TLDR

In 2021, the real estate market saw a surge in demand due to low interest rates and supply chain disruptions. The upcoming hike in interest rates may worry some homebuyers, but historical data shows that well-planned property investments can still yield substantial profits despite interest rate fluctuations. Rising interest rates are often linked to inflation, which can actually drive property prices up. Focusing on other key factors besides interest rates when choosing an investment property is crucial for maximizing returns.

We have all seen in 2021, an amazing year for sellers as we saw property prices hitting new peaks. A pent-up buying demand caused by impacts on tourism and uncertainties in the financial markets during the Covid-19 pandemic has steered many to the real estate market. Adding fuel to the hungry fire, delays in construction and rising costs in materials caused by global supply chain disruption and manpower crunch amplified the heat further.

This huge spike in demand against the depleting supplies has forced many homebuyers to sweep up the unsold inventory causing it to hit a record low of 19,409 in 2Q2021.

Homebuyers were further enticed by the increase in their purchasing power with interest rates hitting an all-time low.

Fast-forward to the present, as the economy is moving towards recovery, there are plans by the US Fed to raise interest rates for the first time since 2018. As most of you might know, Singapore’s interest rates are closely pegged to the movements of the US Fed’s interest rate.

So how will the imminent hike in interest rates affect you?

To better understand this, let’s first take a look at the types of interest rates offered here in Singapore.

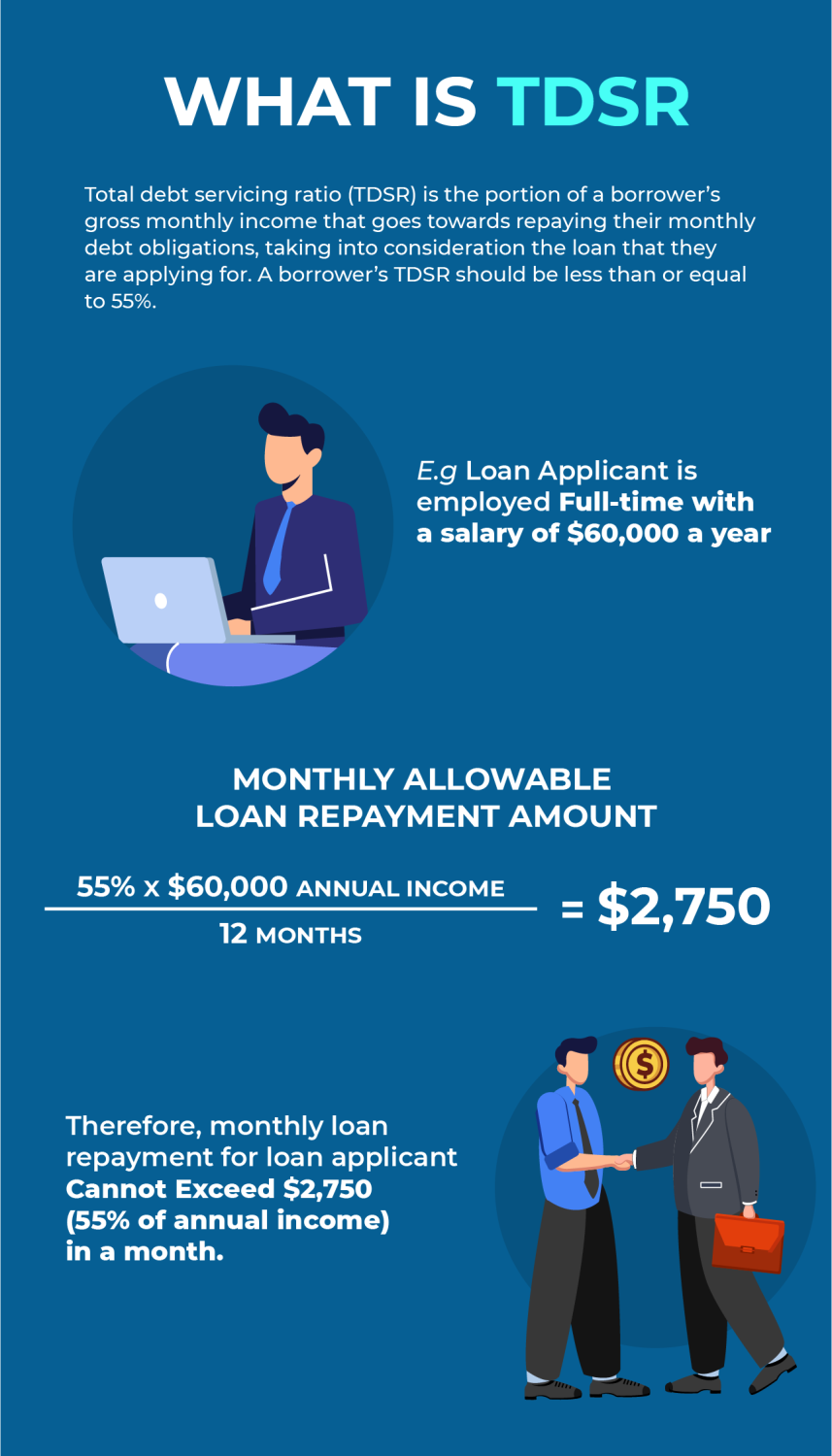

Total Debt Servicing Ratio (TDSR)

