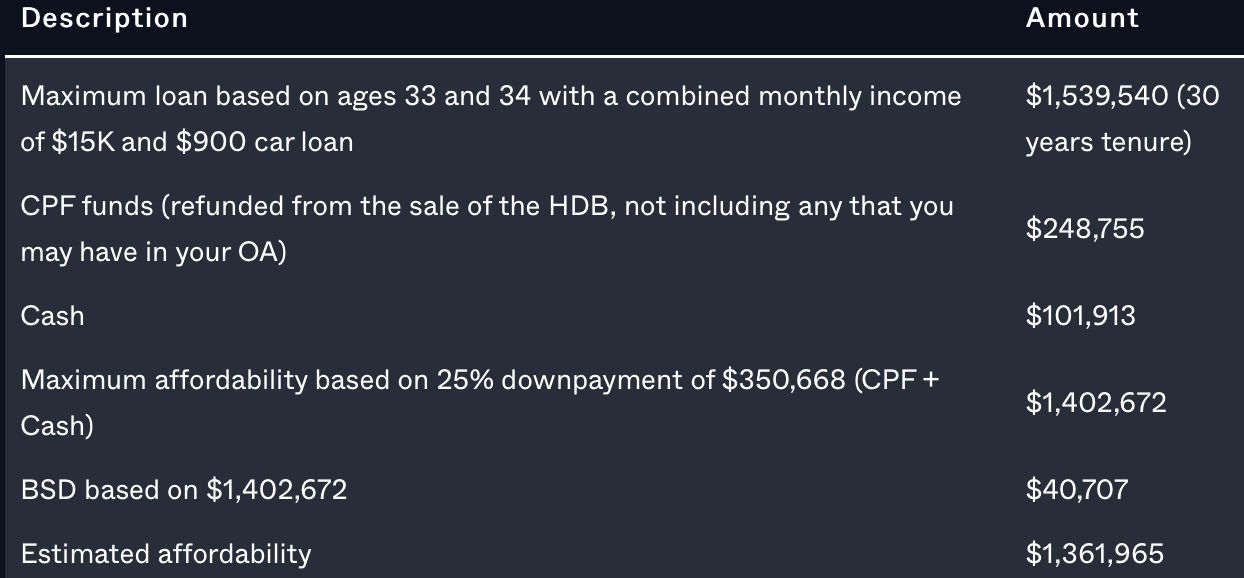

Now, let’s see how much you can afford after selling :

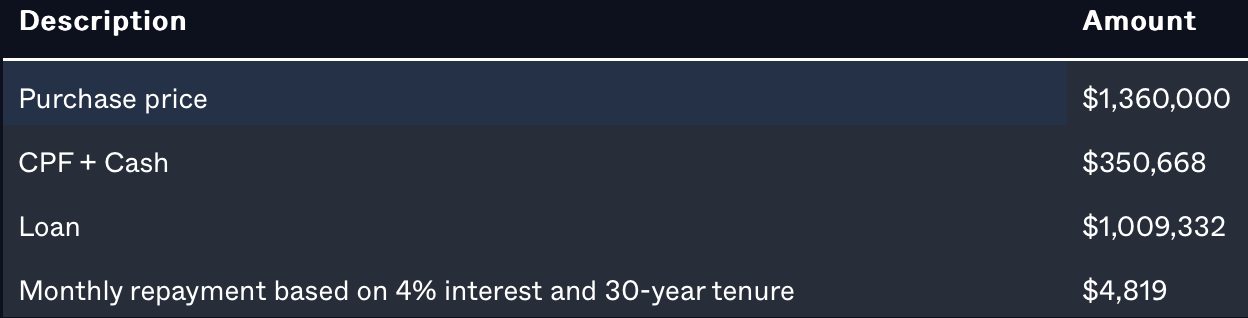

Since you have a combination of CPF and Cash amounting to 25% of the $1.36 million property, you won’t be able to get the maximum loan.

