When you flip open the papers or turn on the news nowadays, the common buzzwords are “INFLATION“, ” INTEREST RATE HIKES” & ” LOOMING RECESSION“.

These aforementioned occurrences do intrinsically affect us in varying degrees. With the stability of the economy called into question, people are naturally more prudent in the way they spend their money. As much as our human instincts force us to play it safe during times of uncertainty, what if the best opportunities are present during these times?

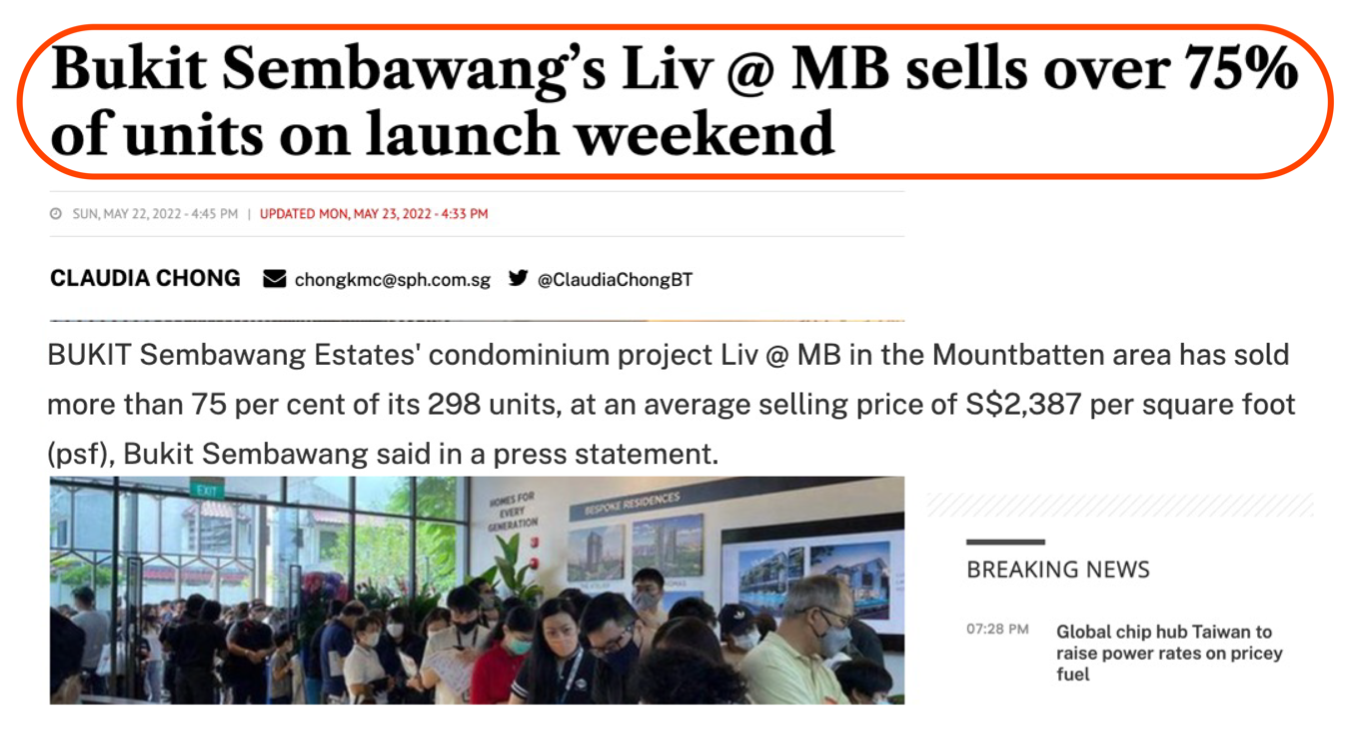

Amidst inflation & rising interesting rates, the property market remains absolutely resilient.