Total Debt Servicing Ratio is a financial safety mechanism introduced by the Singapore Government to ensure that its people are not overleveraging and have the necessary financial capabilities to pay off their loans.

The Impacts Of Rising Interest Rates

Consumers are afraid of raising interest rates because it affects the eventual amount home buyers have to pay after calculating accrued interest from their home loans.

What if I tell you that whether the interest rate is moving upwards or downwards has minimal effects on your home – if you’ve made calculated considerations on buying your home?

Many would think that it’s a bad time to be thinking about buying a home when interest rates are set to hike, but let the statistics and examples below reveal to you the truth about the relationship between the property market and interest rates.

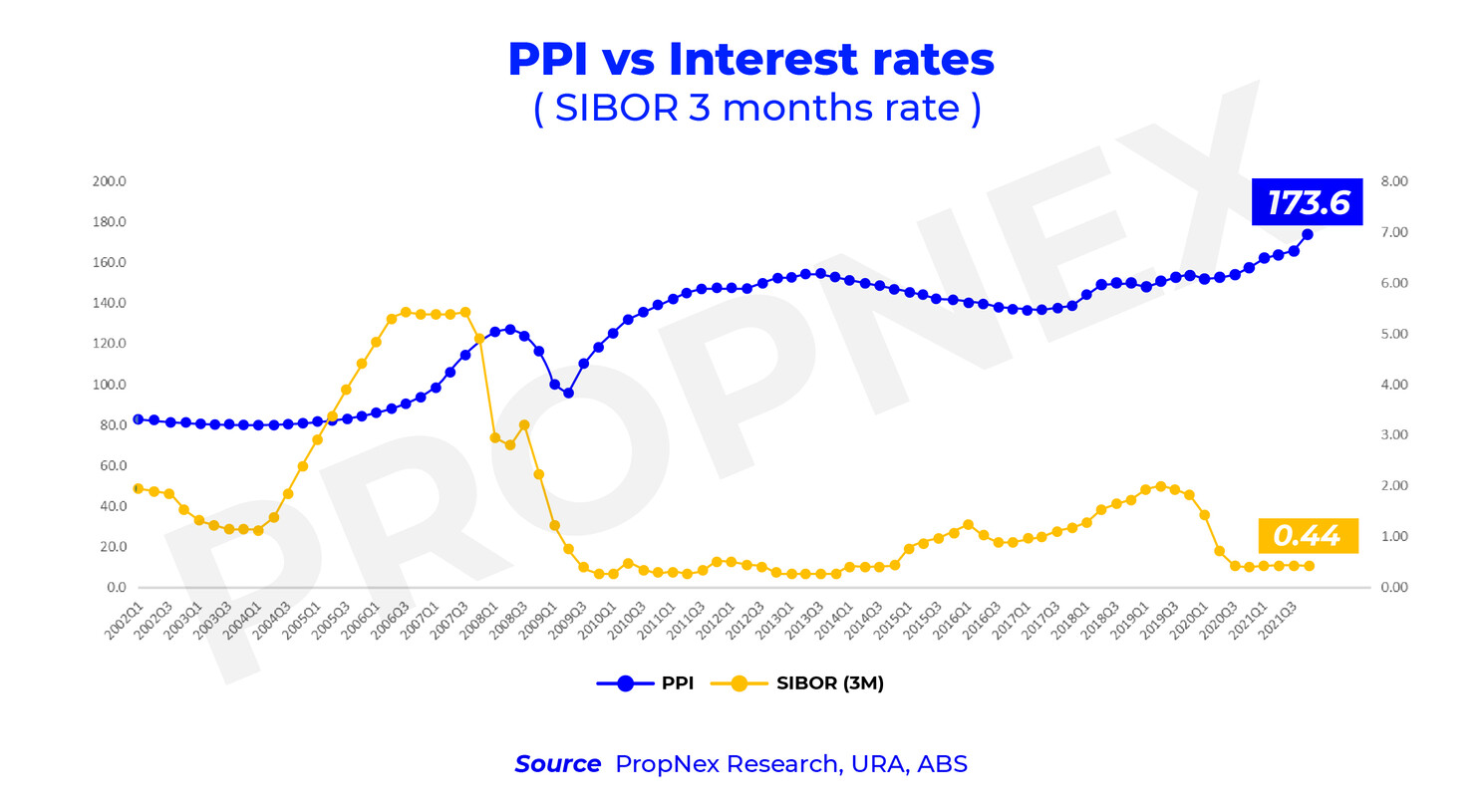

Looking at Figure 1 below, property prices have been on an incline over the past 20 years. In fact, since 2010Q1, interest rates have been relatively flat except for 2015Q1 when they started surging and then slumming again when the pandemic came.

