When you flip open the papers or turn on the news nowadays, the common buzzwords are “INFLATION“, ” INTEREST RATE HIKES” & ” LOOMING RECESSION“.

These aforementioned occurrences do intrinsically affect us in varying degrees. With the stability of the economy called into question, people are naturally more prudent in the way they spend their money. As much as our human instincts force us to play it safe during times of uncertainty, what if the best opportunities are present during these times?

Amidst inflation & rising interesting rates, the property market remains absolutely resilient.

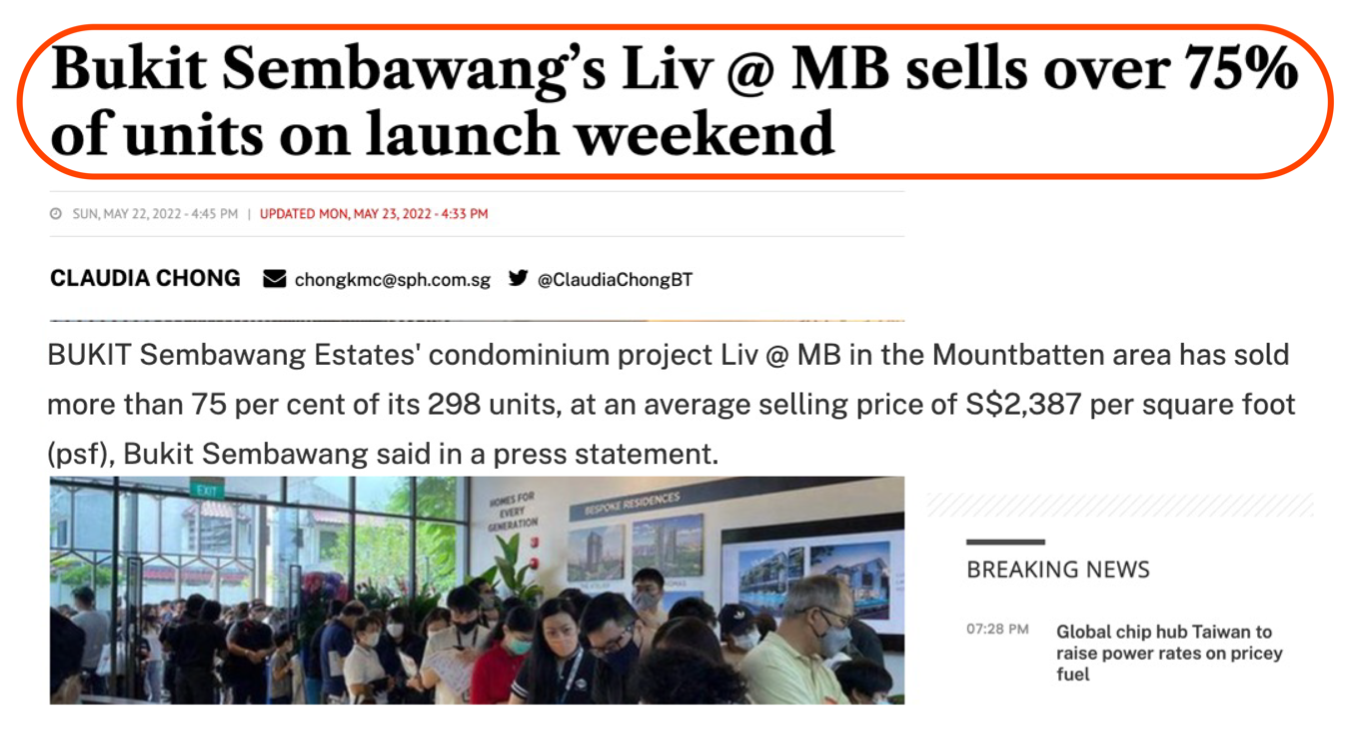

As you can see from the two articles below, Liv@MB and Piccadilly Grand are two very recent launches, and the reception was outstanding. Both of them sold more than 75% of the units in just the opening weekend alone.

Why do Singaporeans continue to spend or invest their money in real estate?

If you are sitting here wondering why, what are the secrets they know that you don’t?