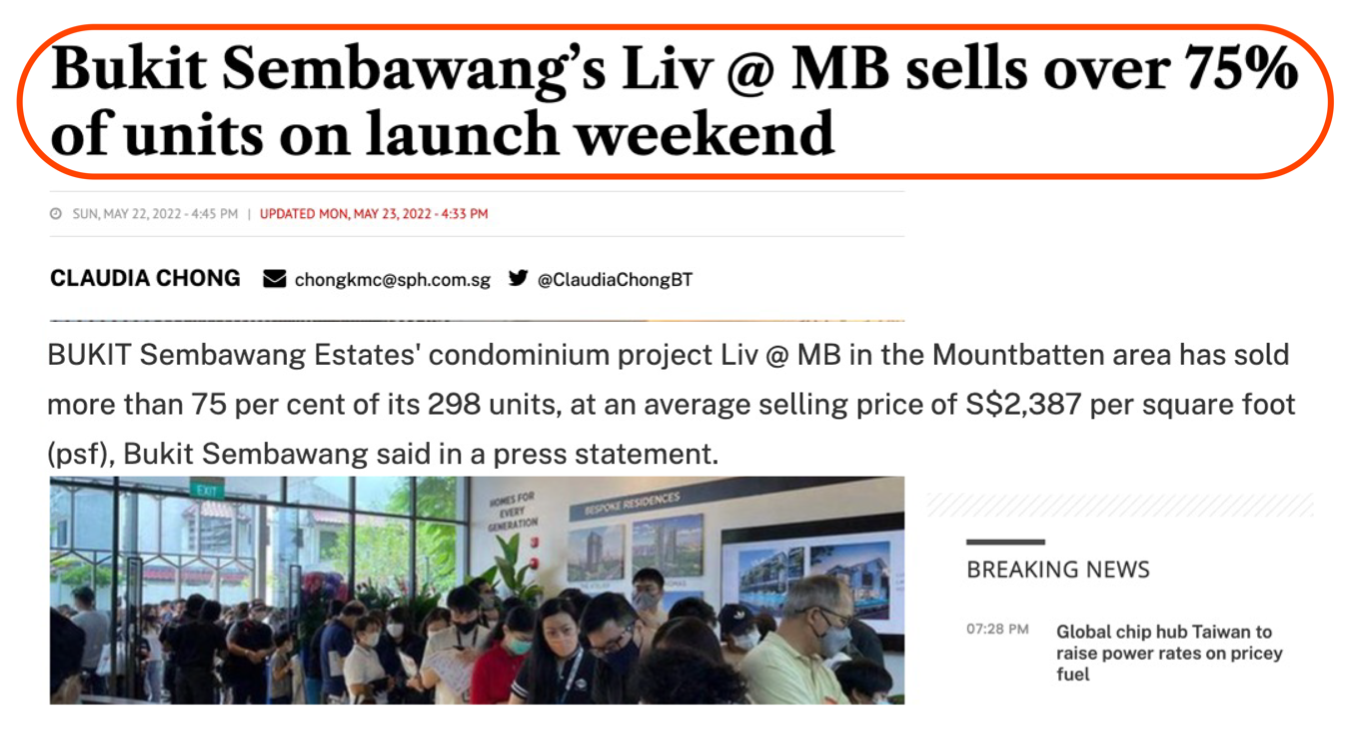

As you can see from the two articles below, Liv@MB and Piccadilly Grand are two very recent launches, and the reception was outstanding. Both of them sold more than 75% of the units in just the opening weekend alone.

Why do Singaporeans continue to spend or invest their money in real estate?

If you are sitting here wondering why, what are the secrets they know that you don’t?