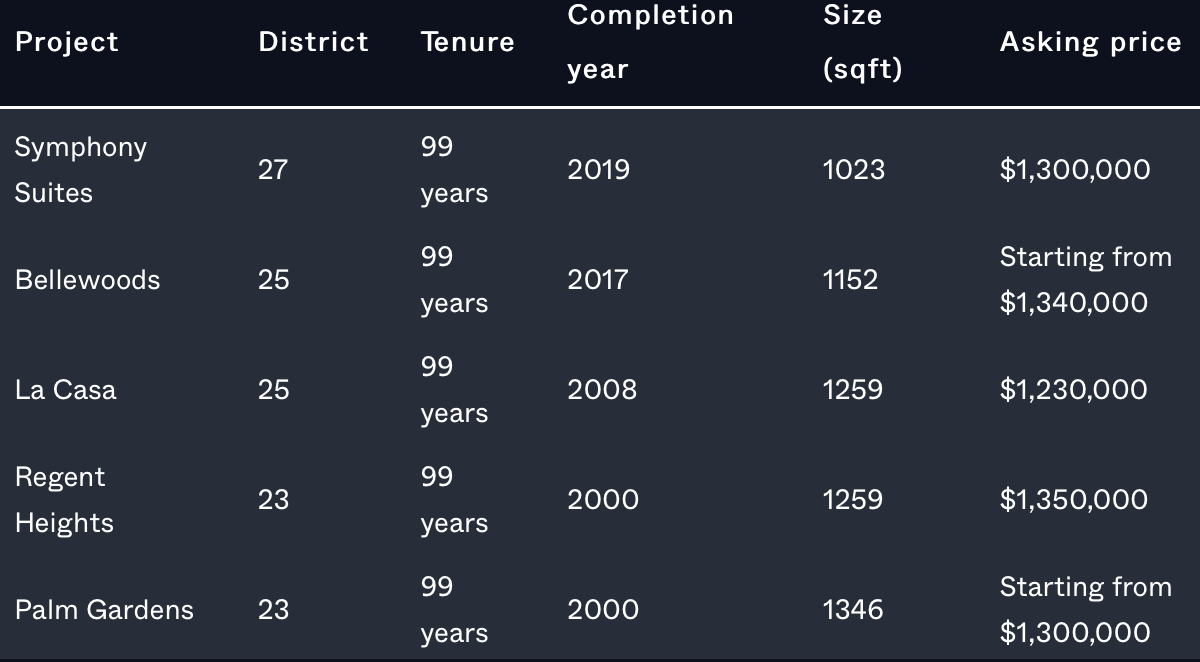

Check out these four bedroom properties available with a budget of $1.36 million :

If you run a search on PropertyGuru, you’ll find several resale EC units that fit your budget. Although these units haven’t yet reached their Minimum Occupation Period (MOP), they’ve been granted special permission from HDB to be sold prior.

Hence, the loan amount will be determined using MSR instead of TDSR and a resale levy must be paid by second-time buyers.