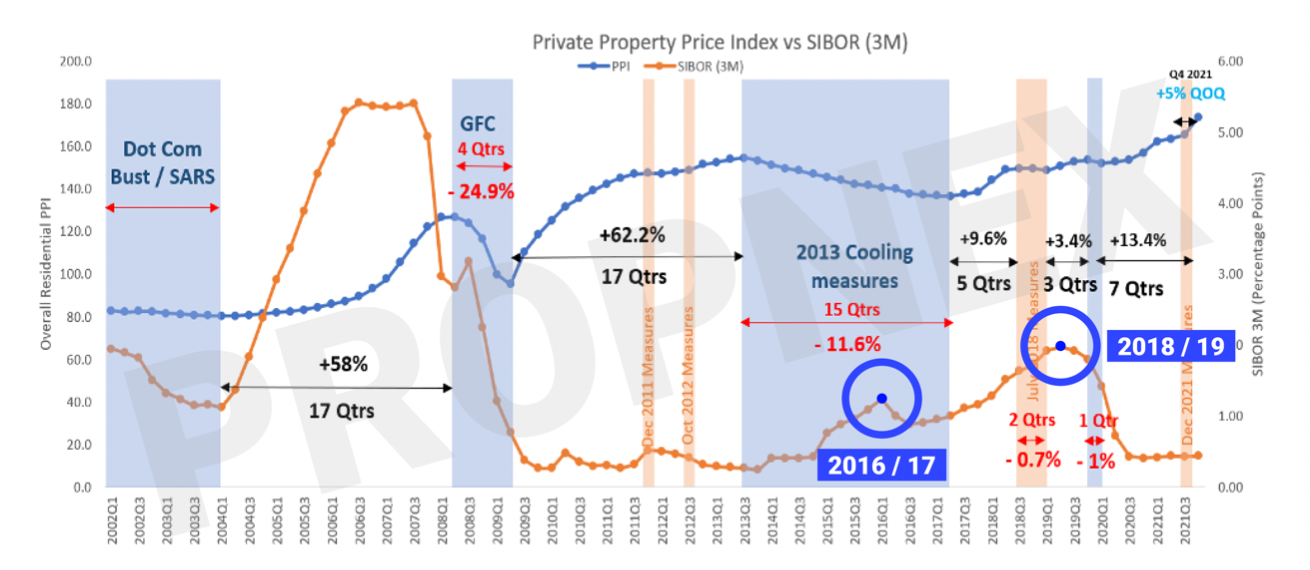

For one, people who know what they’re getting into and take action during a crisis or times of uncertainties tend to make more money. If you’d take a look below and see, in the 2016/17 and 2018/19 periods, you’ll notice that the interest rates were at one of their highest points in recent years. See Chart > Private Property Price Index VS SIBOR chart