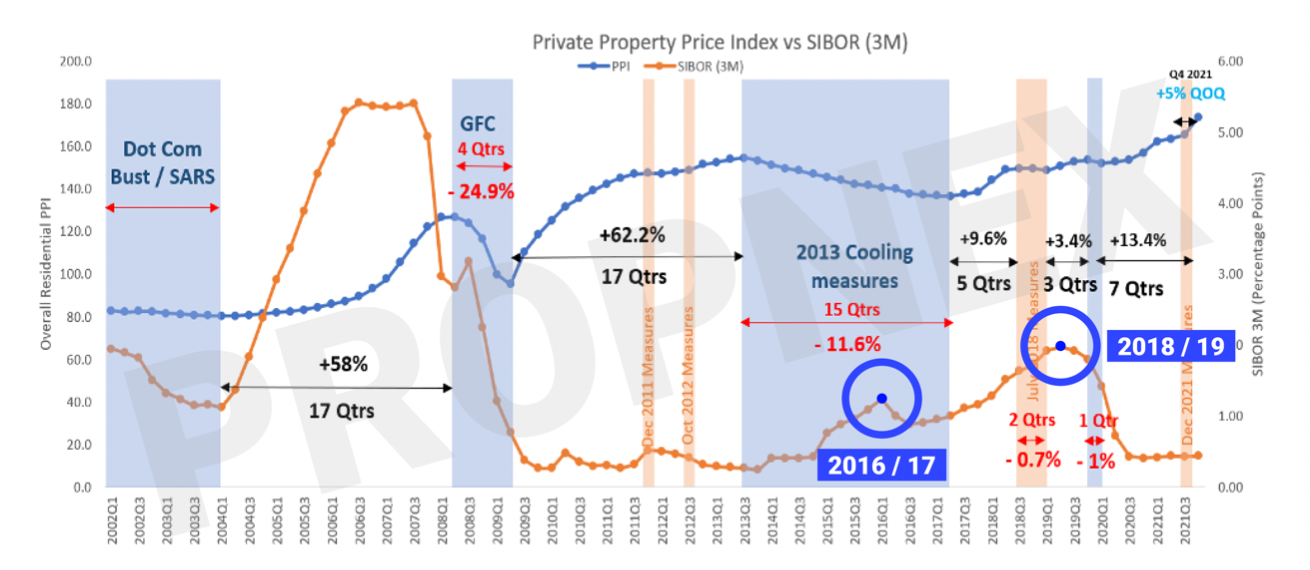

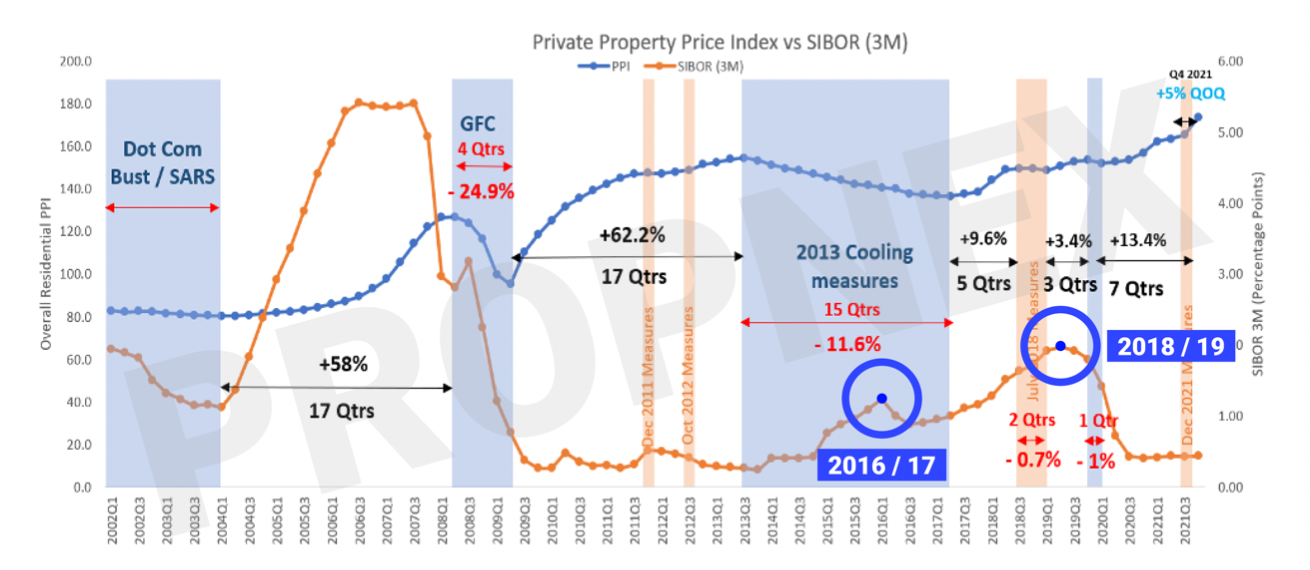

For one, people who know what they’re getting into and take action during a crisis or times of uncertainties tend to make more money. If you’d take a look below and see, in the 2016/17 and 2018/19 periods, you’ll notice that the interest rates were at one of their highest points in recent years. See Chart > Private Property Price Index VS SIBOR chart