Figure 1: PPI vs Interest rates (2002Q1 to 2021Q3)

Does it mean that people who bought properties between 2015Q1 and the pandemic suffered losses when the interest rates flattened over the last 2 years?

You will be very surprised to find out that not only did they not suffer a loss, but many buyers made extremely lucrative returns.

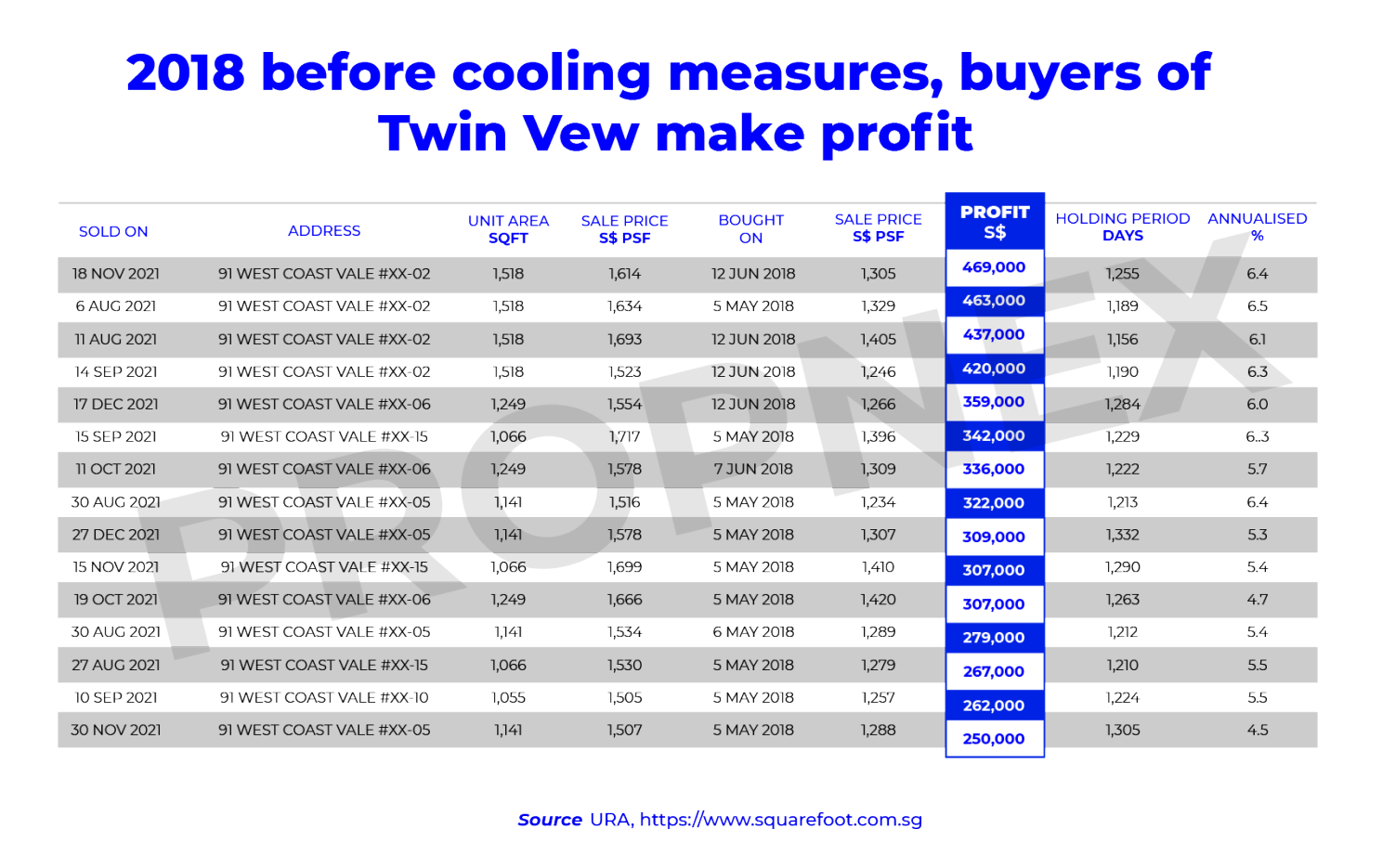

Just as buyers of Twin Vew in Figure 2 below, who bought their property at one of the peaks for interest rates in 2018, and managed to make close to a whopping half a million dollars when they sold it in 2021.