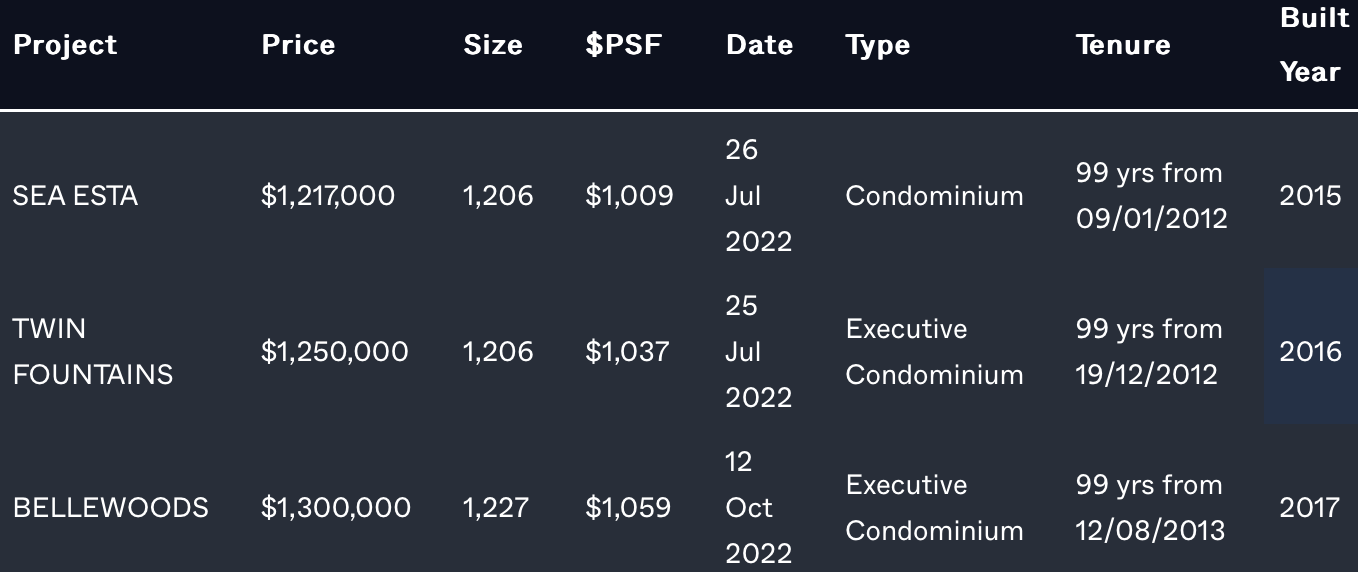

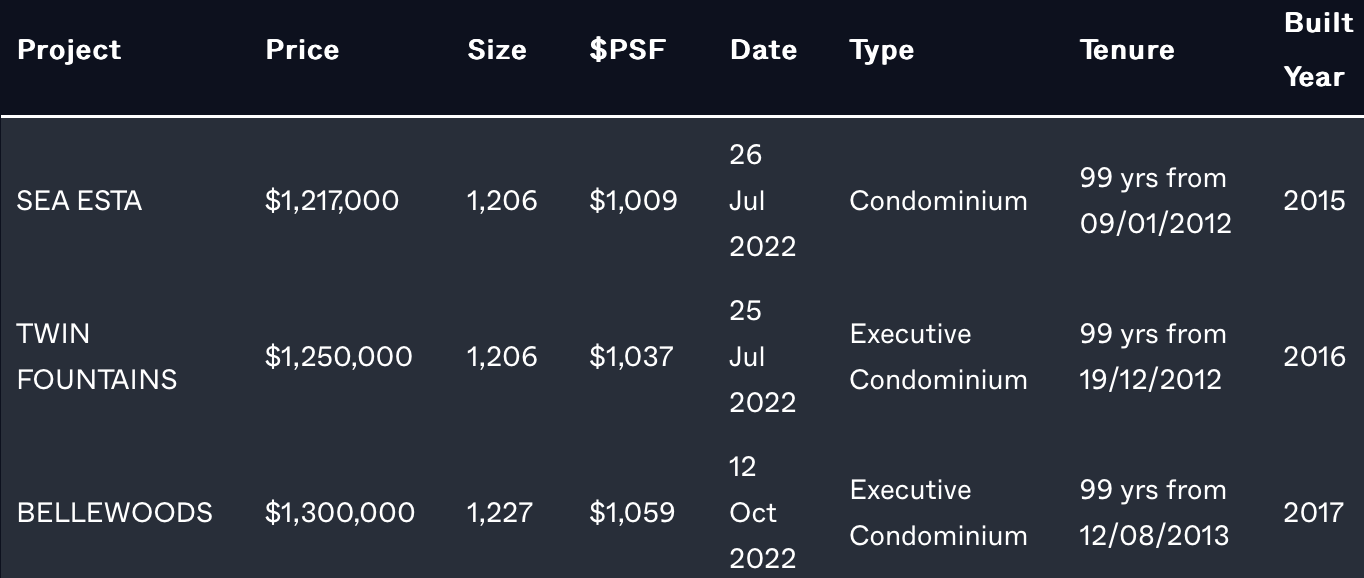

To give you an idea, here are some four-bedroom condo transactions that happened in the past 6 months, and were all built in the past 10 years or less.

With only $942,576 of loan eligibility for you and your husband for an Executive Condominium, you may have to camp out and wait for a four-bedroom unit at a historical price of $1.36 million.

This would result in a short-fall of $66,756, which must be paid in either cash or CPF.

Don’t forget, if you took any CPF housing grants for your current HDB, you will also have to pay a resale levy of $40,000 in cash.

Should you upgrade to a four-bedroom private property?

Considering the fact that you and your partner were only a family of two in 2017 and your children are likely to be under five years old, you have mentioned your plan to remain in the same place for a long time until your children are older.

We can only imagine the difficulties of the moving process, but seeing as you both are still in your early 30s, it may be wiser to take advantage of this time and move once or twice instead of sticking to a single spot until your children reach the age of 30.

What is the reasoning behind this?

Given a budget of $1.36 million, your options for a four-bedroom are unfortunately quite slim. For instance, the youngest development, Symphony Suites, has been around since 2014 (its 99-year lease is still in progress) and in 25 years, it will be 34.

A glance at the current market reveals four-bedroom units of 1,200 sq ft or more that cost no more than $1.3 million and are ten years old or newer.