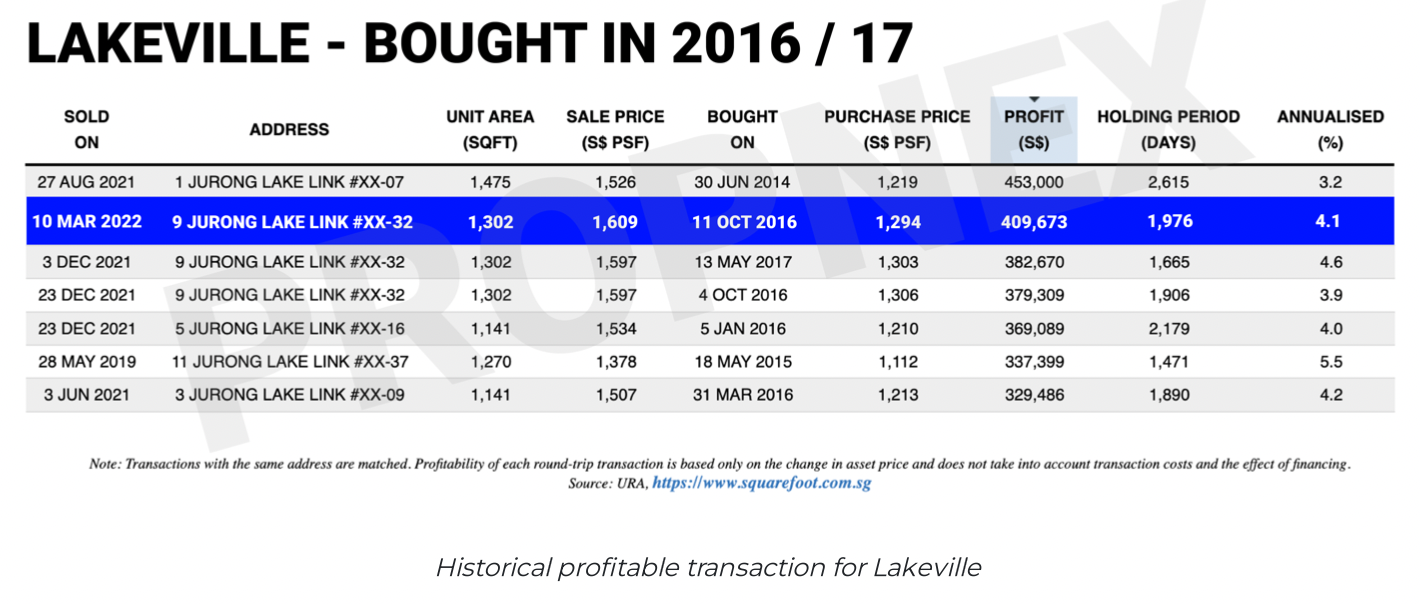

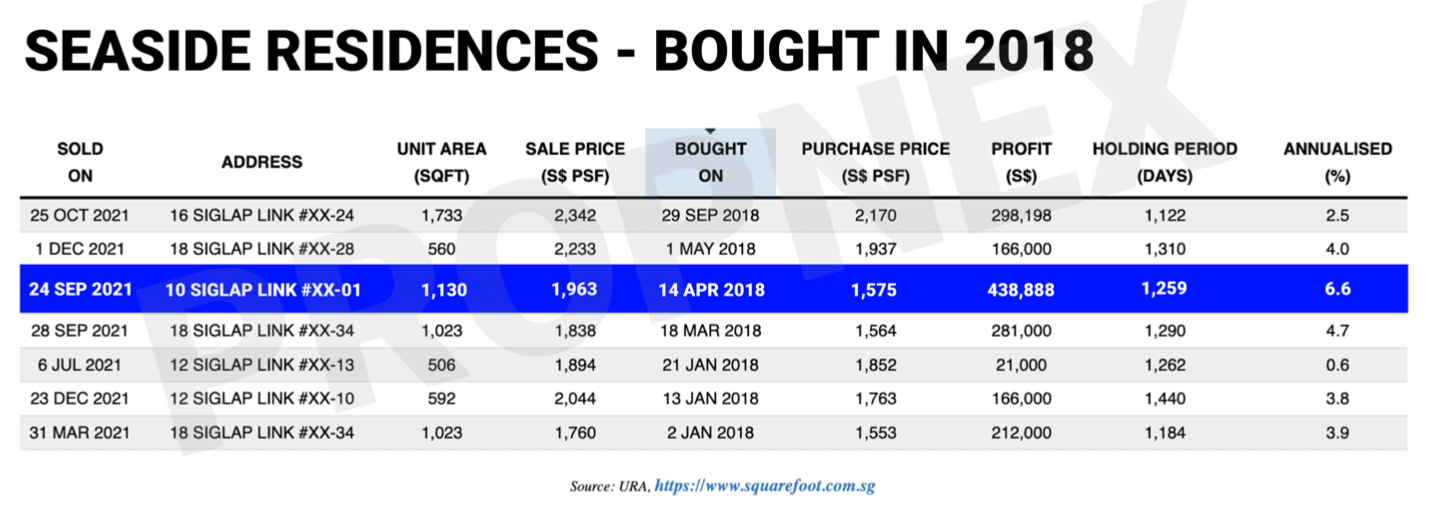

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

You must be asking yourself, why did these people dare to take action?

It is simply because they have knowledge of the real estate market and did their due diligence by assessing their finances & risk involved. That is why it is essential for you to learn before you take any action, especially during this period when there are many lingering uncertainties.

There is a general rule of thumb that 80% watch on as 20% of the people makes money

We can always design our own future instead of falling into the wrong side of the spectrum by default.

DM me here, you’ll learn how you can navigate through crisis and make the right moves on your property journey.

You May Also Like …