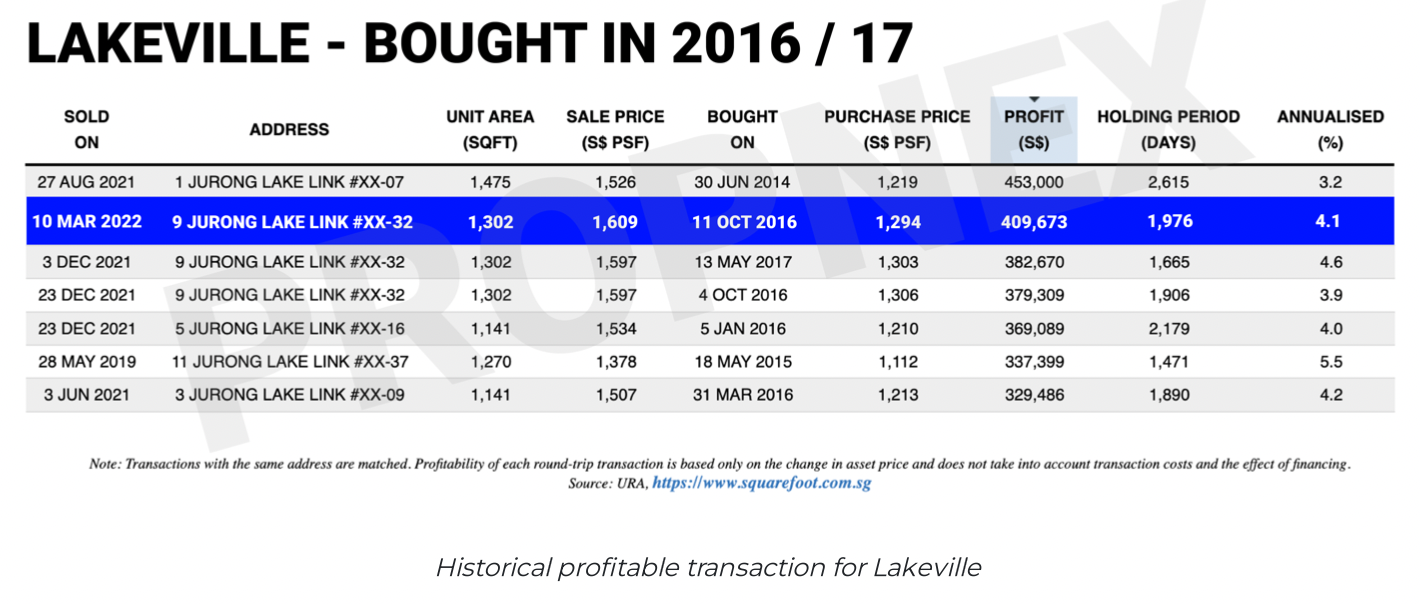

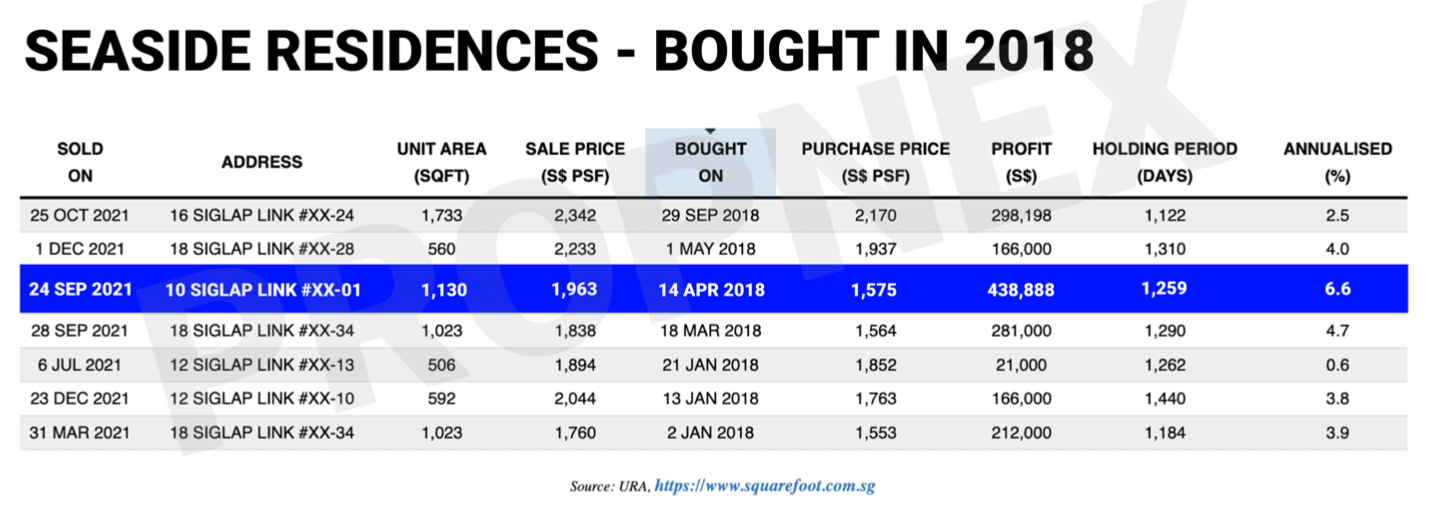

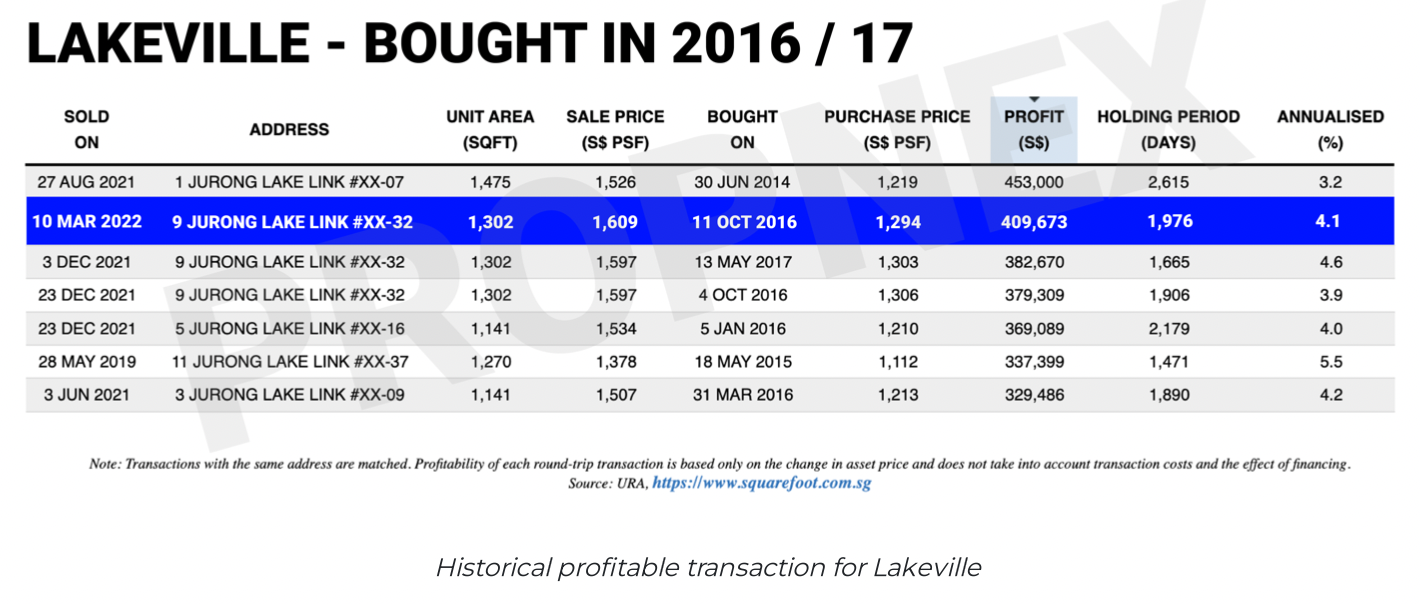

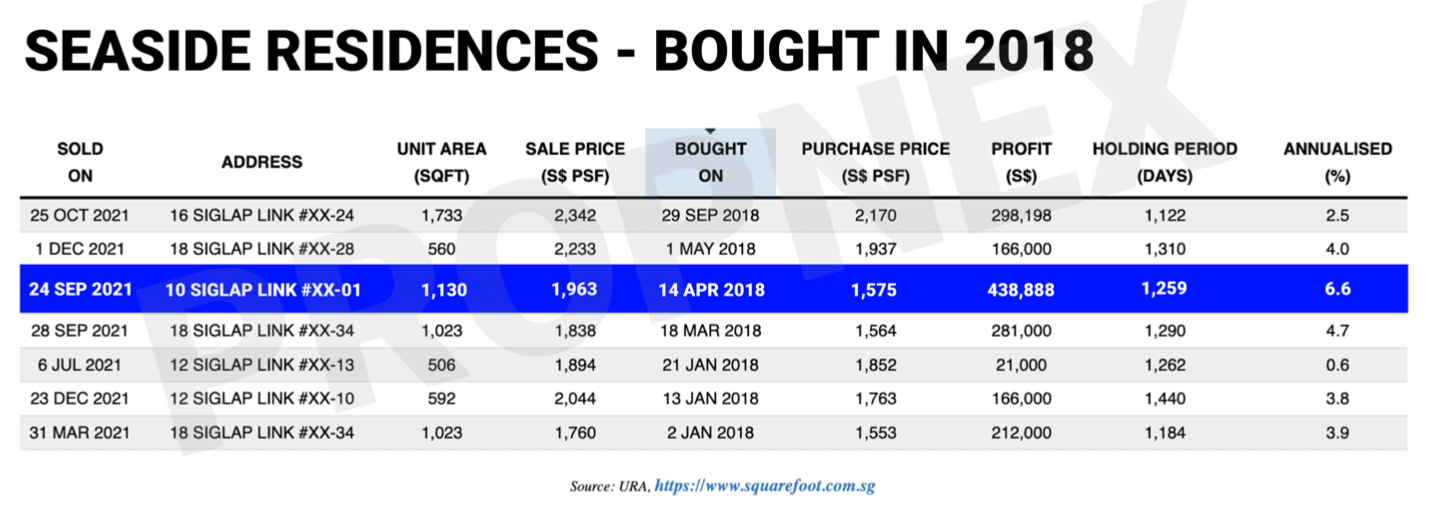

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

You must be asking yourself, why did these people dare to take action?

It is simply because they have knowledge of the real estate market and did their due diligence by assessing their finances & risk involved. That is why it is essential for you to learn before you take any action, especially during this period when there are many lingering uncertainties.