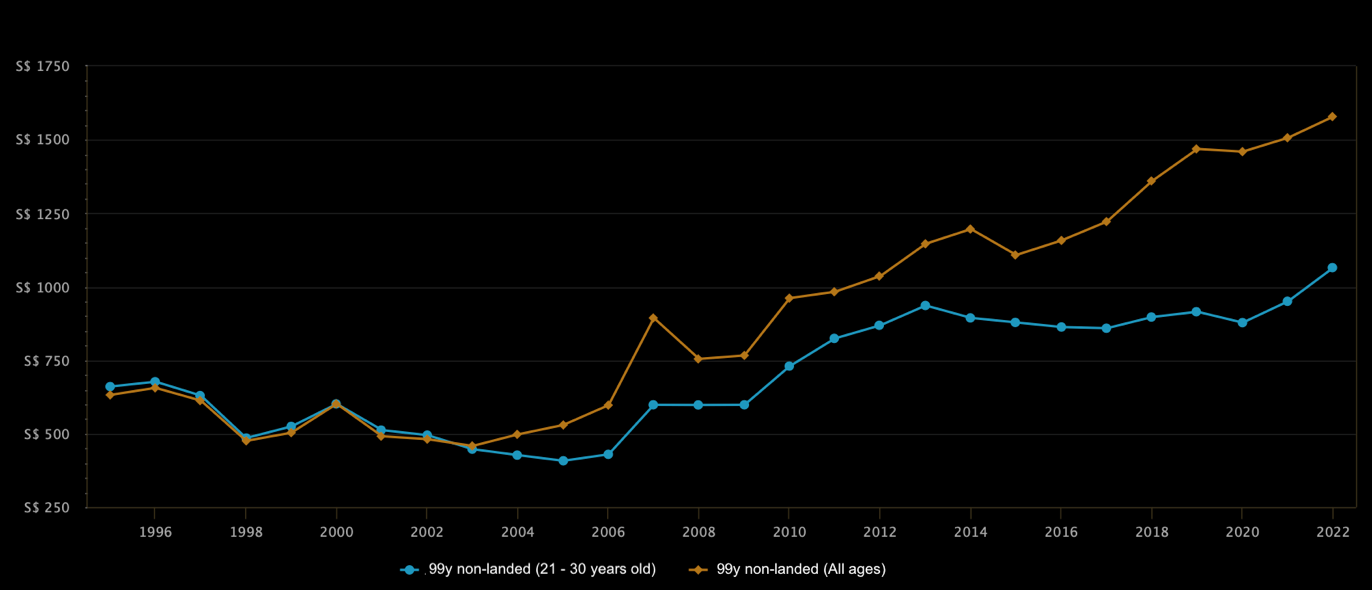

Typically, prices of 99-year leasehold developments start to plateau after they reach 21 years of age, although this can vary depending on the demand and supply of the area, the characteristics of the estate, upcoming changes, and more.

Analyzing the graph, we can clearly see that the price trend of 99-year leasehold non-landed private properties aged between 21 – 30 years is below the standard. After the implementation of the three cooling measures in 2013, the prices of these developments aged 21-30 remained unmoved, until the onset of the pandemic.

This is why it’s not recommended to hold onto a leasehold property for an extended period of time.

Exploring the option of purchasing a private property to house your family while your children are in primary school is something to consider. If you purchase a project of ten years or younger, by the time your children finish school, the property will still be relatively young, thus ensuring a wide pool of potential buyers.

By the time your income has increased, you’ll have more options available to you. Your children may have grown up, which could mean you no longer require a helper and could be able to buy a three bedroom property in the area you desire. All in all, this would be the perfect situation!

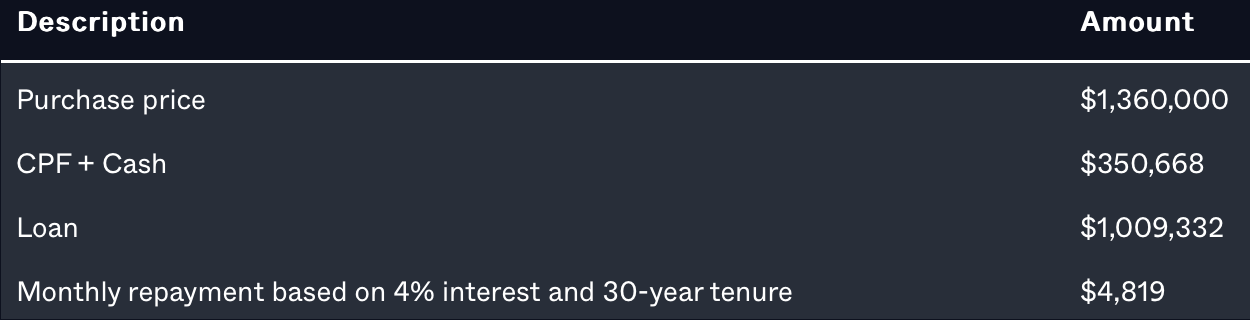

If you were to purchase a $1.36 million property at 4 per cent interest, the monthly repayment would be $4,819. Coupled with your existing $900 car loan, your total monthly debt would amount to $5,719, which is a whopping 38 per cent of your combined income.

