5 ESSENTIAL ELEMENTS OF SUCCESSFUL INVESTMENT PORTFOLIO IN CORE CENTRAL REGION SEGMENT

ARE YOU INVESTING OR GAMBLING?

WHICH IS BETTER?

Property Investment is never about luck or emotional buying. On many occasions, we see consumers hopping from different new project show units just to find “the Right One”. But how exactly will this “Right one” presents itself in the face of consumers?

If you had answered “Ambience” and “Feel” of the unit, you are emotional buying. Many times, these feelings have clouded the analytical skills of the consumers, making them overlook other critical aspects such as the land appreciation, location, sensitive pricing/discounts and market sentiments.

By the time when the consumers are prospecting for new house, they will themselves in situation where their current property is not fetching the desired price and they have missed the opportune time to enter the market.

Real investors are clear with their goals and what they want out of their property investments. They do not rely on hope that the market will one day, change in their favour. Rather, they are aware of the cycle and when to make the “Right move”.

So, are you an investor or gambler? If you are determined to be a savvy investor, you will definitely be interested in the following.

So the Question now is :

How do you Determine the Right Cycle, the Right Time and Right Price to Enter?

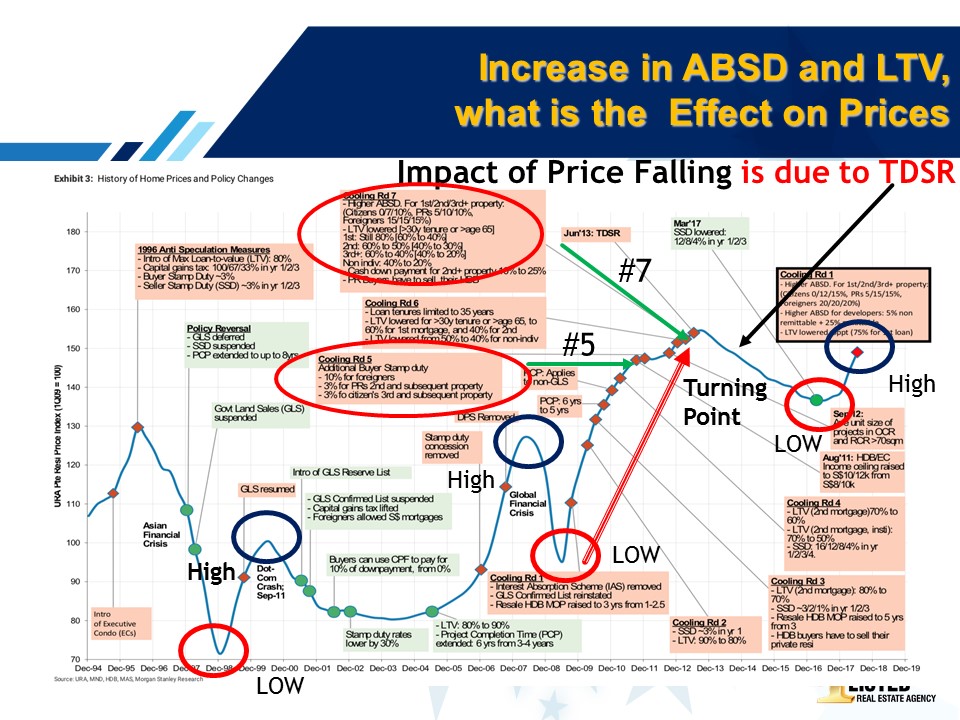

At the first, second and even third glance, you may not be able to figure out all the information which this chart is trying to convey. However, if you study in detail or with some guidance, you will be able to mark out a certain trend that is brewing in the market.

Based on this cycle, you can also identify the best opportune time and price to enter the market.

So the Question now is :

Is This the Right Time to Buy in Today's Market?

Just Understanding the Cycle is Not Sufficient

5 ESSENTIAL ELEMENTS WHICH YOU MUST KNOW IN ORDER TO BUILD A SUCCESSFUL INVESTMENT PORTFOLIO IN CORE CENTRAL REGION SEGMENT

What are the Impacts of the Latest Announcement of the

Reduction in Government Land Sale?

Supply vs Demand

Should we buy when the supply is plenty in the market?

Location vs Entry Price

Which is more important? Many always think that buying a good location near MRT is the safest bet as it is easier to rent out. However, is that really true?

New Launch vs Resale Property

Are you aware which one is likely to drive higher profit margin?

How can we secure the First Mover Advantage?

Just based on the above 5 Rules that you will learn from me, I am sure you will not make the wrong decision in selecting the right property. Even if you have not buy or bought, you should be here to learn this skill from me.

MUST KNOW!