There is a general rule of thumb that 80% watch on as 20% of the people makes money

We can always design our own future instead of falling into the wrong side of the spectrum by default.

What is Your Next Step?

Wait & See?

Make a Move Now?

DM me here, you’ll learn how you can navigate through crisis and make the right moves on your property journey.

You May Also Like …

Jayson Ang – December 8, 2022

TLDR Affordability of HDB Market: Government is focused on ensuring affordable public housing and may increase supply if needed. Long-term...

Read More

Jayson Ang – October 9, 2024

Singapore, a small island nation in Southeast Asia, has become a magnet for the world's ultra-rich families seeking to park...

Read More

Jayson Ang – July 17, 2023

TLDR When considering real estate investments, factors like property size, location, and PSF play crucial roles in determining affordability. Smaller...

Read More

Jayson Ang – January 24, 2023

TLDR When looking for an affordable new launch condo in Singapore as of January 2023, consider projects like 10 Evelyn,...

Read More

Jayson Ang – May 26, 2023

TLDR Renting in Singapore offers various options for foreigners, such as HDBs, Condos, and even unique properties like heritage homes....

Read More

Jayson Ang – January 16, 2024

TLDR Singapore's DBSS scheme faced challenges such as design flaws, developer responsiveness issues, and restrictions on selling. Residents reported various...

Read More

Jayson Ang – June 10, 2024

The proposed Singapore-Malaysia High-Speed Rail (HSR) is a joint project between the two countries that aims to improve connectivity and...

Read More

Jayson Ang – October 27, 2024

TLDR Searching for a forever home should balance heart and practicality. Avoid homes with stairs, high cabinets, big kitchens, and...

Read More

Jayson Ang – April 23, 2024

TLDR The Lease Buyback Scheme (LBS) trend among older Singaporeans is slowly gaining momentum, despite initial reluctance. The scheme allows...

Read More

Jayson Ang – August 11, 2023

TLDR The blog post discusses the challenges Singapore faces in housing affordability, particularly the rising costs of private homes compared...

Read More

Jayson Ang – March 27, 2024

Singapore, a bustling cosmopolitan city, is known for its rich cultural heritage, diverse population, and of course, its love for...

Read More

Jayson Ang – August 1, 2023

TLDR When preparing to sell your house in Singapore, research the average prices in your area to set a realistic...

Read More

Jayson Ang – May 20, 2023

TLDR When considering property investments, understanding your motives is crucial. Factors like accessibility to amenities, remaining lease, transaction history, rentability,...

Read More

Jayson Ang – February 14, 2024

TLDR When it comes to property investments, timing is crucial. Buying at the right moment is only half the battle;...

Read More

Jayson Ang – January 12, 2024

Take a look at this chill spot in Yew Tee. Someone's gone all out to make it feel like an...

Read More

Jayson Ang – November 3, 2024

The decision to invest in a property in Singapore can be both exciting and daunting, especially when faced with the...

Read More

Jayson Ang – March 2, 2023

TLDR When considering purchasing an older resale condo, ensure you investigate potential en-bloc bids, lift conditions, parking conveniences, playground safety,...

Read More

Jayson Ang – July 4, 2023

Singapore Luxury Property: 5 Reasons to Add it to Your Trophy Collection When it comes to luxury property investments, Singapore...

Read More

Jayson Ang – August 15, 2024

Singapore's property market has long been considered a safe haven for investors, even during times of economic uncertainty. The city-state's...

Read More

Jayson Ang – April 26, 2024

The Singapore property market has always been a hot topic for both locals and foreign investors. With its stable economy,...

Read More

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences

With that in mind, is it true that if you buy during the peaks of high-interest rates you will not make money or stand to lose out? You will be very surprised to find out that not only did interest rates barely affect anything, there are still people who made staggering profits of over $400,000 like the two examples below – Lakeville and Seaside Residences