This may/may not be manageable for you, considering you have two kids and a helper. And if that wasn’t enough, you’ll be investing all the cash proceeds from the sale of your HDB in the next property.

Although we assume you have some reserve funds in case of emergencies, it might not be wise to put all your cash into this investment.

Do you think it is wise to hold off until interest rates drop?

“Last year, in the most aggressive policy tightening since the early 1980s, the Fed lifted its benchmark policy rate from near zero in March to the current range of 4.25 per cent to 4.5 per cent, and Fed officials last month projected it will breach the 5 per cent mark in 2023, a level not seen since 2007.” – Straits Times, 3rd Jan 2023

Given the sky-high HDB prices, now is undoubtedly the best time to cash out and reap the rewards. However, despite the slowed interest rate hikes, it appears unlikely that they will decrease in the near future.

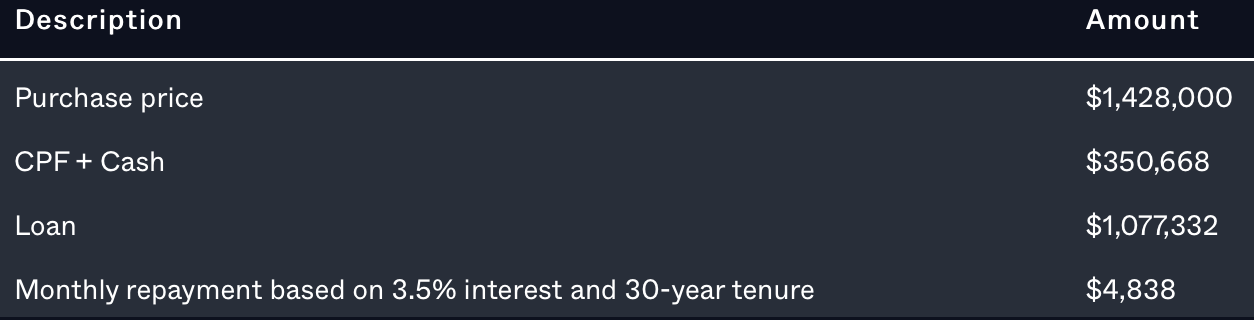

In addition, with increasing mortgage rates, building costs, and limited market stock, Ms. Christine Sun and Mr. Lee Sze Teck of OrangeTee and Tie and Huttons Asia respectively have predicted private property prices will climb by five to eight percent in 2023.

Buying a $1.36 million property today at 4% interest:

A year later, buying the same property but with an increase in prices of 5 per cent and a 3.5 per cent interest rate has become a reality.

Examining the monthly payments closely, you’ll notice that even with a decrease of 0.5% in the interest rate, a more expensive property will still have a higher loan repayment than a cheaper one with a higher interest rate.

What could your monthly repayments look like if you took out a loan of $1,009,332 for a $1.36 million property over 30 years?

When weighing the potential pros and cons of taking out a loan with a high-interest rate, remember that these loan rates are typically renewed every 2-3 years.

That means you don’t have to worry about being stuck in a perpetual financial bind.

However, you may be at risk of being priced out if you opt for a wait-and-see approach. Then again, you can use that extra time to bolster your finances and take advantage of the HDB price hike.

Now, let’s ponder our next crucial query.

Is HDB a lucrative “investment” from 2023 onwards?

Even if you don’t want to upgrade now, staying in your HDB may prove beneficial in the long run since you can earn more and open yourself up to more upgrading options later.

“Flats reaching their five-year minimum occupation period are slated to drop significantly from 31,325 units in 2022 to 15,748 units in 2023, dipping further to 13,093 units in 2024 and 8,234 units in 2025.“ – CNA, 3rd Jan 2023

With a diminishing supply of newly built MOP units in the upcoming years, it appears that the prices of older HDBs will stay stable for the coming years until new BTOs enter the scene. Therefore, keeping your HDB and expanding your financial resources could be a wise course of action for a more prosperous future.

With the prices of HDB units skyrocketing, the government has been heavily regulating the HDB market to make sure it remains affordable for citizens. But no matter the measures taken, the cost of upgrading is something we must all be mindful of.

