Do You Know When Is The Best Time To Exit Property Market After You Have Bought Your Property?

SHOULD YOU JUST HOLD ON TO YOUR PROPERTIES?

There is a high tendency for many people to hold on to their properties for a long period of time even though their properties have appreciated to double the amount of what they have purchased. Is this the best option for properties which have appreciated?

In fact, there is nothing wrong with holding on to the property, but I just felt that many money-making opportunities have been forgone when this option is being chosen. Ask yourself this Question, by working hard for the last 5 years, are you able to save $300,000? I am quite sure it is not possible as I have personally witnessed many couples facing difficulty to attain this feat. Do you know that you can increase your saving by learning the Right Exit Strategies that will help you to build your wealth systematically?

Many of you might be skeptical and will question the RISK involved. Yes, if there is no proper guidance and feasible financial plan, the risk will be so much higher. Therefore, it is always good to learn and plan before taking any ACTION.

So the Question now is :

What Are Your Thoughts Now?

Case study 1 – Being too Comfortable

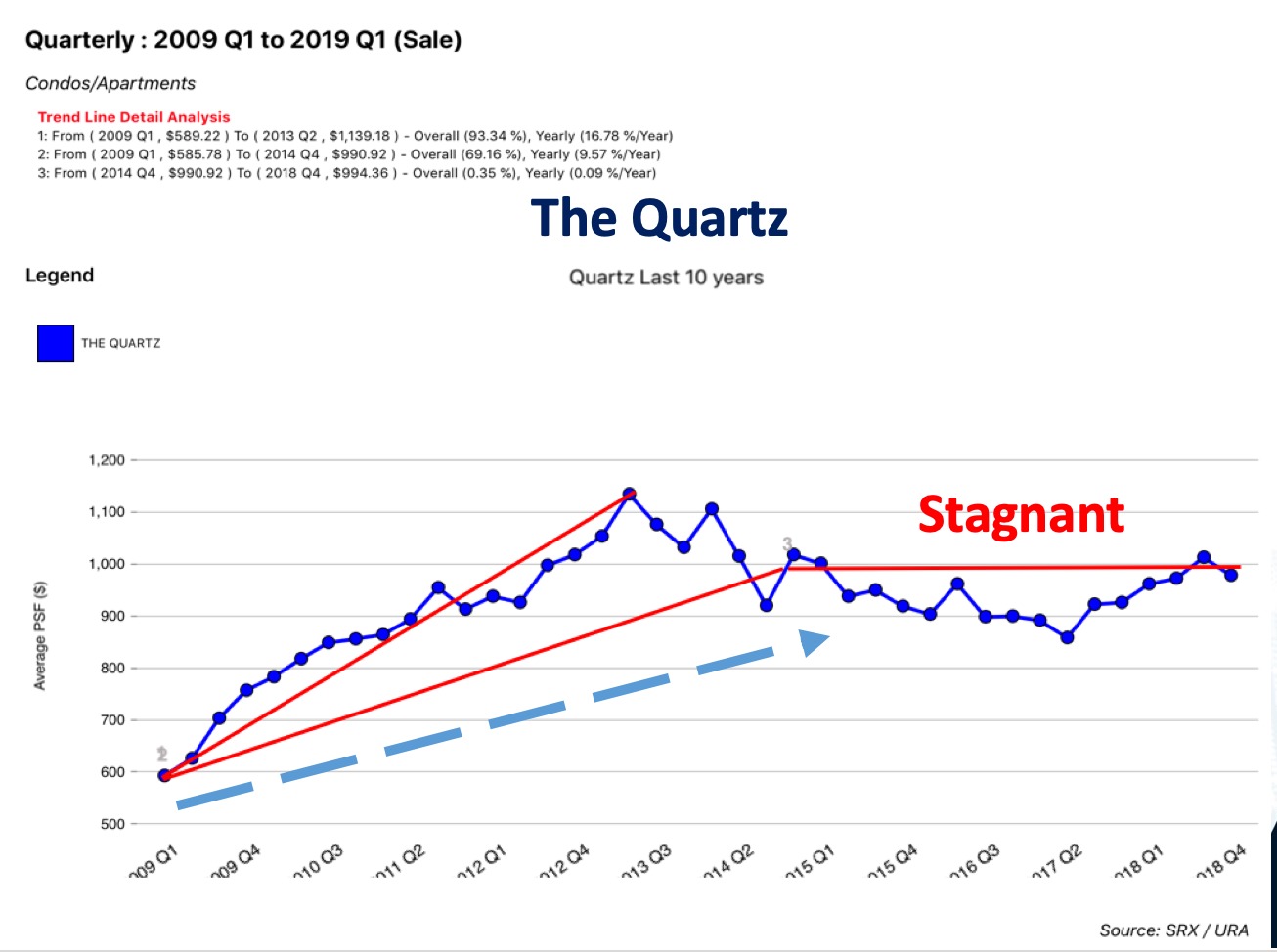

Have you ever wondered WHY The Quartz Condo (in the chart above) has stopped growing for the last 4 years? Currently, the average price of The Quartz is about $1,000psf but the neighbouring new launches are selling at $1,400psf. Even an Executive Condo is selling at approximately $1,000psf.

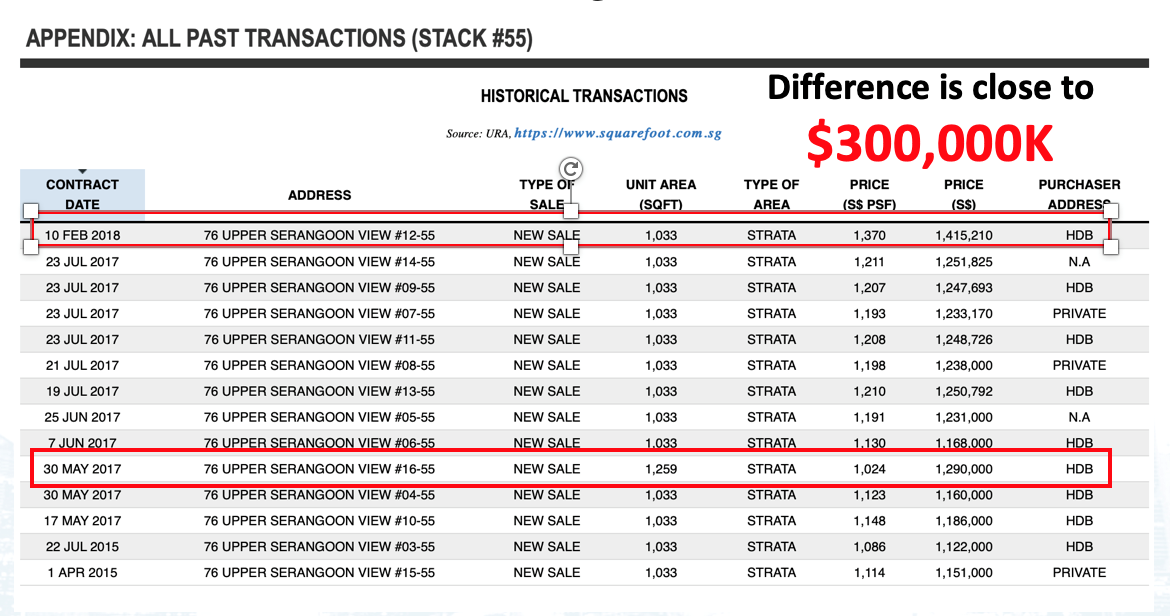

Above is another set of caveats that shows new launches at the nearby Condo – Kingsford Waterbay. In less than a year, the price of a similar unit was sold higher by $300,000. This is not only happening to this Condo, it is also happening to many other resale condo too. Have you ever asked yourself this question? Why can’t I save $300,000 despite working so hard??? Do you want to find out the Answers?

Many clients today earn a combined income of $12,000 and they are already owning two condominium– one for staying while the other one is generating passive income every month. Many homeowners are not doing this because they are not equipped with sufficient knowledge to do so. Do you want to work hard or work SMART? Do you want to provide the best for your family?