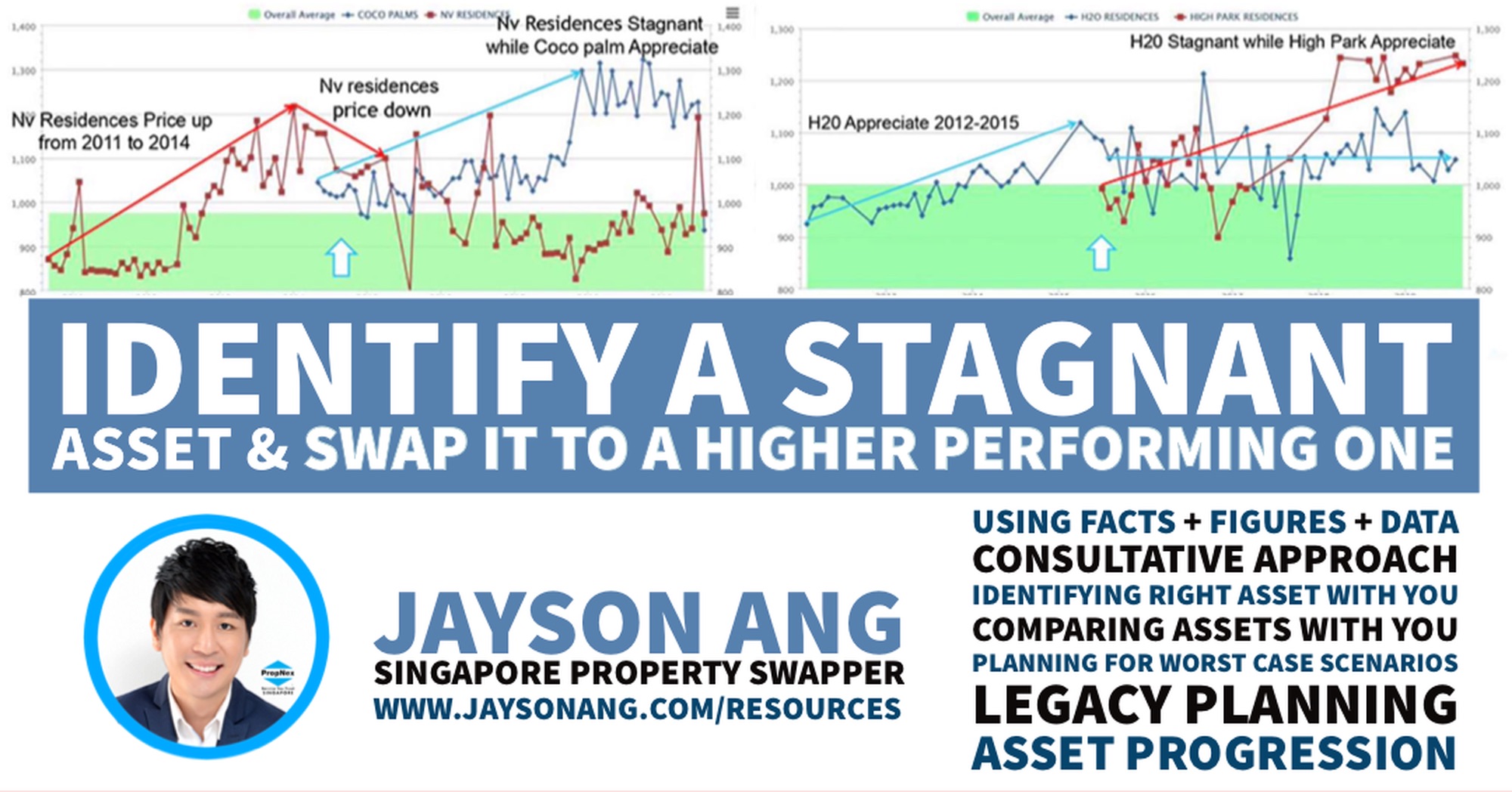

Understand the Charts that will help you identify the RIGHT Entry Price Property!

FIND OUT WHAT'S BEST FOR YOU!

With his career experience of more than 5 years, he has curated a set of Asset Progression Checklist which has benefited his clients greatly. For current and aspiring Singapore property investors, his role is to help them invest wisely. Not only that, he has consistently minimised many of his clients’ risks by leveraging on the most suitable loans available, while maximising the profit potential of their investments.

Being a property investor, he has never invest based on speculation and emotion buying. Using his experience and hard facts and figures, he determines the RIGHT property to invest.

To put his knowledge into writing, Jayson also wrote a book – Asset Progression Checklist, in 2019. The book coaches investors step-by-step guides on conducting researches before purchasing their properties.

Cited with real life case studies, Jayson pens down realistic and detail methodology which ensures reader to grow their wealth in a predictable way.

ASSET PROGRESSION CHECKLIST

THE PRACTICAL & SYSTEMATIC WAY TO BUILD YOUR ASSETS & GROW YOUR WEALTH

Whether you’re just starting to invest in properties or you’re already an experienced investor, you will find the Asset Progression Checklist, accompanied with real-life case studies, to be very insightful.

JAYSON WANTS TO BE CONNECTED WITH YOU.

FREE RESOURCES

Jayson shares his views in his reports on the current property market.

Discover some strategies you can use to overcome your real estate challenges.