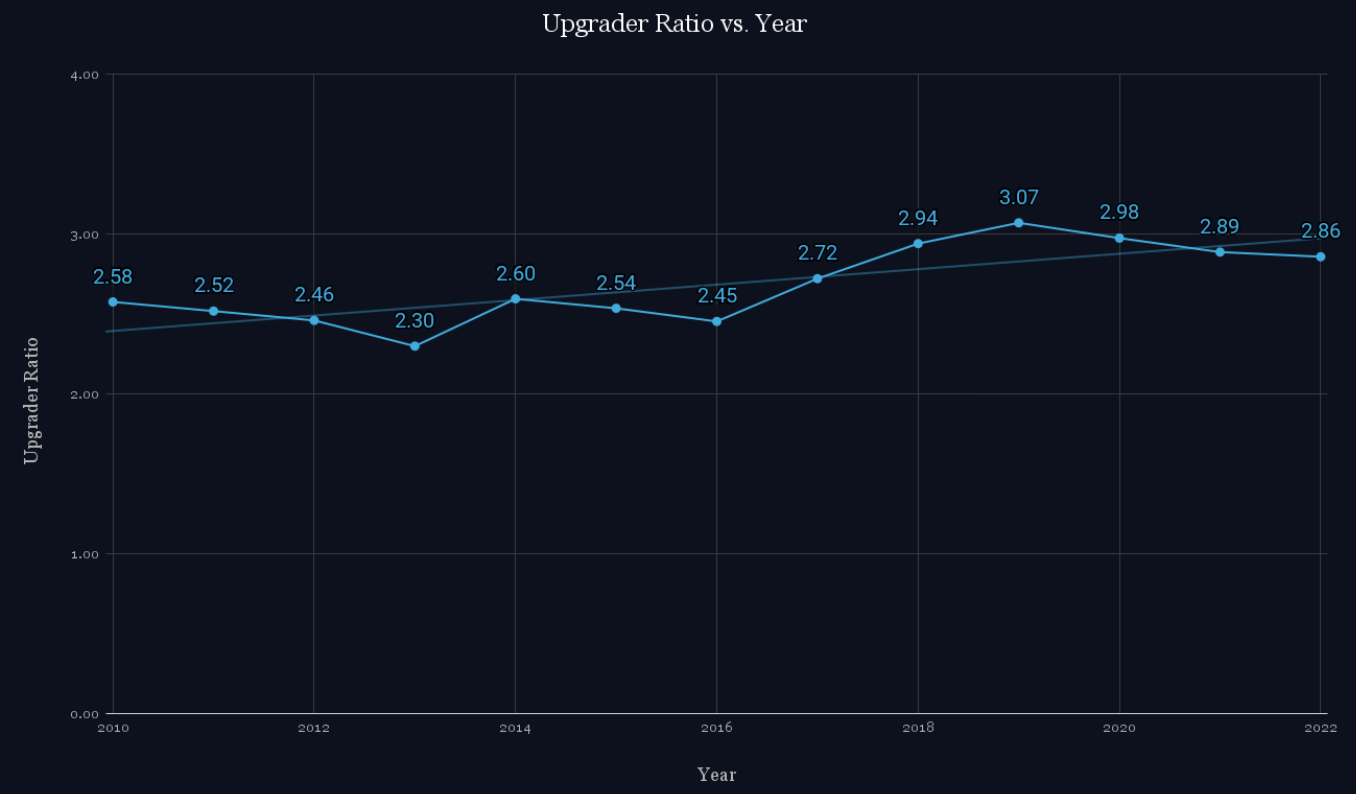

Have we seen a trend in the cost of upgrades over time? Is affordability for upgraders rising or falling?