Interest rates for mortgages may be one of the most important concerns you may have when purchasing a property. However, few realised that it should not be the most important factor to consider when it comes to choosing the right property for reaping good profits. The case study above clearly illustrates that rising interest rates did not hinder the growth of a well-planned and selected property.

Figure 2: Historical profitable transactions for Twin Vew

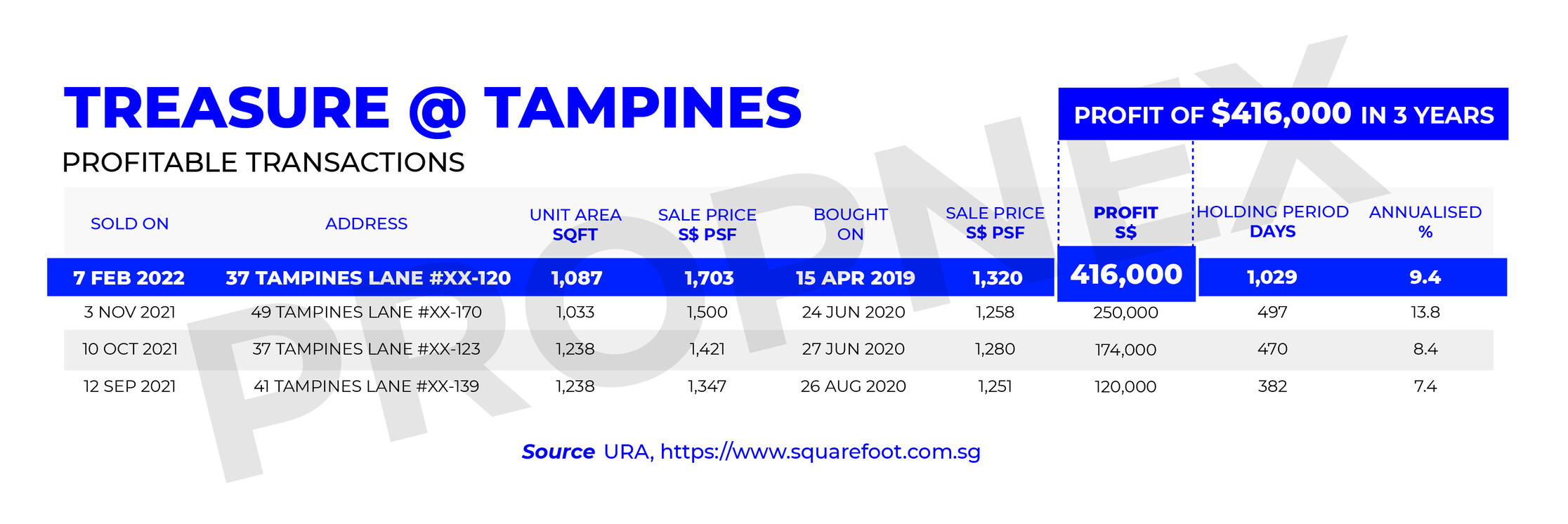

Here’s another example for you, Treasure @ Tampines in Figure 3 below, the unit that was bought when the interest rates were high in 2019Q2 also managed to make tremendous returns of $416,000 in just less than 3 years.

This could be you if you knew exactly what to buy and when, instead of worrying about interest rates. Ultimately, the growth of property prices greatly overshadows hiking interest rates.

Figure 3: Historical profitable transactions for Treasure @ Tampines

To understand the rationale of why hikes in interest rates are not causing the property market to crumble or stagnate, one has to understand the reason why interest rates are increasing.

In fact, we all know that inflation has caused the increase in prices of almost everything money can buy – that includes property. And in order for the monetary authority to mitigate inflation, increasing the interest rate is one of the most effective tools to do so. So even if there isn’t any growth in the real estate market over the next few years, we will possibly see property prices escalate solely fuelled by inflation.

What does this mean for homebuyers?

Focusing on the wrong thing may incur a heftier opportunity cost. The rising interest rates and other trigger factors* should be an indication for investors or homebuyers to start taking swift action.

It is monumentally tough for anyone to time the market but there is always a way to sift out the ideal investment property that could reap the best possible rewards.

Hit me up and I shall share with you the other factors* to look out for when choosing the ideal investment property.

You May Also Like …