Do not wait further! You should be joining me in this seminar to learn the 5 strategies to exit the property market. After the seminar, I am confident that you will not make the wrong decision and let your property price stagnant for the next 4 years. This seminar is not only meant for home sellers, but also, first-time buyer or home seekers. Click here to register ASAP!

So the Question now is :

New Launches vs Resale? Which is a Better Buy Today?

Why RESALE Prices are cheaper than New Launches? Does it mean that we should buy if it is CHEAP?

Have you ever wonder why the resale prices are much cheaper and yet many people still choose to pay more for New Launches?

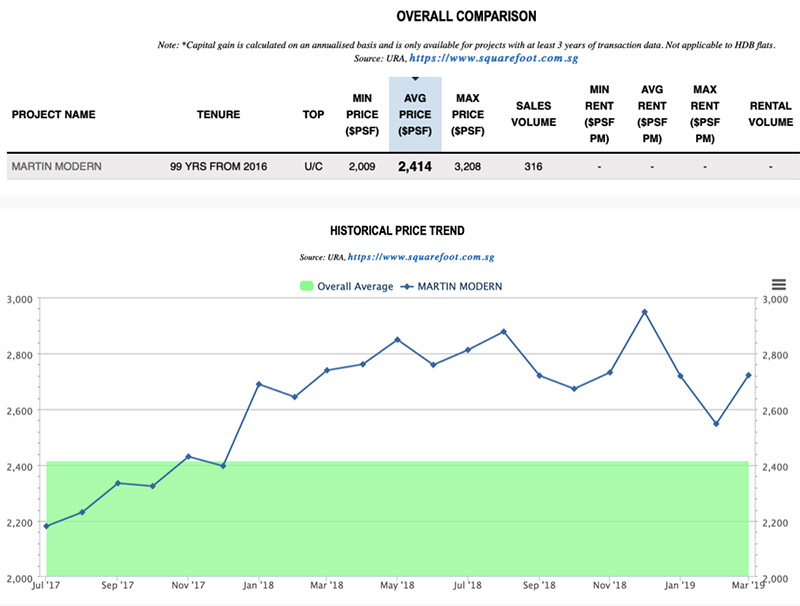

Look at the below chart on one of the new launches, Martin Modern. Why is it that the price has shot up from $2,000psf to more than $3,000psf in less than 2 years? In some instances, the prices of Freehold projects did not even reach $3,000psf. Do you want to know WHY?

So the Question now is :

Is It Worth to Buy New Launch or Resale?

This happened during a new launch where everyone is trying to get a unit. Will you buy when you see this situation in the showflat? Many times, we saw people interpret long queues as buying good deal and will rush to get a unit when they see such situation. When this happens, I always refer it as the “Kiasu” syndrome.

Is this the way to determine the RIGHT ENTRY PRICE? I have seen many people making such decision without differentiating right from wrong. Do you know that one mistake make by emotion may cost you more than hundreds of thousands of dollars? Hence, in this sharing session by me, I will be covering 5 Essential Rules for you to take note when identifying the RIGHT ENTRY PRICE property.

FIND OUT WHAT'S BEST FOR YOU!