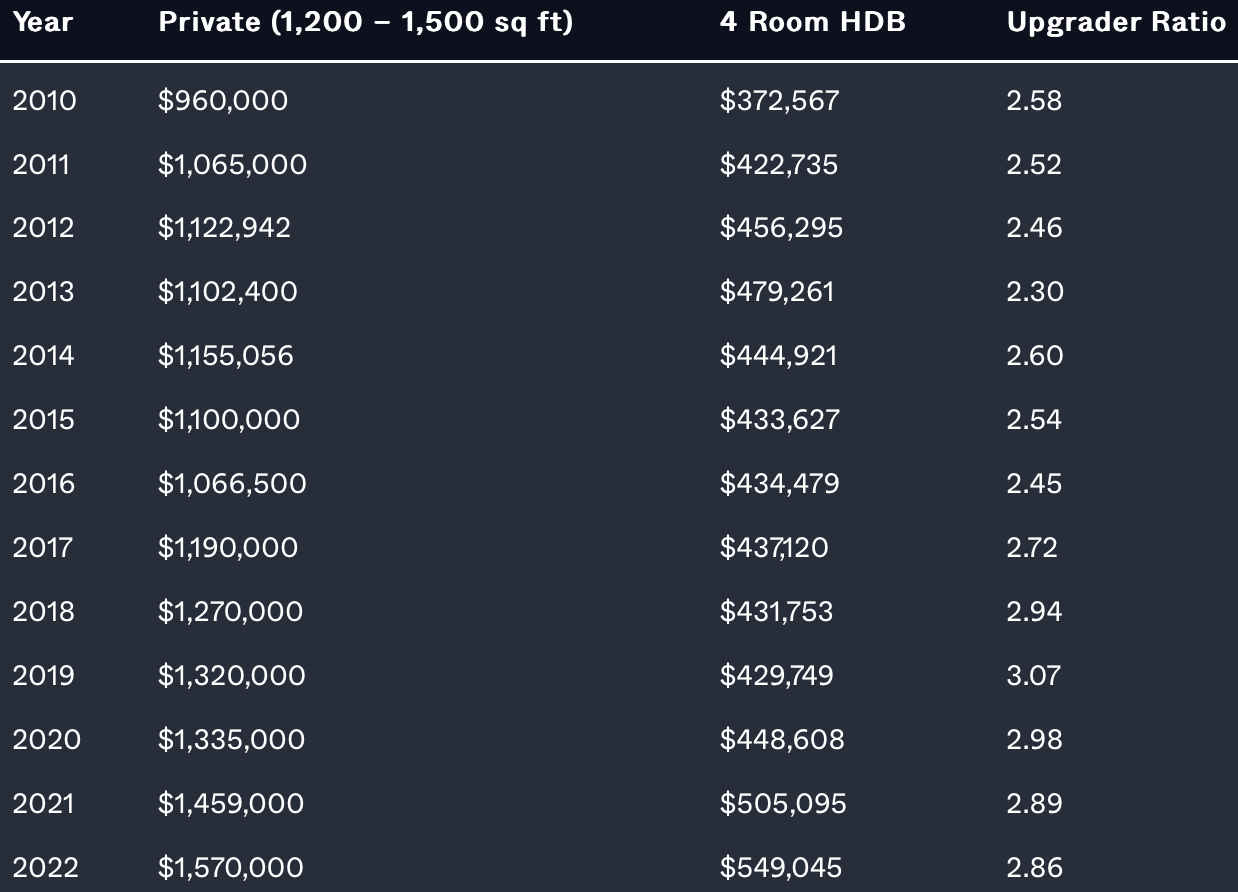

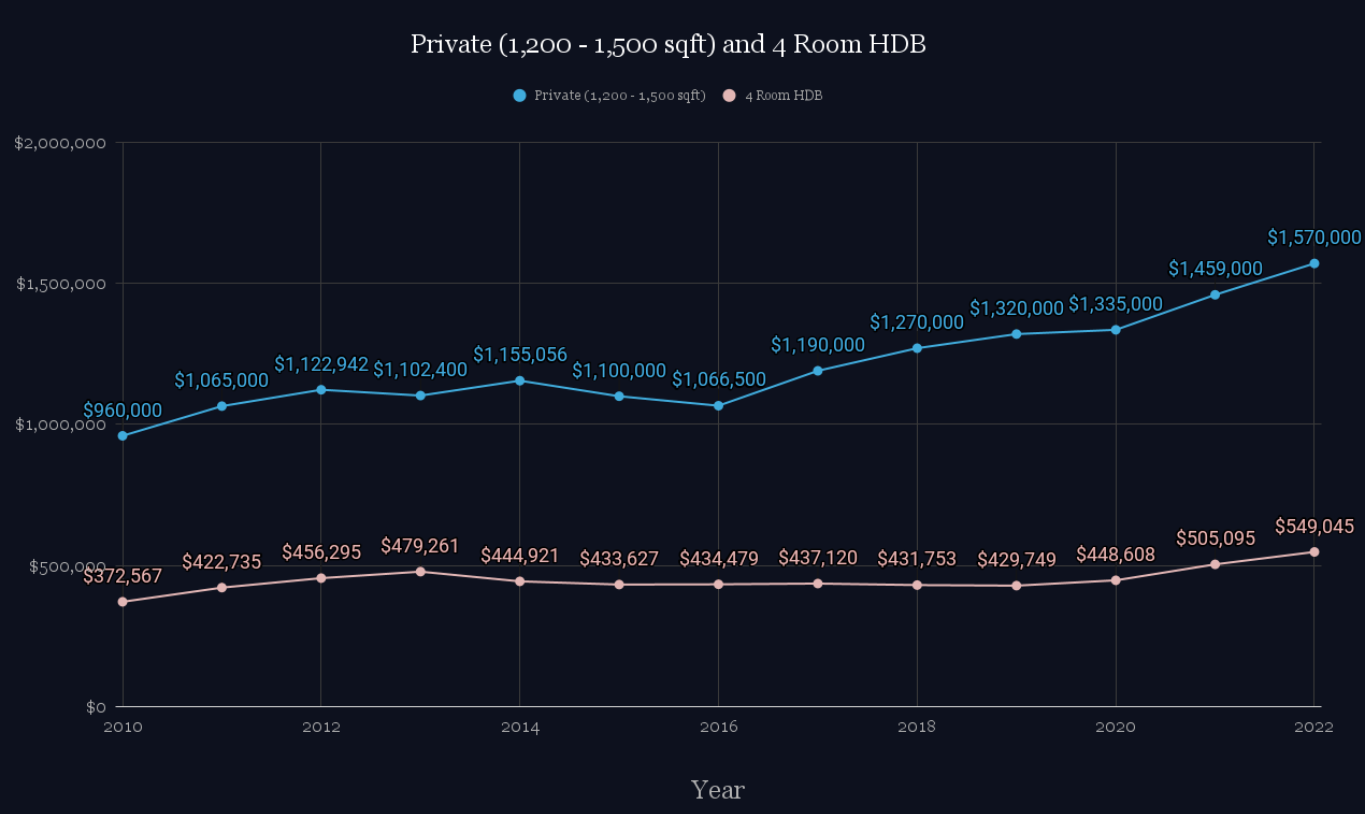

Let’s take a peek at the average 4-room HDB prices and 1,200 – 1,500 sq ft private properties, which might be the closest match to four-bedroom units. So, what does this pattern signify for those planning to upgrade their HDB?

With the intent of understanding the difference in costs over time if a HDB dweller living in a 4-room flat chooses to upgrade to a four-bedroom condo, we are looking at the pricing of private, non-landed properties within the Outside Central Region (OCR) region.

Let’s take a closer look at what these prices entail:

Let’s take a look at the difference over a period of 12 years :

What pattern emerges when we observe the fluctuations in prices?

The graph demonstrates that the price gap between 4-room HDB and four-bedroom condos fluctuates, yet the peak and trough of each cycle is higher than the previous one.

This indicates that the transition from HDB to condo is becoming more difficult over time. As such, it might be beneficial to purchase a private residential home now, despite the high-interest rate, rather than waiting and taking the risk of being unable to afford it in the future.

If you’re planning for the long-term, say 20 years, the current prices shouldn’t be too big of a concern. Of course, it’s always wise to be prudent when making a purchase. So, if you need the extra space and you can find something that meets your criteria, and you’re comfortable with the potential for higher monthly payments, then go ahead and get it!

Conclusion

Considering HDB prices are at an all-time high and your current HDB appears to be a worthwhile investment, you may be tempted to take advantage of this opportunity to make some money. However, with the high-interest rates and a livable living situation, it may be prudent to take a wait-and-see approach.

