TLDR

A comprehensive overview of the real estate market trends, emphasizing the importance of strategic property analysis and investment decisions. It discusses key factors such as market sentiments, property valuation, buyer considerations, and portfolio restructuring. The narrative highlights the significance of leveraging assets to maximize wealth growth and the potential pitfalls of not utilizing resources effectively. Additionally, it offers valuable advice on navigating property investments in Singapore’s dynamic real estate landscape.

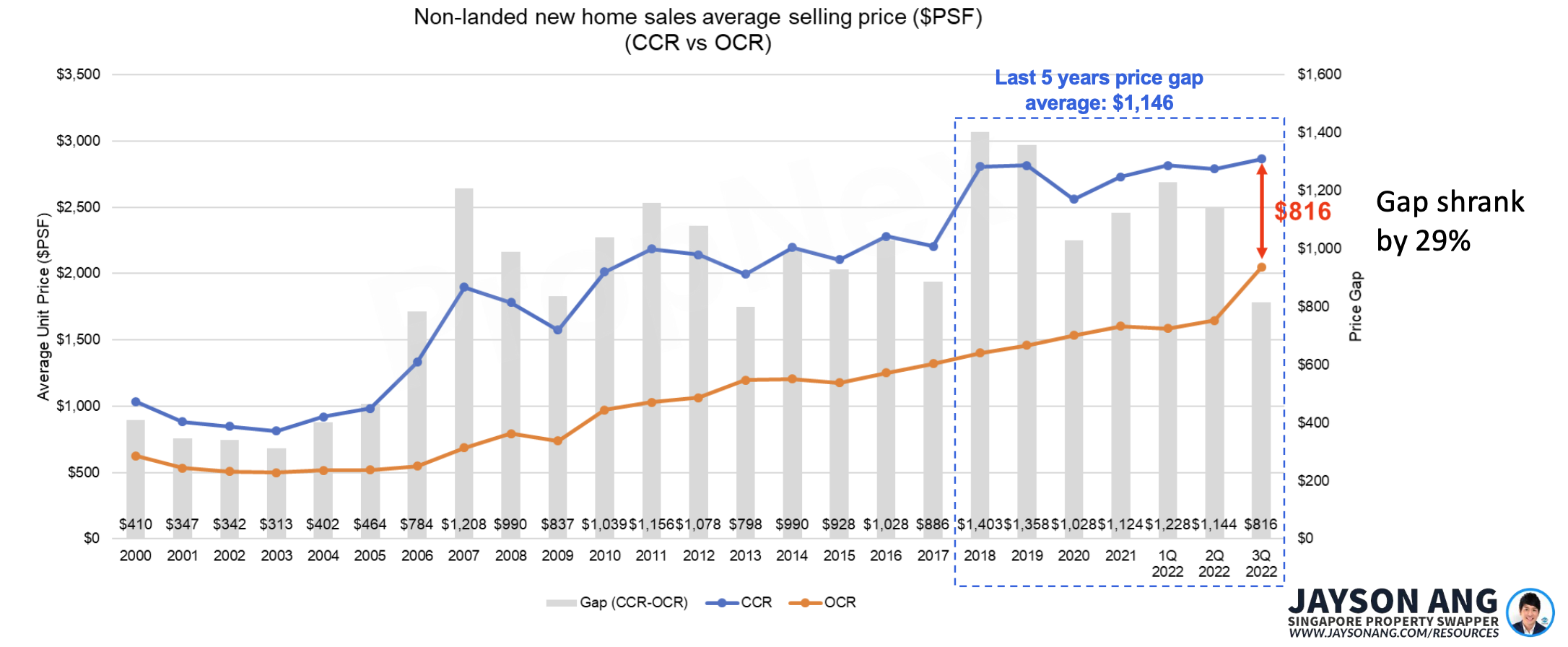

Time Truly Flies! As I Write This, We Have Already Passed 2022. Let’s Take A Look At The Chart Below. How Do You Think The Market Has Been Performing In The Last Quarters?

It Is Not When We Buy The Property But When We Sell The Property That Determines The Actual Profit At The End Of The Day.

Are you wondering whether it is a good time to enter the market now? | believe many buyers are asking themselves this question, or thinking, “Should I wait further? I may get a good deal later when the market corrects further!” I totally understand their mentality because I was once like that too.

When we do not know how to analyze a property and determine whether it is a good deal, even if a unit pops up right before us and appears to be below market price (BMP), we will still not buy it. Why? Because when the market sentiment is weak, everyone will always choose to wait for prices to go lower and then they will end up not buying the property; I speak this from experience.

January 2009 was the time when the market was at the lowest. My client could get a unit at The Sail above #60 and facing the Bay at $1750psf. However they did not get it. Why? Because they said, “Let’s wait further…

My client ended up buying a unit below #10 for $2300psf. Fortunately for them, they managed to sell that low floor unit at a higher price. The lesson we learnt from this was: Many of us tend to time the market but most of the time we end up buying a much higher price unit.

In my opinion, it is not when we buy the property but when we sell the property that determines the actual profit at the end of the day. Now with the Seller’s Stamp Duty (SSD) in place, we have to pay a heavy tax if we sell our property within 3 years of purchasing it, which, of course, many of us are unwilling to do so.

Do Not Just Work Hard For Money, Let Your Money Work Hard For You!

Remember however that we cannot predict the future. When SSD is over, the market may not be in your favour and at the end you may still not be able to sell your property! Therefore I will strongly advise buyers to learn how to assess the property they have selected. Does it have potential upside based on the current market versus the various properties transacted?

Next, buyers need to carry out a ‘stress test’ on the property that they have selected. This will help to determine the risk level. If you do not know how to go about assessing the property, I have analysis tools available which will help you.

Looking at the number of transactions reported, what should homeowners do today? Is there still an opportunity for them to grow their wealth today?

Many of us carry the mentality of working hard to save enough money to own a 2nd property. But think about it; is it easy for any working couple to save enough? What will their age be when they have saved enough?

Before I became a real estate person, I worked for others too. I know how difficult it is to save because of our fixed expenses. Furthermore when our age goes up, the loan tenure will be affected and the mortgage will be high too.

I have met up with quite a number of couples recently. They own a property currently, have fully paid their property, and are currently sitting on profit on the house. However, they do not know how they can use their asset to work hard for them. asked them, “Why aren’t you using your asset to work hard for you?” The answer they gave was, ” have no idea or knowledge how to do it!” As a result, they have been putting this aside and are just focused on their work. I have seen many people working hard for money and not using their “sleeping money” to work hard for them.

Another frequent concern raised was the loan instalments. Many assumed they needed to pay a lot to own an asset. The fact however is that they did not work out the cost of the asset! When I carried out the stress test with them in planning for another asset, they realised that it was actually workable and sustainable.

With all the property measures in place, what should homeowners do today? For those of you who own 1 property now, this thought would likely have crossed your mind, “Wouldn’t it be great if I had bought 2 assets instead of 1, just 5 years ago!” Today, if you have 2 assets, your wealth would have doubled.

We need to constantly think of how we can restructure our portfolio and tap on our unutilized money in our asset or in our CPF to work hard for us. Do not just work hard for money. As often tell others, “Let your money work hard for you.” Lastly to paraphrase a view commonly heard, remember, “Invest during the bearish and exit during the bullish times!”

You May Also Like …