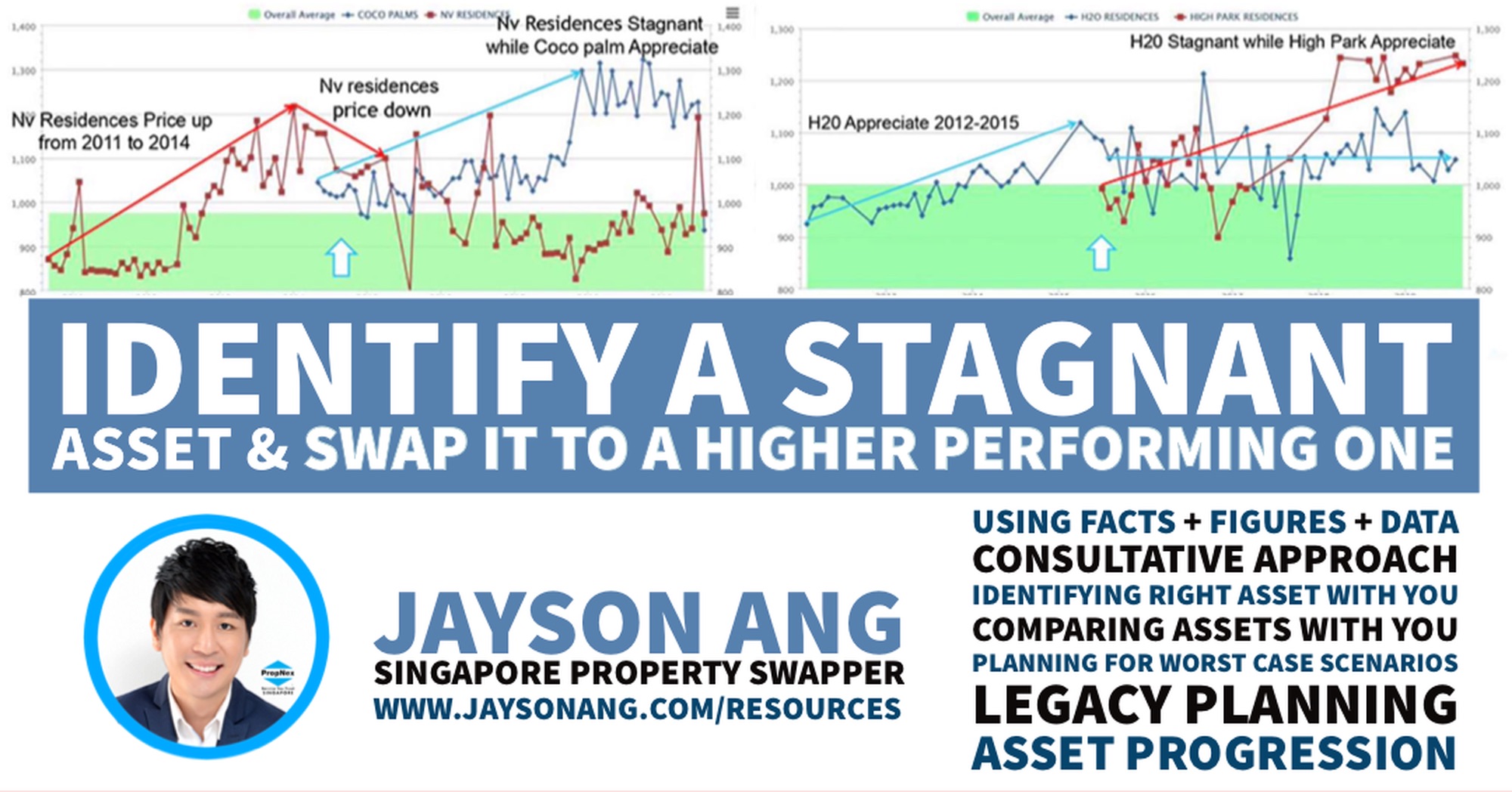

With his career experience of more than 5 years, he has curated a set of Asset Progression Checklist which has benefited his clients greatly. For current and aspiring Singapore property investors, his role is to help them invest wisely. Not only that, he has consistently minimised many of his clients’ risks by leveraging on the most suitable loans available, while maximising the profit potential of their investments.

Being a property investor, he has never invest based on speculation and emotion buying. Using his experience and hard facts and figures, he determines the RIGHT property to invest.

To put his knowledge into writing, Jayson also wrote a book – Asset Progression Checklist, in 2019. The book coaches investors step-by-step guides on conducting researches before purchasing their properties.

Cited with real life case studies, Jayson pens down realistic and detail methodology which ensures reader to grow their wealth in a predictable way.

ASSET PROGRESSION CHECKLIST

THE PRACTICAL & SYSTEMATIC WAY TO BUILD YOUR ASSETS & GROW YOUR WEALTH

Whether you’re just starting to invest in properties or you’re already an experienced investor, you will find the Asset Progression Checklist, accompanied with real-life case studies, to be very insightful.

JAYSON WANTS TO BE CONNECTED WITH YOU.

FREE RESOURCES

Jayson shares his views in his reports on the current property market.

Discover some strategies you can use to overcome your real estate challenges.