Despite the potential interest savings, property prices have risen significantly during this wait period, making these savings more of an illusion. What’s more, we’ve seen in the past 12 years how difficult it has become to upgrade, and this trend doesn’t seem to be changing. Even though we could be wrong, the only way to get an accurate answer is to look at the historical data.

Should We Upgrade to a Condo Now or Wait for Interest Rates to Go Down?

Should We Upgrade to a Condo Now or Wait for Interest Rates to Go Down? Considering what type of property best suits your needs, it’s essential that it fulfils your living requirements and is within your budget. Exercise prudence in this time of uncertainty; if you can find a place that can provide for your family, and the monthly payments won’t break the bank, then now may be the perfect time to upgrade!

Considering the options available on the market, most of which are 99-year leasehold developments above 10 years of age, we would not recommend holding on to this property for the long haul due to the decreasing value of a leasehold.

As an alternative, it may be prudent to remain in a younger leasehold property in the short- to mid-term, relocating to another property with greater potential, and then downsize to an HDB once your kids have moved out.

Do you have a burning question? Send me an email at ask@jaysonang.com

In search of a home? Get in touch with me for a more detailed consultation.

Final Thoughts

- Carry out an in-depth financial analysis to guarantee you are making wise decisions for the near future and can confidently stand behind your decisions.

- Also take your timeline and family wishes into account, plan ahead and provide your family with a sense of security so that you can proceed with peace of mind.

If you’re curious about the prospect of relocating to private property and would like expert advice, I’m just a message away!

You May Also Like …